Essential Features for Creating a Payment App Users Trust

Summary:

Creating a payment app users can trust requires prioritizing key features that ensure security, usability, and reliability. Essential elements include robust encryption for secure transactions, easy-to-navigate interfaces, and fast payment processing.

Offering multi-factor authentication and fraud detection systems also boosts user confidence. Seamless integration with various payment methods and platforms, along with clear customer support options, ensures a smooth experience. By focusing on these core aspects, developers can create a payment app that not only meets user expectations but also builds long-term trust in the app’s functionality and security.

Introduction

We all know about the fact that mobile payments are constantly being defined in how we manage our finances, and create a payment app that users trust. As the number of digital transactions increases, security and an attractive user experience become non-negotiable for consumers. In order to stand out from the rest, it is important to focus on creating user confidence and protecting sensitive information.

Whether it is for daily purchases or large transactions, the success of the payment app depends on the ability to provide users with a safe and visually appealing experience. In this blog, we will discuss the key features required to create a payment app that not only meets the user’s expectations, but more than them.

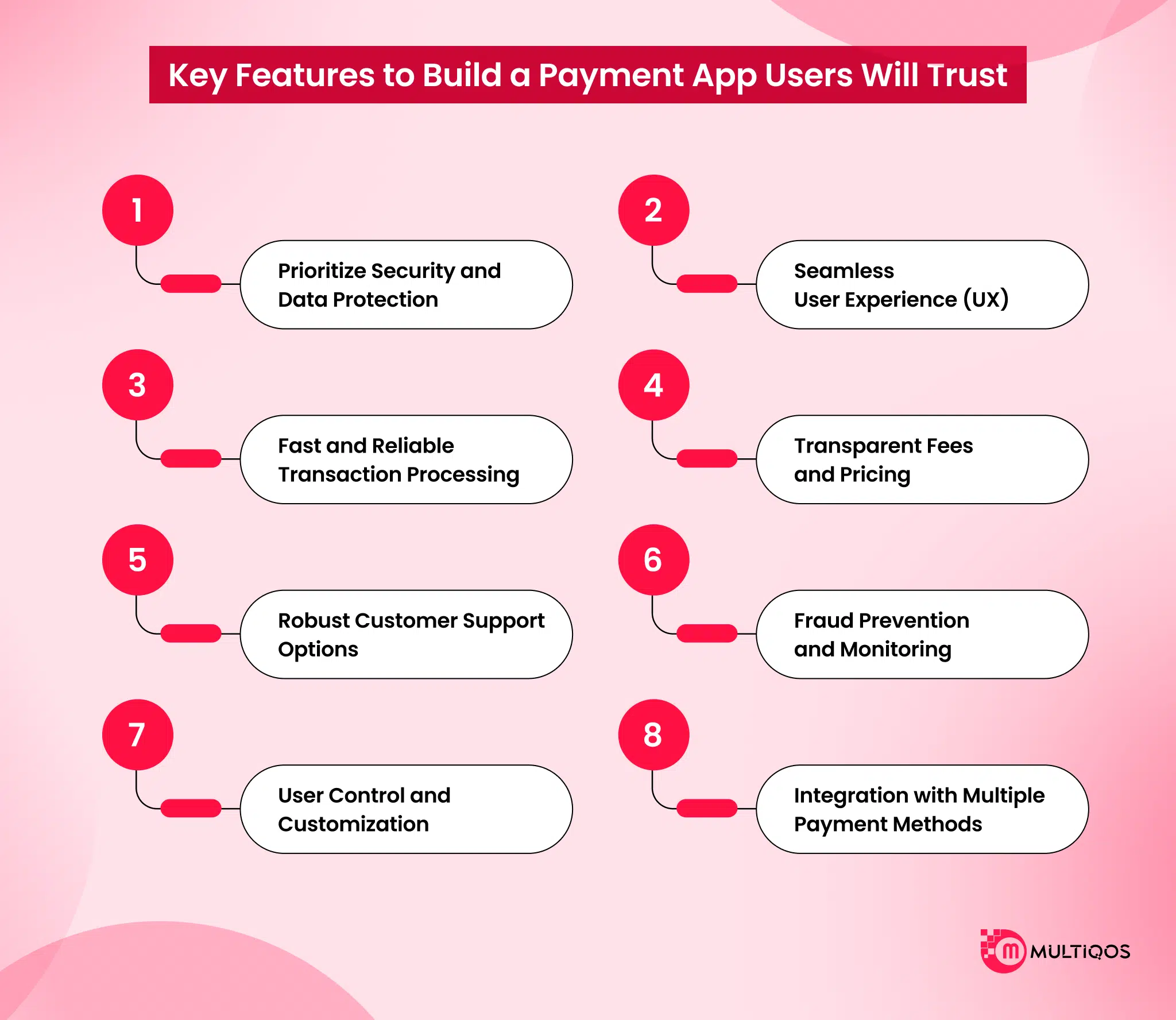

Key Features to Build a Payment App Users Will Trust

When creating a payment app, the app’s success and reliability depend on several features that prioritize both user satisfaction and security. Here is the breakdown of the elements required to create a payment app that users will rely on:

1. Prioritize Security and Data Protection

As we all know, the backbone of any payment app is security. Make sure that all sensitive user information is preserved while creating a payment app. You can use encryption protocols, multifactor authentication and security compliance, such as PCI-DSS and GDPR, to ensure that all transactions are safe. By identifying strong security measures, there are high opportunities that users will rely on your app for your financial information.

