Everything You Need to Know About Developing a Buy Now Pay Later App

Customers are always looking for flexible and convenient payment options. Offering such options will boost your business and help you increase overall revenue. One of these trending payment options is BNPL.

Buy Now Pay Later or BNPL is a payment method that enables customers to split costs into manageable installments. BNPL apps have become popular these days that enable users to avail of this service.

These apps help users to defer payments for their purchases. It means, instead of paying the full amount upfront they can split it over a certain period of time. So, payments become convenient for the users as paying the whole amount may not be feasible for all.

Thanks to these applications, the users can buy products that are labeled with a high price tag and full payment cannot be made instantly. If you want to create a BNPL app then this blog is for you.

In this blog, you will know everything about BNPL app development, features, costs, and more. So, let’s check out the information to build your own BNPL application.

A Quick Overview of Buy Now Pay Later (BNPL) App

Buy Now Pay Later (BNPL) app is a fintech solution that allows users to purchase goods or services and pay in installments. It’s like buying a product on EMI. However, BNPL applications are meant to make purchasing products and services more accessible by enabling users to defer payments instead of paying the full amount upfront.

Let’s take an example, there is a global supplier of electronic goods. Vendors around the world procure goods from this supplier to sell in the local markets. However, some vendors with small businesses cannot pay the full amount of goods procured.

This is where the BNPL app comes in to support those vendors. The supplier can offer the BNPL service as a payment option for them and they can leverage it to procure goods and pay in small amounts over a certain period.

So, the BNPL app offers a convenient way to purchase goods and services when financial constraints exist. The BNPL service provider pays the supplier for the amount. As you must have learned till now it offers a credit service.

The BNPL app serves as a bridge between the supplier and the vendors by providing the financial assistance required to complete the transactions among them. It offers many opportunities to all the parties.

BNPL app development encompasses designing and developing a mobile application to offer Buy Now Pay Later services. Developing such an application requires extensive research, planning, and budget.

How Do Buy Now Pay Later Apps Work?

The following points demonstrate how a typical BNPL application works.

- Payment Option: First off, a user of a BNPL app will purchase a product or service and get BNPL as a payment option.

- Make Payment: After purchasing the product and choosing BNPL for payment, the BNPL app will pay the amount.

- Pay in Installments: When the transaction is completed, the user will pay in some interest-free installments. The first installment will be paid during the purchase.

- Pay over a Longer Period: Users can also choose to pay for a longer period of time by choosing installments with interest.

- BPNL App Takes the Risk: The risk is now owned by the BNPL app and it is solely responsible for recovering the debt.

- Manage Payments: The users are able to manage payments from the app and view payment schedules.

What Makes BNPL Applications So Attractive?

There are many reasons to invest in BNPL app development. They offer new business opportunities to businesses and convenient payment methods for customers. Let’s see all the benefits of these applications.

Convenient Shopping

People love online shopping but those heavy price tags make them turned off. With a BNPL application, they can buy must-have products and split their costs into manageable parts. So, it makes shopping convenient for them. Now financial constraints aren’t a hurdle for them anymore.

FOMO Factor

People don’t want to miss out on the latest techs, trends, and fashion due to the FOMO factor. However, BNPL apps help them stay on top of the latest trends and fashions without paying the full amount upfront.

Interest-free Payments

Another reason for the popularity of BNPL apps is interest-free payment options. Many BNPL services allow users to pay in installments without incurring any extra charges. So, they can shop and pay in interest-free installments.

