The Ultimate Guide to Fintech Software Development in 2025

Table of Content:

- Introduction

- What is Fintech?

- Financial Software Development Explained

- How Fintech Works

- Trends & Market Overview

- Role of Financial Software Developers

- Traditional Banking vs. Fintech

- Types of Fintech Software

- Essential Features

- Pros and Cons

- Development Process

- Technology Stack

- Cost of Development

- Future of Fintech

- Hiring a Development Company

- Why MultiQoS?

- FAQs

Introduction

The financial industry is changing rapidly because of fintech, or financial technology. Fintech uses innovation. The financial industry is rapidly changing due to fintech or financial technology. Fintech uses technology to make financial services smarter and more efficient.

There are many factors driving this change. Advances in mobile technology have made banking more accessible. The increasing use of data analytics is helping companies Understand customers better. Moreover, Blockchain and cryptocurrencies are changing the way we think about money.

In this blog post, We explore the key trends and innovations driving this change. We will look at emerging technologies such as artificial intelligence (AI), blockchain, and data analytics. Also how it will shape the future of Fintech.

We will also discuss Fintech software development costs and what to consider when hiring a Fintech software developer. So, let’s dive in and start by understanding:

What does ‘Fintech’ mean?

Fintech is a shortened form of financial technology, which means technology in the financial industry. It refers to employing new technology to deliver enhanced and speedier financial services.

For instance, instead of having to visit a bank to complete a balance check, you can do so right on your phone through FinTech. In its various forms, such transformation facilitates the execution of various activities, including applying for loans or finance management.

Fintech also develops products in payment, credit, insurance, and other services using software such as mobile applications, Artificial Intelligence, and big data. These are useful in enabling individuals to manage their own funds and make better choices.

What is Financial Software Development?

Fintech software development primarily centers on creating the tools and applications needed by the finance sector. These tools can even be as basic as a bookkeeping program for a start-up firm to as complicated as the high-velocity trade floors of large investment banks.

The idea is to develop applications that make work easier and are cheap and secure. These systems help to provide more simplified and targeted financial services to the company’s users.

It is very important for developers who work in fintech to have general knowledge about finance, laws & regulations, and security to create software that can work perfectly with high security and meet all the legal requirements.

How Does Fintech Work?

Fintech involves the utilization of technology in the enhancement of finance services among the business entities and the user. The purpose is to achieve this goal faster, cheaper, and with less effort.

To the companies, fintech reduces expenses per deal and assists them to work more profitably. It is ideal for consumers since payments can be made or financial services can be made more easily.

Fintech is therefore characterized by technologies such as blockchain, robotic process automation (RPA), artificial intelligence (AI), and machine learning (ML). Maturity of capital must be managed besides improving security and risk management.

For instance, with apps such as PayPal or Venmo, you can send money instantly through cash transfers, eliminating the need for bank visits or checks which are much simpler and swift.

FinTech Software Industry: Trends & Market Overview

The Fintech software industry is continuously expanding because of technologies that continue to provide customers with easier and more efficient services.

An important driver of this growth is the growing cooperation between national supervisors and financial entities. These affiliations enable financial services to enhance the application of these technologies to provide timely, valuable added services to customers.

The International Fintech market today is growing in regions that include the Middle East, Asia Pacific, Africa, North America, and South America. It is expected to rise to about USD $698.48 billion by 2030.

According to Allied Market Research, the main areas that will lead this growth from 2021 to 2030 include payment and fund transfers, loans, insurance, personal finance, and wealth management.

What Do Financial Software Developers Do?

Financial software developers are responsible for developing and maintaining software used in financial transactions. They handle everything from planning and design to developing and supporting tools such as financial planning and personal finance management (PFM).

These entrepreneurs may work independently or be part of a fintech development company. Tech that specializes in building these systems. To succeed Fintech software developers need to have a strong understanding of the banking and financial sector.

