How to Create a Mobile Banking Application like Chime?

Millions of individuals use mobile banking to complete daily transactions throughout the world, thanks to the global upsurge in the popularity of mobile banking apps. They are a practical option for financial and banking organizations to promote growth through technology improvement, leading to the development of digital economies.

How?

Well, these apps are specifically designed to perform immediate transactions, check balances, gain control over spending, and access the banking features of all banks without paying any additional fees. Furthermore, certain mobile banking apps, such as Chime, have propelled the development of mobile banking apps to an entirely new level.

But are these apps like cash apps and Chime really smart solutions?

In this blog, we gain a more precise current market scenario about banking apps like Chime and how you started with one in 2024.

Market Statistics for a Mobile Banking App Like Chime

According to MX research, the Covid-19 pandemic has contributed to a 50% increase in mobile bank contact. In 2019, more than 75% of Americans checked their balance on a mobile device, while 6.93% of millennials utilized banking apps like a chime. According to Statista, 80% of millennials in the US regularly use banking applications.

Additionally, based on the increasing popularity of banking apps, research has been conducted recently, which predicts the market to reach over a $2 billion milestone by 2026.

But what is Mobile Banking App Chime?

A mobile banking app is software that enables bank clients to use a smartphone or tablet to access their account information and conduct transactions. These applications often have capabilities for bill payments, fund transfers, and account balance inquiries.

However, Chime is more of a financial technology business than a bank. Millions of people rely on it to start immediate transactions. The software lets users check their account balances and manage spending with only a few touches. It is available through more than 60K fee-free ATMs found in Walgreens, 7-Eleven, CVS, and other locations, and it doesn’t impose any hidden costs for any transactions.

What Kinds of Apps are Available for Mobile Banking?

There are four main categories of mobile banking apps like Chime that help businesses make significant profits while providing consumers with the finest mobile banking services ever.

- NFC (Near Field Communication): These apps allow users to make contactless payments using mobile devices utilizing the newest banking app trends.

- Online transactions: Applications for mobile banking are linked to online internet payment systems like PayPal or Stripe that enable users to make purchases with only a tap.

- Electronic wallets: By storing the user’s bank card information, digital wallets do away with the necessity for actual physical cards. They typically use NFC technologies.

- Handling of Mobile Transactions: With this virtual banking software, users have complete control over every transaction made using their bank card. It allows the customers to avoid going to the bank to do any banking-related business.

Also Read: Top UAE E-commerce Payment Gateways

These are a few mobile banking options for businesses and the fintech mobile app.

How to Make a Mobile Banking App like Chime?

Well, here is a step-by-step guide on mobile banking app development to help you launch your banking app with zero hassle…

Step 1: Identify the market and develop a plan

You need to be thoroughly aware of your rivals, market dynamics, significant development trends, and the target audience for your mobile banking application. You may develop an efficient strategy based on these to design an app suited to your users’ requirements.

Step 2: Prepare a prototype

You may develop the app concept by creating a prototype that showcases the app’s design and business logic. Moreover, it provides more specific examples of the app’s functionality, functional features, and design layout.

Step 3: Determine the Banking App’s Features

Online banking mobile applications are similar to other mobile applications in this regard. Choose the unique features and capabilities you can include while you build an app like a chime. You can finalize the characteristics considering several variables, including financial services, the market, the target market, the budget, etc.

Step 4: Work on the UI and UX design

You should provide a personalized customer experience based on the best practices for banking UX/UI design for applications. Make sure that the app’s general design is simple and safe, offering the user easy access to their account. Keep the app basic yet practical, no matter what features or functionalities you choose to incorporate.

Step 5: Choose the technological stack

Choose a technology stack to facilitate quicker and less expensive development while providing outstanding performance, reliability, and customer engagement.

- Programming Languages: Kotlin, Java, Swift-5, Objective-C

- Platform: SDK, Android SDK latest version, Cocoa Touch

- IDE: Android Studio (latest version), Xcode 11, App Code

- Push Notifications: Firebase Cloud Messages, User Notifications Framework

- Databases: PostgreSQL, MySQL

- Location Services: Google Maps

- Web Server: Nginx, Apache

- Analytics: Hotjar, Google Analytics

- Cloud Storage: Amazon services, Heroku

Step 6: Third-party systems integration

A banking mobile application project must use APIs from third-party apps for certain functionalities and features. Consider the performance and security risks of the solutions when integrating them with third-party providers.

Step 7: Develop a mobile banking app

The baking app’s source code is developed in this phase, and its features and capabilities are tested before going live. You should connect with fintech app development services if you still need to get the ideal team in place to create a mobile banking app. The experts will fully comprehend your needs and assist you in creating a perfect company application.

Step 8: Test and launch your banking application

Before launching, rigorously test your mobile application to remove any flaws or mistakes. If your banking app is too sluggish or has any errors or bugs, no people will utilize it. So, to deploy the application on the specified platform, be sure to conduct the testing appropriately (Android, iOS, or both).