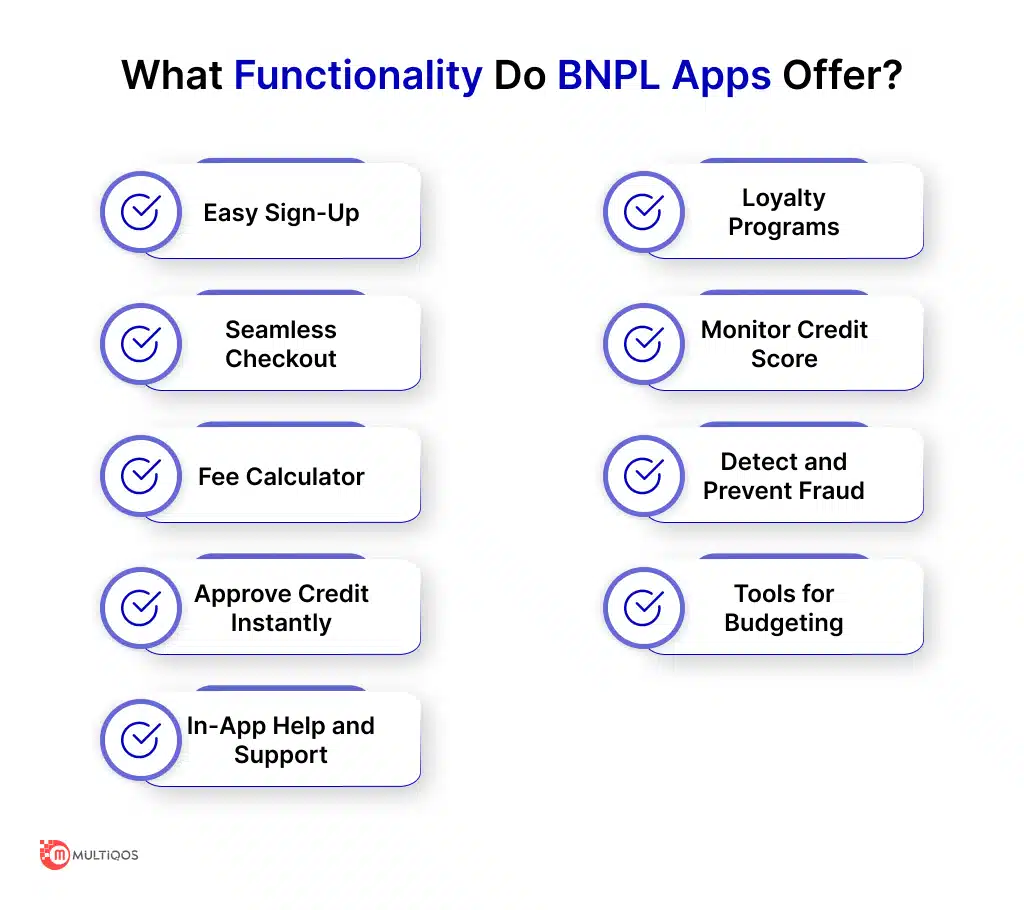

What Functionality Do BNPL Apps Offer?

Now that you know what a BNPL app does and why they are so popular, let’s look at the key functionality of these applications. The following are all the functionality that you need for a good buy now pay later application.

- Easy Sign-Up: Your BNPL application should allow users to quickly sign up without too much information. Ask for only the necessary information to make sign-up easy.

- Seamless Checkout: Ensure integration with merchants’ checkout system to make payments hassle-free.

- Personalize the Payment Schedules: Personalizing the payment schedules with their pay periods will minimize the risk.

- Fee Calculator: Integrate tools to enable users to calculate fees and interest charges based on their purchases.

- Approve Credit Instantly: Provide instant credit approval to users that will streamline checkout resulting in improved user experience.

- In-App Help and Support: The app should offer help and support from within the application to enable users to solve their problems or resolve queries instantly.

- Loyalty Programs: Provide incentives to users to get exciting benefits and offers to reward their loyalty.

- Monitor Credit Score: Allow users to check their credit score which will enable them to make the right decisions when it comes to availing the services.

- Detect and Prevent Fraud: Implement measures to prevent and protect against fraud to ensure the fair use of the services.

- Tools for Budgeting: Provide budgeting tools that will help the users manage their finances and stay on track.