This includes knowledge of the latest technology in the industry. For example, companies like MultiQoS select the most experienced experts to ensure they provide the best financial software solutions to their clients.

Traditional Banking vs. Fintech: What’s Changed?

| Aspect | Traditional Finance | Fintech |

| Innovation | Focuses on stability and trust, often slow to adopt new innovations compared to fintech startups. | Leads in innovation, using cutting-edge technologies to offer modern financial services. |

| User Experience | Offers personalized services but may lack the digital convenience and speed of fintech solutions. | Provides seamless, user-friendly experiences through advanced digital platforms and apps. |

| Financial Inclusion | Serves a wide customer base but may exclude some due to strict requirements and traditional processes. | Helps unbanked and underbanked populations access financial services, creating more inclusive solutions. |

| Product Range | Offers traditional products like loans, investments, and insurance. | Provides tailored solutions like robo-advisors, peer-to-peer lending, and access to cryptocurrencies. |

| Regulation | Has a strong regulatory history, building trust over time. | Faces changing regulations, ensuring protection but dealing with challenges in adapting to new laws. |

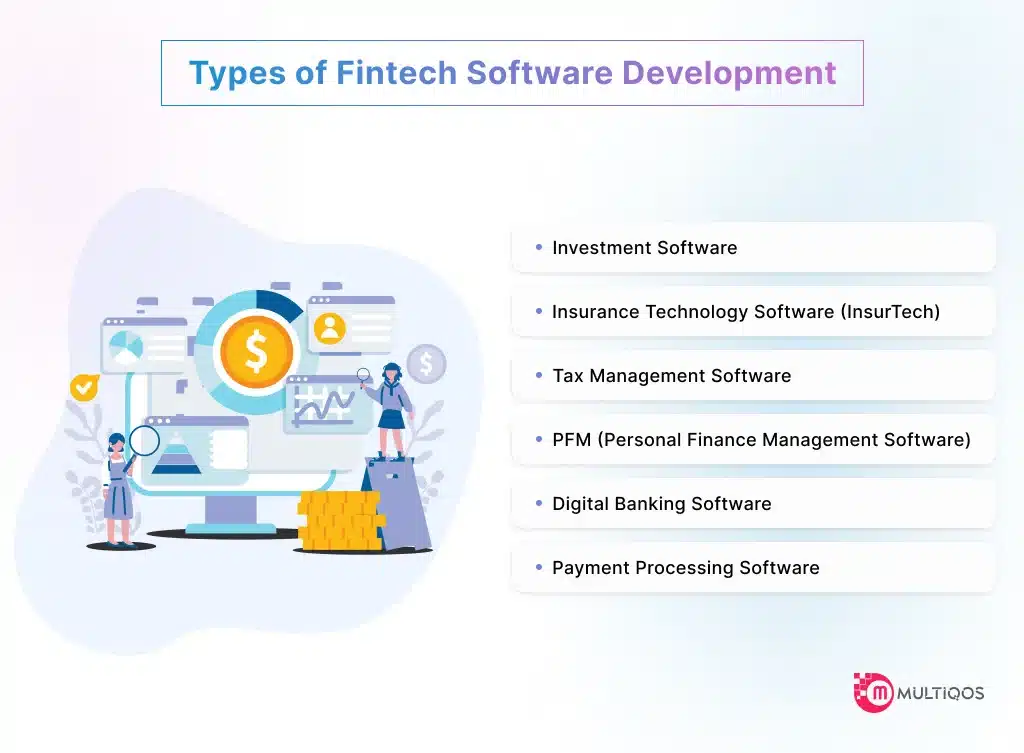

Types of Fintech Software Development

The fintech industry offers various options for startups looking for proven fintech ideas. Here’s an overview of the primary types of financial software you can explore:

Investment Software

Investment software breaks the high barrier that has limited investment opportunities to the rich alone. These apps assist in lowering the commissions, eradicating the middleman, and making trading, bidding, and buying and selling more straightforward for all investors.