2. Seamless User Experience (UX)

A payment app should provide a frictionless, spontaneous, and user-friendly experience. For processing payments without misleading stages, it is necessary to create a smooth flow from the account setup. Either users pay bills, transfer money, or it should be easy to navigate with the business, app with minimal effort. Quick users can complete a transaction, more likely it depends on the platform and use it regularly.

3. Fast and Reliable Transaction Processing

In the world of payment, time is money. Creating a payment app with fast transaction speed and high reliability is crucial. Users should not experience delay when transferring money, especially in significant moments. Fast transaction processing is an important factor in user satisfaction, and no one can affect the confidence in a downtime or interval platform negatively.

4. Transparent Fees and Pricing

Trust is at the core of every mobile app, and it is created on transparency and openness. While creating a payment app, you should always consider that all the fees are included, whether it is transaction fees or service fees. Hidden fees can break trust, so it is better to offer clear and easy-to-understand rates to keep users satisfied and create credibility.

5. Robust Customer Support Options

Customer support is the cornerstone of a successful payment app. Users should think that if something goes wrong, they can get help quickly. Whether it is a payment problem, questions about account management, or solving technical issues, it is important to have a strong customer support option.

Many channels offer support, such as 24/7 live chat, phone support, email assistance, and extensive FAQs, ensuring that users can easily reach out for support when needed. Fast and more efficient problems are solved, more loyal users will form for your app, and create a long time and customer satisfaction.

6. Fraud Prevention and Monitoring

Working with a reputable mobile app development company to create payment app means ensuring a strong fraud prevention and monitoring system. Facilities such as real-time transaction alerts, AI-driven fraud and machine learning models require suspicious behavior to protect user data.

By updating the Security Protocol regularly, by integrating a safe payment gateway, and by offering fraudulent protection or insurance plans, you can create a reliable app that prioritizes the user’s security. This active approach provides security to users and makes them feel safe when using your platform for transactions.

7. User Control and Customization

In order to build trust, it is necessary to help users control their own experience. User control and customization features, such as determining the expense limit, allowing them to adjust notification preferences, and select security settings, can significantly increase the user’s satisfaction.

In addition, users are allowed to optimize the payment app interface, such as changing subjects or optimizing payment methods, adding a personal touch and improving the obligation. The more users feel that they are under control, the more likely they are loyal to the app.

8. Integration with Multiple Payment Methods

The more payment options your app can support, the more likely it is to attract a diverse user base. Many payment methods, such as credit/debit cards, bank transfer, digital wallets (such as PayPal or Apple), and even integration with Cryptocurrency, give users the flexibility to pay the way they feel best.

This gives users more opportunities to work on boundaries, so your app appeals to a global audience. To ensure that your app is compatible with a wide range of payment options not only improves your user experience but also increases the versatility and adoption rate of the app.

Why Build a Payment App with MultiQoS?

When creating a payment app, it is necessary to focus not only on security and purpose but also on performance. At MultiQoS, our development team uses data-driven mobile app KPIs to ensure that your app continuously performs its best, provides a comfortable experience for both users, and provides action-rich insights into your business.

- We design with the user in mind, ensuring a simple and intuitive interface that promotes smooth, seamless transactions and improves customer satisfaction.

- Your payment app will support many currencies and international payment portals so you can serve users worldwide.

- Safety is a top priority. We integrate compliance with advanced encryption, multi-factor authentication, and PCI-DSS and GDPR standards to ensure that users’ data is safe.

- We provide constant updates, bug fixes, and 24/7 customer support to keep you safe and updated on your app.

- Our solutions are cost-effective, giving you strong, safe, and high-performing apps at competitive prices.

- Since you have a business, your payment app will easily scale to handle high amounts, and facilities will be added without compromising performance.

Final Thoughts

Creating a payment app that requires user safety, ease of use, and a strong focus on reliability. By incorporating key features such as end-to-end encryption, multi-factor authentication, and seamless navigation, you can make sure users feel safe in each transaction. In addition, the offer of transparency in fees, real-time notifications, and strong customer service may further increase confidence.

To convert your vision into a successful, user-friendly app, it is necessary to hire mobile app developers who specialize in developing scalable and safe mobile solutions. With the right development team, you can create an app that not only meets the highest industry standards but also provides an experience that holds users back in a competitive market.

FAQs

We focus a lot on user experience (UX) to ensure your app is easy and easy to use. Our team designs clean, simple interfaces and ensures that users can quickly complete the transaction. We also conduct usability tests to ensure that the app meets the real-world expectations.

We integrate strong dispute resolution systems into the app so that users can report problems or returns easily. In addition, we ensure that your app follows the best practices for handling disputes quickly and transparently, with clear communication and responsible support.

We make payment apps with regard to scalability. By using cloud-based infrastructure and custom backend systems, we ensure that your app can handle transactions and an increasing number of users without compromising on display or security.

You can reach out by filling out our contact us form and get your free consultation call to understand your project’s needs better. We’ll respond promptly to schedule a convenient time to discuss your vision and requirements.

To ensure a productive interaction, please share the details of your business goals, target groups, your payment app and specific design or security settings. If you have a timeline or budget, you can include it so we can tailor our attitude accordingly.

Get In Touch