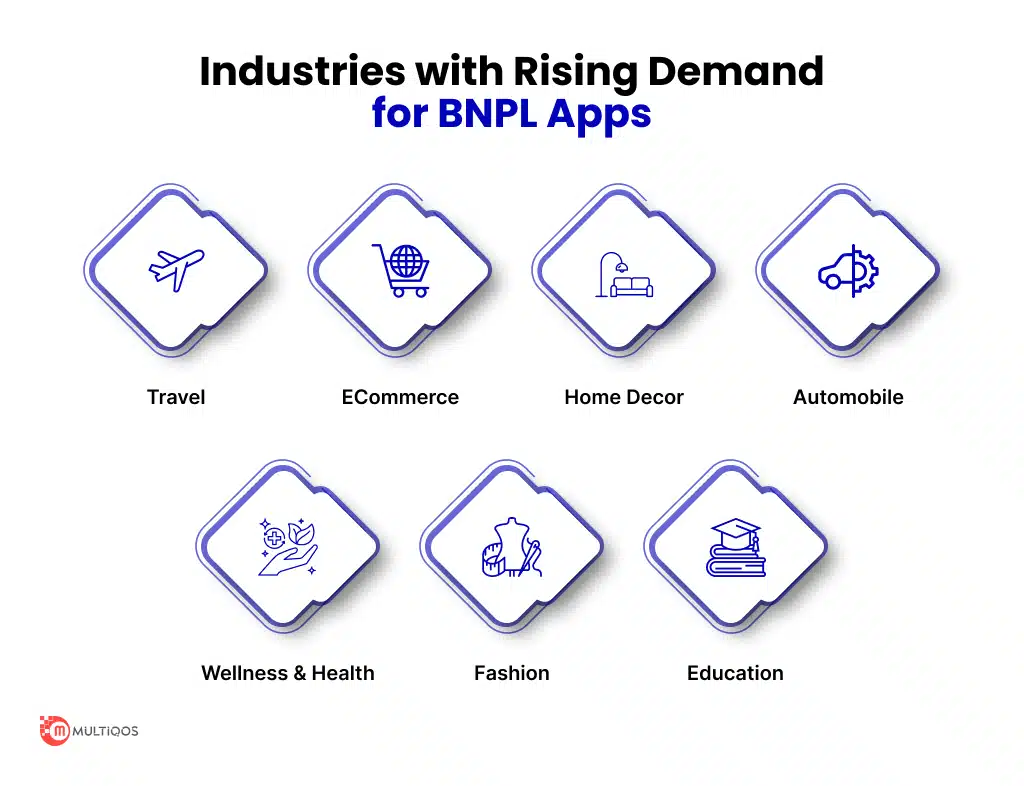

Industries Where the Demand for BNPL Apps is Rising

Well, the demand for the BNPL mobile app development is rising across different industries be it Travel, eCommerce, Automotive, or any other industry. As they offer a simple and convenient method for payment, these apps become an in-demand solution for diverse industries, Business across multiple industries can leverage this solution to increase sales and revenue.

Let’s find out which are the industries that benefit from BNPL app development the most.

Travel

Well, travel businesses can take advantage of the BNPL app development to offer affordable recreation and vocational services. They can allow customers to break payments into manageable installments that will boost their business and increase revenue.

eCommerce

By leveraging the buy now pay later option for customers, eCommerce businesses can boost their sales, improve conversion, and reduce cart abandonment. With this option, customers who cannot purchase right away due to funds will do their shopping and pay in installments.

Home Decor

Another industry that will benefit from the Buy Now Pay Later app development is the home decor industry. It involves businesses related to home furniture and furnishings. Businesses can make expensive purchases affordable for customers by offering the Buy Now Pay Later services.

Automobile

The automobile industry can benefit more from a BNPL app development because it offers products that are expensive and many customers cannot afford. However, with a BNPL app for this industry, businesses can help make the dreams of many families turn real.

It will make these products more affordable with manageable payments that can be made over a certain period of time.

Wellness & Health

Healthcare is often expensive and many people may not afford these expenses. However, the BNPL app can help customers access healthcare services without breaking the bank. They can pay for healthcare services in easy installments that eliminate the burden on them. Plus, it can help businesses to sell their wellness products or services by splitting the costs.

Fashion

Another key industry that can benefit from investing in the development of a BNPL application is fashion. In this industry, businesses can increase order value by encouraging customers to purchase more by offering easy payment plans. So, customers are likely to buy more which will benefit businesses in terms of increased sales and revenue.

Education

Education can also benefit from the BNPL service. Since education is often too expensive many students cannot afford it in a one-time payment. In this case, BNPL can help those students with payments in installments and get access to quality education. This provides benefits to both the students and educational institutions.

How to Develop a BNPL Application?

You have understood how the BNPL app can benefit diverse industries and allow businesses to increase their sales and revenue. So, investing in BNPL application development can offer outstanding benefits to your businesses.

If you want to develop such a mobile application, you can follow the below steps to create it. These steps provide the necessary information to create a buy now pay later application. So, let’s check out these steps.

Research

Any app development project begins with a session of brainstorming and cross-team discussions that define the roadmap for further steps. Market and competitor research is an important part of this step. It helps identify the scope of the project. Plus, it helps determine the app’s features, user experience, UI, and other things.

UI/UX Design

The next step involves designing the user interface and user experience for your application. While UI defines the user interface elements for your application, the UX defines overall user interactions.

UI/UX design entails creating a graphical representation of your application with the desired features, UI elements, icons, and more. So, it helps turn your abstract concept into a visual design that can be interpreted and approved by higher management.

The UI UX designers create mockups and prototypes to visualize how the product will look and feel. Plus, it also offers user interactions to understand, how the product will behave. It helps validate your idea and see how it will work with a demo application.