Insurance Technology Software (InsurTech)

InsurTech software assists insurance firms in risk evaluation and increases their ability to supply better offers. It has fast access solutions for insurance and also claims for its users. There are several kinds of insurance that insurance management apps can deal with, some of them are; Life, auto, home, and pet insurance.

Tax Management Software

The application of tax management software is a way of simplifying the tedious work of managing and or filing taxes. Such software deals with the preparation, filing, and handling of taxes and other paperwork that is related to it. The beauty of it is that you do not need to be an expert or even know an accountant to handle tax systems.

PFM (Personal Finance Management Software)

One of the greatest advantages of fintech is assisting the management of personal money. The usage of PFM applications means that incomes and expenses can also be controlled effortlessly. These apps are advantageous as they compile financial information making it easy for individuals who use them to track their spending habits.

Digital Banking Software

Bank applications are applications that enable the user to perform banking activities using the internet with no physical interface. It allows to conduct all the usual banking operations, including account creation, obtaining loans, money transfers, and payments from devices.

Payment Processing Software

Payment processing software deals with transactions for financial service providers. It works to link PSPs and cardholders to facilitate purchases through the Internet or mobile devices. Additionally, this software enables small businesses to accept payments via cards and other online modes without a problem.

Must-Have Features of Financial Software Systems

Multi-user collaboration

One of the most important features for Fintech software in 2025 is the ability for multiple users to collaborate on transactions and deals within the platform. This ability makes the process more efficient and positive for all parties involved.

Biometric authentication

The use of biometric authentication is essential to ensuring security in fintech applications. Features such as fingerprint scanners Or facial recognition can provide secure access. At the same time, it improves the overall user experience. This makes it easier for users to enter safely.

Live Chat and chatbots

Integrating live chat and chatbots into your app is essential. These tools provide immediate customer support and are becoming more popular among users. By providing faster support will improve the customer experience and may lead to increased revenue.

Cross-platform integration

Cross-platform integration is essential. Allow users to connect your app to other apps or platforms for various financial services. This integration adds convenience and flexibility to users. This makes the overall experience sharper.

AI for data analysis and visualization

Combining AI with analytics and visualization can add significant value to your investment program. AI can analyze user data and present visual insights. Help users better understand their finances and make more informed decisions.

Pros and Cons of Fintech Software Development

Like any technology product, financial software systems have their advantages and disadvantages. A lover of numbers must consider the following before opting for a fintech app from the ground up either for feasibility, dexterity, or optimization: Here’s a closer look:

Pros of Financial Software Development

Adaptability

Financial software makes banking firms to be in tune with the prevailing market situations in the market at any given time. This flexibility can be an advantage to counter any threat within the ever-changing and evolving industry.

Accessibility

Through the fintech solutions, customers can undertake different kinds of banking and financial transactions without having to physically move to the facilities. It saves time to travel or wait for days; everybody with an internet connection can access the services they require at any time.

Cost Reduction

One can discover that creating fintech products requires fewer resources than maintaining antiquated systems. This reduction in costs enables organizations to deliver their services to their consumers more effectively.

Time Optimization

Fintech solutions free up users’ time as all the services are available through the Internet. Customers can transact without physically visiting the physical branches of these organizations, and the transactions are less time-consuming.

Variety of Services

The nature of services offered by the fintech companies can be flexibly partitioned so that they can suit the various customers and service providers. This helps diversify the entire experience one has when using a particular site.

Cons of Financial Software Development

Data Theft

Security and specifically cybersecurity issues remain a major concern in the development of fintech applications. Due to the connectivity to other institutions, another major problem arises: the more points with connection to the internet the higher the probability of cyberattacks and potentially important data leaks.

Lack of Regulations

In the case of fintech, the nature of competition is evolving, and legal standards are dynamic. This constant shift makes it challenging for fintech companies to standardize their compliance procedures efficiently.

