How to Choose and Integrate Payment Gateway in a Mobile App? – Important Tips

Table of Contents

- What Exactly Is A Payment Gateway, And How Does It Operate?

- Introduction Of Payment Gateway Integration

- Payment Gateway Integration Into Mobile Apps

- Top 5 Payment Gateway Providers

- Merchant Accounts: Different Types

- Direct Credit Card/Debit Card Payments Integration

- Payment Card Industry or PCI’s For Payment

- How To Integrate Payment Gateway In An iOS App

- How To Integrate Payment Gateway In An Android

- Cost Of Integrating Payment Gateways In Mobile Apps

- How Can Multiqos Help In Integration Of Payment Gateway In Mobile Apps?

- Wrapping Up

Choosing and integrating payment gateway can be quite a task and this is why we bring you this article to help you with the steps.

What Exactly Is A Payment Gateway, And How Does It Operate?

Payment gateways are portals that help a bank account connect to the apropos payment processor and does the job of transferring transaction related information either virtual or through offline means.

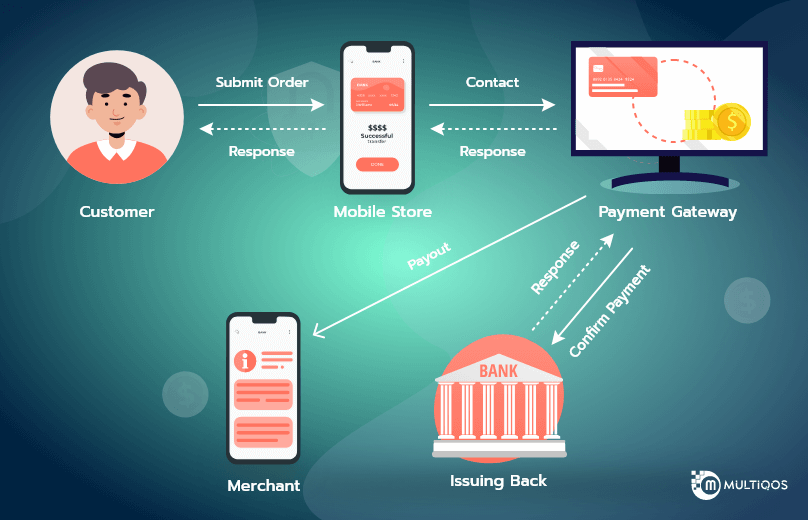

The working of such payment gateway doesn’t seem complex. Such payment portals/apps follow procedure in order for the payment to be received/made. This takes place when any consumer places their order via apps/portals where such payment services are available. Once the payment has been made, it just needs to be transferred to the merchant’ account.

Introduction Of Payment Gateway Integration

Now one may mull over the meaning of integration and how the process is to be brought off. Well, payment gateway integration makes references to integrating any payment system with the shop you are running in order for the consumers to be able to relish the benefits of online payments.

Payment Gateway Integration Into Mobile Apps

To put the steps simply, the consumer first decides upon the app through which he will be shopping. Thereafter, he chooses the product and the product gets marked on for the purchase.

Once it reaches the cart, the cartthen syncs up with the payment gateway.

Upon requesting for the product, the payment is given the thumbs up. Within seconds, information pops up on the interface of the merchant’s account. The information sites there until and until requested otherwise.

This may require you Mobile App development or Mobile application Development, though not necessarily.

Top 5 Payment Gateway Providers

Paypal

The first one is pretty well-known across the globe, supporting both transactions and transferring from one bank account to another. Paypal proffers its customers two types of payment methods namely Paypal Payments Standard and Paypal Express Checkout. While the former allows for accepting credit cards online, the latter helps customers complete and follow up with their transactions.

Stripe

Another brick on the block is this payment option that goes with the name Stripe. This provider has successfully won the trust of reputed companies like Pinterest, Lyft and Slack. This one seems suitable for debit and credit card processing, even more so for transactions requiring one to be present there physically. Though, it can be carried out however you want.

Square

The next type of payment gateway provider is square. It has been one of the most reliable providers ever since its launch. This application allows retailers to accept mobile as well as credit card payments, which could be either through chips or near-field communication.

Apple Pay

Next up we have apple pay and as the name suggests, it’s apple’s in-built application. This application permits buyers to make purchases just by putting up their Face ID and Touch ID. You will have no problem accepting credit card and other payment methods, provided the store you are shopping from provides an NFC terminal.

Amazon Pay

Up next, we bring you Amazon pay, which you are quite well acquainted with. Over here, all of the transactions are brought off through the payment process on your site’s page. All you have to do is to log in to your account and you are good to go.

These were a few of the best payment gateway providers.

Also Read: A Complete Guide to Start your Hyperlocal Marketplace Business Model.

Merchant Accounts: Different Types

There are two types of merchant accounts and we will be alluding to the same over here.

Dedicated Merchant Account

The first type of Merchant account regards to lone business owners or individuals as we call it and everything is tailor-made as per your needs. There is, however, a downside to such accounts, for the account holder has to splurge some money as a form of added expenditure.