Development

Once your app’s design is ready, the next comes the role of app developers who turn it into code. They leverage the most suitable programming languages, frameworks, databases, and other technologies to create the frontend and the backend of your application.

You can start with an MVP (Minimum Viable Product) which is a mobile app with minimized features. With this app, you can then build iteratively to improve features. So, you can save money by creating an app with fewer features that will cost less.

Choosing the right technology is the foremost step in developing a BNPL app. You must evaluate different technologies to build the right mobile app. Plus, you can leverage mobile app development frameworks like Flutter, Ionic, and React Native to build cross-platform apps.

Testing

Testing or quality assurance is the next step that involves evaluating the application to verify its quality. You need to test applications on various parameters to check their performance, security, usability, and more. It will ensure that your application will run smoothly on different devices.

Apart from normal functional and usability testing, you should also performance compliance assessment to ensure that your app meets the required standards. Your BNPL app should meet many standards like GDPR, PCI DSS, HIPAA, and more depending on the industry type.

Deployment

The final step is the deployment of your application to make it accessible to the end users. It involves configuring and publishing the app on platforms like Apple App Store and Google Play Store. Once published your mobile app will be available to users and they can easily install it on their devices.

How Much Does It Cost to Develop a BNPL App?

Developing a BNPL app requires budget allocation. So, you need to understand how much it costs to develop this type of app. Typically, an app like BNPL can cost around $40,000 – $250,000. However, it depends on many things like the app’s complexity, features, customization, and more.

Let’s check out each of the crucial factors that determine the cost of developing a BNPL app and how they affect the cost.

- Complexity: The app’s complexity significantly impacts the cost because it determines the amount of resources needed. The more complex app will require more time in development and more resources. So, depending on the extra hours and resources used in development, the cost will rise.

- Features: More features will increase the development time which will lead to increased costs. Hence, the number of features also affects the cost of BNPL app development. A more complex app requires more features. So, they go side by side.

- Team Location: Another factor that affects the cost of app development is team location. It means where the development you hire for developing the app is located. There are different app development rates around the world. The developers’ rates in the USA, Australia, and Europe are high, but the rates are low in the Asian region while the quality is the same. So, you can lower the cost by hiring app developers in the Asian region.

- Customization: The cost of app development also depends on customization. So, the more customization you do for your mobile app, the more costly it will be. Again customization requires more time and effort that will increase the cost.

- Technology: Another factor in app development cost is technology. Well, technology can be free if you choose open-source options or it can be costly if it’s paid. So, depending on which type of technology you choose the cost can be lower or higher.

To Wrap Up

Buy Now Pay Later is a kind of app that can help end-users purchase products and make payments by splitting the amount into easy installments. So, it offers a simple way to buy products or services that are usually unaffordable for a customer.

However, creating a BNPL app requires the right team with relevant experience and industry knowledge. This is where you can rely on MultiQoS as we are a leading app development company with experience in developing diverse fintech solutions like BNPL apps.

We can help you build a top-notch app with cutting-edge features by leveraging the latest technologies. Call us for a project discussion and we will be here to help you.

Frequently Asked Questions

It typically depends on a host of factors covering the complexity level, number of features, third-party integration, customization, and many more. On average, BNPL software will take around 6-9 months or more depending on project requirements. Well, a basic BNPL software with a few features can be developed in a few months like 3-6 months.

However, developing a highly complex BNPL software with a lot of features and customization will require many months or even more than a year. The more time is invested, the better the software will be. All in all, your project determines the time it will take to develop the software.

Developing and launching a buy now pay later app can be challenging if you do not go with the right path. Don’t worry as the following tips can help you streamline the process.

- Choose market: Start by selecting the right market that matches your brand needs and offers good profit.

- Build teams: You need the right teams for different operations that can make your business run smoothly. For example, you will need a team to market the app and another one to provide customer support.

- Offer intuitive user experience: Make the app user-friendly with simple features that have navigation that isn’t confusing.

- Make smooth checkout: Ensure that the checkout process is frictionless with only a few steps. A smooth checkout process is crucial to ensure user satisfaction and improve user experience.

The number of businesses offering the buy now pay later option is rising. There are many popular BNPL apps that are already floating in the market. Some popular applications include AfterPay, Klarna, Sizzle, PerPay, and Affirm.

You can learn from these existing applications and build an app that can offer features that these apps don’t offer. Learn about customer app points and look for gaps that you can fill to make it a success.

Get In Touch