Professional Liability

Currently, a major challenge is the finite resources that most of the fintech firms have and this makes it a challenge to put in place the most up-to-date operating standards. This can cause problems and undesired consequences in the provision of services.

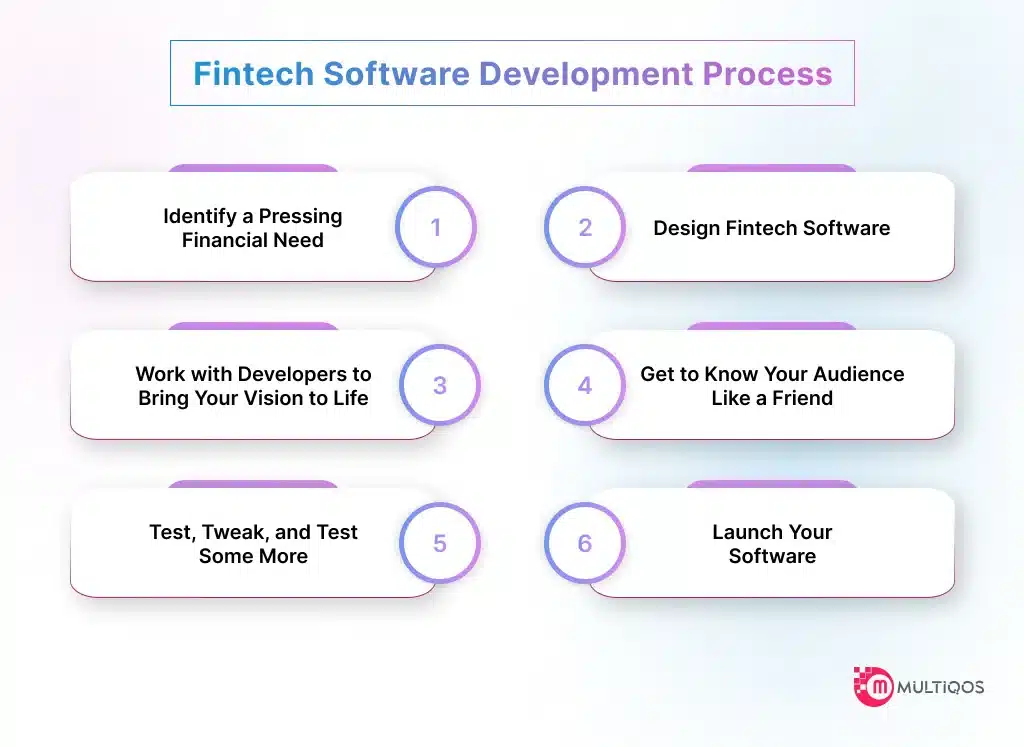

Fintech Software Development Process

Here’s a straightforward guide to help you develop your fintech software effectively:

Identify a Pressing Financial Need

Start by recognizing a specific problem in the financial world. This could be anything from simplifying budgeting to improving investment decisions. Finding a real need is key to creating a valuable solution.

Design Fintech Software

Imagine your software as a friendly financial advisor. Ensure it is easy to navigate and visually appealing. Include features that make managing money simple, like budgeting tools and mobile banking options.

Work with Developers to Bring Your Vision to Life

Collaborate with developers to create a user-friendly and secure platform. It’s crucial for users to feel safe sharing their financial information with your software.

Get to Know Your Audience Like a Friend

Understand your target users thoroughly. What financial challenges do they face? How do they currently manage their money? Knowing these details will help you create a solution that resonates with them.

Test, Tweak, and Test Some More

Before starting Let all tests be done. Collect feedback from real users and customize your app based on their feedback. This step is crucial in resolving all issues and ensuring professional performance.

Launch Your Software

Once everything is ready, it’s time to launch! Promote your software through social media, blogs, and others When everything is ready, it’s time to get started! Promote your program through social media, blogs, and other channels. Bring excitement to your fintech solutions and empower users to manage their finances.