Aggregate Merchant Account

Next up, we bring you an aggregate merchant account. This is the place which readily allows you to hoard money, including your customers'( if there’s any). When set against the dedicated merchant account, this one is more preferred and popular.

To further expound, this type of account is offered by some of the most sought-after payment gateway providers.

Direct Credit Card/Debit Card Payments Integration

There are several gateways letting people make purchases through the use of their debit or credit cards, while making use of API for processing those transactions.

As easy as it may sound and look, the upshot may strike you quite hard, for you will bump into a lot many difficulties along the way.

The main drawback of such an integration is that you will be held accountable for any mishap in your transaction journey. Another biggest turn off is that you may not be able to process transactions, especially where transactions carried forth through mobile apps are strictly prohibited.

So, you will have to be mindful of such details while choosing this.

Payment Card Industry or PCI’s For Payment

An alternative to the previous system, we bring you Payment Card Industry or PCIs, and also because of reduced risk.

Though the problems relating to online gateway portals are inevitable, this slightly helps you carry out transactions securely.

Big companies are pitching on PCI because for security reasons, inclusive of comprehensive native solutions and bumped up libraries for any operating system. These are the factors one gives the go-ahead to this type of payment method.

How To Integrate Payment Gateway In An iOS App

In order to integrate payment gateway in your iOS app development, follow the procedure outlined below:

- Collecting Customer Payment information

- Under this, one can get a checkout for this payment gateway provider namely PayPal and credit card transactions by getting the Drop-in UI added to your system. For this, you will require a code.

- If you already have a checkout at your disposal, you may be required to expand your payment horizon so opt for PayPal, Apple Pay and others.

- Lastly, you are allowed to save your consumer’s information by rolling your own check UI and thereby making use of credit card tokenization.

- Set up the iOS client

- Before going ahead, you have to sync up the Braintree DropIn pod with your profile.

- Once the above step has been performed, your app will ask for a client token on your server(there is a code for that)

- Further, you will be getting welcome with a new client token every time your app launches. Make the most of this before user interaction gets shut out.

- Next you will be adding the import statements by making use of the payment gateway provider namely Braintree, to any class.

- One can reap the benefits of Drop-In to get things underway. The resulting method for payment would be sent off to your customer.

- Testing will require you to have a Braintree sandbox account ready, along with the credentials like sandbox merchant ID, Public Key, Private key.

- Bear in the mind, the real payment method won’t be of any use in the sandbox, you may have to turn to Braintree Test card numbers and nonces

- Once you are live, swap your sandbox API credentials with production credentials

How To Integrate Payment Gateway In An Android

Android app development users needn’t be worried. This heading will specifically deal with payment gateway integration in androids.

- Set up your client: Braintree offers SDK v2 for those of you who use Android systems.

- First and the foremost thing that you will be needing is a client token. This will enable you to establish and sanction connections with Braintree’s servers.

- To get started with the client SDK, you will be required to type in configuration and authorization details. Look into your client token and you will find these pertinent details.

- Get started with Braintree after you get a hold of a client token from your server. The way to get your hands on the token depends upon what you go for.

- Drop-In UI

The easiest way any merchant can obtain customer payment information through the client SDK is by using the Drop-in UI component. It provides an expedited and amped up payment experience. You are very much open to the option of creating custom UI and thereafter tokenizing payment related information directly.

To get into your Drop-in UI, you will have to add dependency to your build-gradle file (there is a code that you will have to paste in the given box).

Once the code has been pasted, the user will now be able to enter or type in the payment information. And once the user is done with entering the relevant information, the same will be sent off to your app with payment method nonce in your calling Activity’ under your on-Activity Result section, which you can stretch beyond to seek the desirable response.

Lastly, you will need to send the nonce to the server and that’s all for the payment part.

Also Read: Mobile App Development Cost- Understand the App Budget to Build Powerful Apps

Cost of Integrating Payment Gateways In Mobile Apps

The price of such payment gateway integration hinges on the pricing structure, which is rife in the market.

- Classic: These resemble PayPal’s gateway pricing structure a lot. Sellers receive a rate of around 2.9%+ $0.30 every transaction they make.

- Innovative: Up next we have innovative, having the features of paying monthly fee, and if this doesn’t work for you, you are well allowed to pay fee after every transaction.

- Interchange Plus: These rates are inclusive of interchange rate along with a markup.

Though, the markup could be anything from a percentage to even a per-transaction fee.

And around this, the final cost is splashed out by your account.

How Can MultiQoS Help In Integration Of Payment Gateway In Mobile Apps?

MultiQoS has some exemplary programmers working at their place, who can carry through the reception of payment from customers effectively and efficiently, for it is highly unlikely you would face any issues.

Wrapping Up

The aforementioned article delved into the world of payment gateway transactions and it lifts up the fog-related to the same in an extensive manner. Skim through the article if you are looking for assistance in the process.

Do you already have a great concept that’s set to go viral, but you’re not sure how to include a payment gateway into it? Then, feel free to contact us.

Let’s Create Big Stories Together

Mobile is in our nerves. We don’t just build apps, we create brand. Choosing us will be your best decision.

Get In Touch