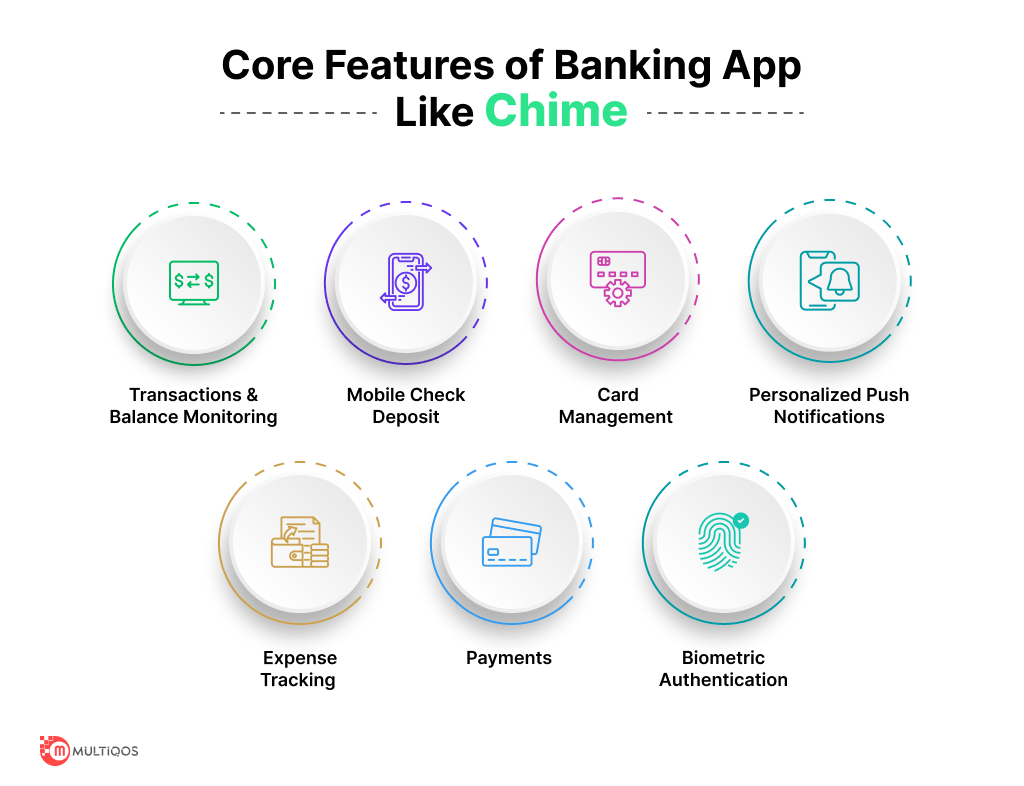

Which Features Should Mobile Banking Apps Like Chime Have?

If you intend to create banking applications, they must meet client expectations. Here is a summary of the main characteristics of banking app development solutions like Chime that can assist you in developing a growth-driven business application.

- Transactions and Balance: Users can check their balance and recent transactions while navigating the banking application.

- Check Deposit: Users may use this function to take photos of the check from both sides and submit them using the app.

- Manage Cards: Users can attach credit or debit cards to multiple accounts and prohibit them from using this capability. Users can also establish restrictions, modify PINs, and carry out other actions made possible by their bank.

- Third-party Push Notifications: Users can provide permission for a scheduled transaction to be requested via notifications to get updates on their accounts.

- Expense Tracking: While using offline banking services, keeping track of costs is difficult, but this feature will enable users to track their spending and adjust their financial plans quickly.

- Bio Authentication: Supporting fingerprint and FaceID sign-in will help your customers feel secure and comfortable.

How Much Does It Cost To Build a Banking App Like Chime?

While this is a unique phenomenon and may vary based on several circumstances, on average, the cost of developing a Chime or Chase mobile app ranges between $20,000 and $25,000.

Some of the cost variance elements listed below might have an impact on the ultimate price:

- Functionalities And Features

- Third-Party APIs

- Security Features

- Location Of the App Development Partner

- UI/UX Designing

- Technology Stack Selection

- Platform Selection

Discussing these elements in person is crucial so that the mobile application development company in Dallas can assess your needs and provide you with a strategy in line with them.

Wrapping Up!

Mobile banking applications and other digital solutions are in high demand in the banking industry. Everyone demands speedy, flawless services online these days, and they always want quick fixes. In such circumstances, chime app development is the best option for providing customers with the best banking experience.

However, developing a mobile banking app requires a lot of technical considerations and is time-consuming. It involves careful planning of every element linked to the user experience and the business goal. So, for better outcomes, you can hire banking app developer to gain your clients’ confidence and establish a long-lasting relationship.

Want exceptional FinTech App?

Experience accelerated digital innovation with our comprehensive custom FinTech app development services.

FAQs on Chime Banking App Development

Depending on the type of app being produced, the time needed for fully functional application development ranges between four to five months.

Banking applications are more convenient, secure, and effective. Also, creating a mobile app like Chime reduces the costs of hiring people, running the business, and using paper.

Always do your own research on your market instead of investing in both. IOS has a 59% market share in the US, compared to 41% for Android. Client preferences will influence the decision you make.

Get In Touch