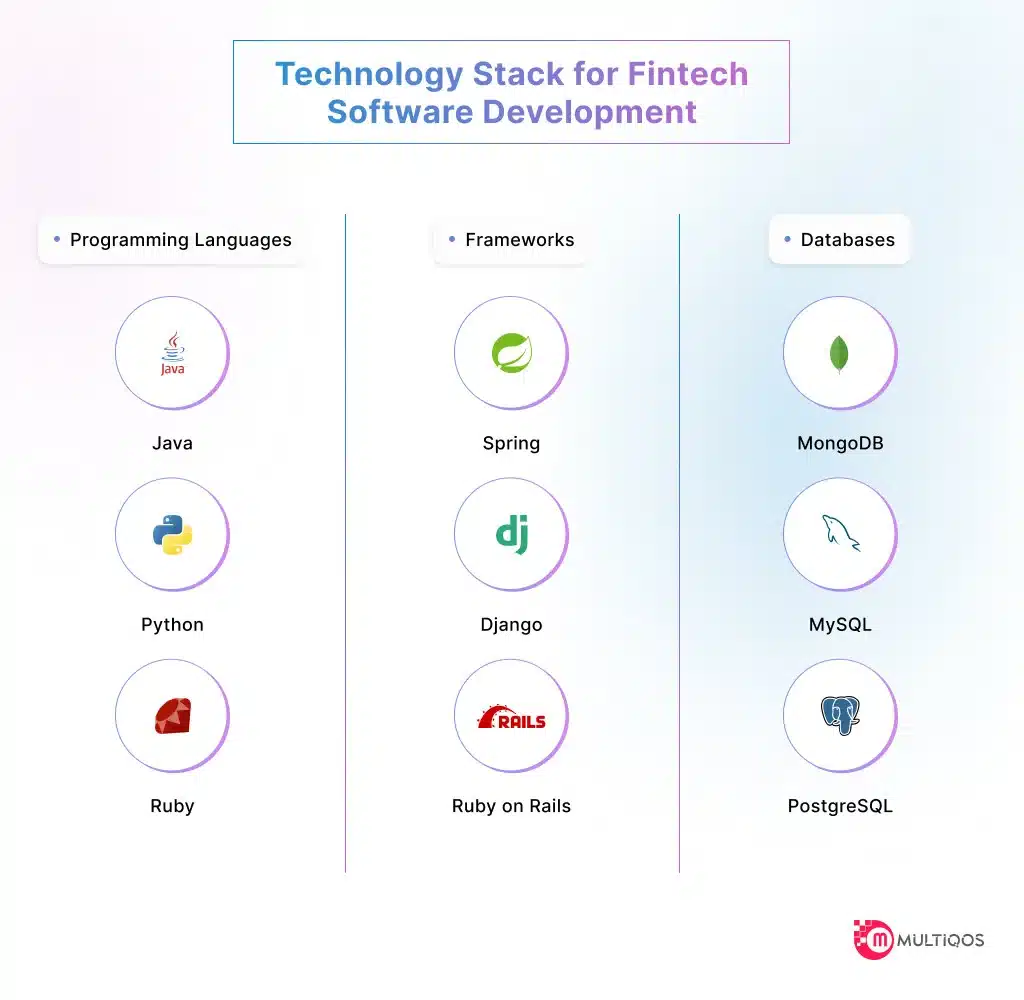

Technology Stack for Fintech Software Development

Technology is crucial for Fintech software. It helps users access financial services easily. The main goal of Fintech software development is to make finance simple for everyone.

Successful Fintech apps use a technology stack that meets the specific needs of each project. This stack includes programming languages, frameworks, databases, and other important technical elements.

Here are some common technologies used by top Fintech software companies today:

Programming Languages

Java

Python

Ruby

Frameworks

Spring

Django

Ruby on Rails

Databases

MongoDB

MySQL

PostgreSQL

How Much Does Fintech Software Development Cost?

The cost of developing Fintech software can vary widely. Many factors affect the total price. On average, costs range from $20,000 to $500,000. Prices depend on features like digital wallets, payment gateways, security needs, the platform (iOS, Android, web), and third-party integrations.

Here are some estimated costs based on the type of Fintech app and the location of the development firm:

| Type of Fintech Software | Asia | North America | Central/Northern Europe | Western Europe | Oceania |

| Banking Software | $120,000 | $360,000 | $180,000 | $250,000 | $320,000 |

| Lending Software | $86,000 | $240,000 | $140,000 | $160,000 | $210,000 |

| Insurance Software | $60,000 | $150,000 | $160,000 | $100,000 | $120,000 |

| Investment Software | $90,000 | $210,000 | $130,000 | $160,000 | $190,000 |

| Consumer Finance Software | $110,000 | $360,000 | $150,000 | $260,000 | $320,000 |

Note: The prices above are rough estimates. Actual costs may vary due to different factors.

When choosing an offshore software development company, you may encounter language and time zone differences. While Radixweb is also an offshore vendor, we offer flexible engagement models to suit our clients.

You have control over your project while we handle the work. We set meeting times that work for you and create a communication plan to avoid misunderstandings.

Future of Fintech Software Development

Predicting the future of Fintech software is tricky, like predicting the weather. But one thing is clear: the market will keep growing. More businesses will enter the financial software space. This growth is good, but it will also make it harder to stand out.

The exciting news is that as the industry grows, so do the tools for development. Costs might rise slightly, but with technology changing our lives, it’s worth it. Innovations like artificial intelligence, robotic process automation, virtual reality, open banking, and smart contracts are on the horizon.

If you’re in the Fintech field, now is the time to think about how to use these trends to stand out.

How to Hire a Finance Software Development Company

Now that you understand the need for Fintech software and its future, let’s look at how to choose the right software development company.

Here’s a simple guide to hiring software engineers who can create the financial services your customers want:

Portfolio

Look at the company’s past work. You need a developer with relevant experience for your project. Their portfolio should show completed projects similar to what you want.

Expertise

Define your project requirements clearly. The skills needed for a Fintech app might be broader than for other types of software. Make sure the developers have the right expertise.

Client Reviews

Read reviews from past clients. This is important if you like their experience and portfolio. Websites like Clutch, GoodFirms, and TopTal can help you find dedicated developers.

Cybersecurity

Your Fintech software must be secure. The development team should ensure strong cybersecurity before launching the app and continue supporting it afterward. Emphasize security when selecting your developer.

Why Develop Your Next Fintech App with MultiQoS?

Choosing MultiQoS for your Fintech software means you will get a solution that uses the latest technology. We specialize in blockchain technology, artificial intelligence, and machine learning.

Our team understands regulatory compliance, cybersecurity, and data encryption. We create Fintech applications that are secure, compliant, innovative, and user-friendly.

Partner with MultiQoS to unlock the full potential of Fintech. Together, we can improve digital banking experiences and promote financial inclusion worldwide.

Frequently Asked Questions

Fintech software development helps financial institutions become more efficient. It automates processes, cuts costs, and improves customer experiences with personalized and easy-to-use financial services. It also increases security through advanced encryption and fraud detection technologies.

Companies face several challenges when developing fintech software. They often deal with regulatory issues, cybersecurity risks, and technical difficulties in integrating new solutions with existing systems. Maintaining customer trust and ensuring consistent service quality can also be tough.

Fintech software enhances customer experience by offering personalized financial services. Users can access banking and financial products anytime and anywhere. Features like real-time transactions and user-friendly interfaces make the experience more convenient and satisfying.

C++ is a popular choice for fintech companies that need speed. Companies involved in online trading often use C++ because it helps create low-latency programs, which are crucial for fast transactions.

Get In Touch