Fintech App Ideas: Top Creative Visions For Next Unicorn Startup in 2025

Introduction

During the past decade, there has been a surge in online transactions. Since we are in a transition period and gradually entering digital technology, we will use more technology in our lives. So, when finance and technology combine, we get what is known as Fintech. So, with the help of Fintech, a business or enterprise takes advantage of digital technology to improve and build its financial services. Therefore, if you want to stay strong in the current market situation, you must take the services of the fintech app development company.

It will help users smoothen their online transactions and use them without hassles. Moreover, according to recent trends, people are more comfortable making transactions with the help of their mobile phones. Hence, the app must be mobile-friendly and easy to use.

Some Quick Facts & Stats About Fintech Apps

Fintech apps are gradually becoming popular as it offers a wide range of services for the ease of the consumers. Some of the quick facts about the Fintech app are the following:

Convenience

Fintech apps are incredibly convenient for users as they create transaction efficiency. As the number of consumers gradually increases using mobile apps to manage their finances, it is becoming popular.

Tracking Customers

The prime advantage of using Fintech apps by companies is that they can help track customers. With the app’s help, you can get detailed information about the customer’s needs.

Quick Approvals

The fintech app helps to determine customer satisfaction. With the app’s help, customers can make transactions quickly and safely; moreover, the approval time is also less.

Top Futuristic Fintech App Ideas for FinTech Industry in 2025

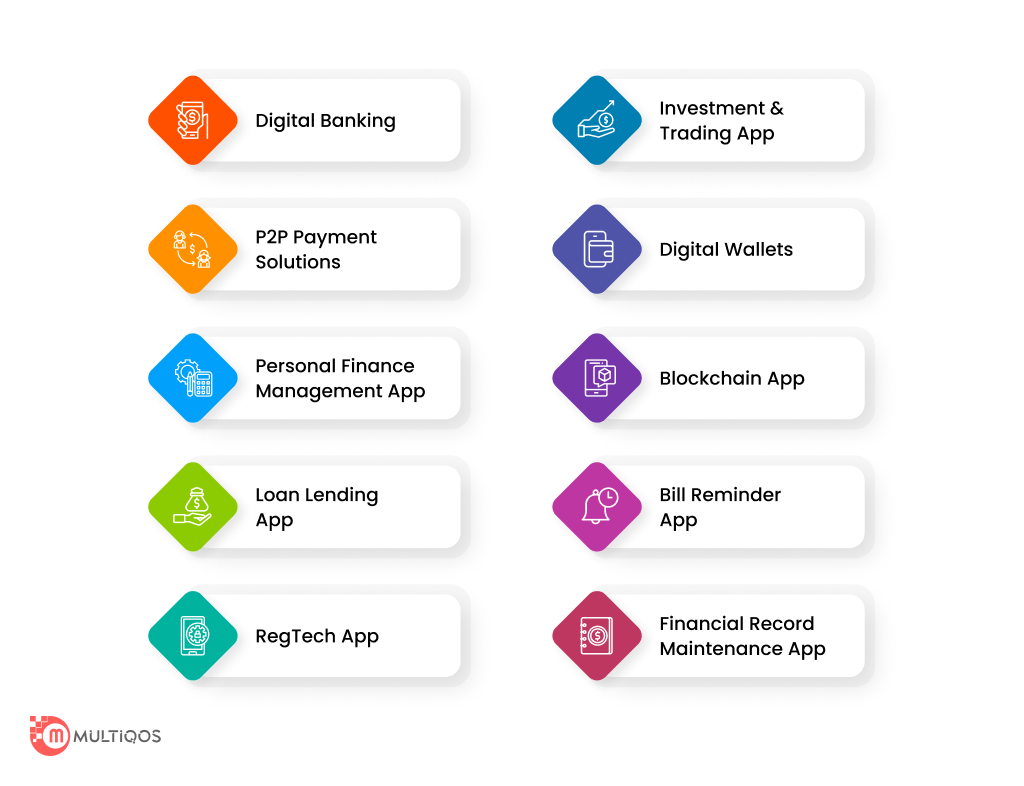

The trend of fintech apps is gradually infusing into our daily activities. Following are some of the top Futuristic Fintech App ideas for the Fintech Industry in 2025.

Digital Banking

Investing in Digital Banking is one of the most essential fintech app development ideas. We have transitioned from traditional banking to digital banking in the past few years, and it is because it is safer and faster. Moreover, you can transact at your convenience from anywhere instantly.

The introduction of ATMs has been a boon to us as we no longer need to stand in queues for long hours to withdraw money. Also, there is the ease of money withdrawal as you can do so at any time of the day. With the help of fintech apps, you can do anything with a soft tap on your mobile phone.

P2P Payment Solutions

There has been a considerable rise in many digital transaction apps in recent years. Hence, if you are banking to invest in a P2P payment solution app, then you must seek the services of the best fintech mobile app developers.

Various P2P payment apps have a stronghold in the market and are also popular among many. Therefore, if you are planning for the same, you need to develop an app that can give some extra features than the others. The need for today is instant and safe transactions without the interference of a third party.

Personal Finance Management Application

In the present era, people are gradually becoming more conscious about savings and earnings, which has led to the development of various personal finance management applications. Hence, it is one of the best fintech mobile app development ideas to give you a perfect startup for your business.

The prime advantage of promoting the app is that people are gradually becoming financially conscious, and the app will help them to manage their finances smartly and efficiently. The fintech app developers have the perfect skill and ideas to make the app appealing to the customers.

Loan Lending App

Many suddenly find themselves in a financial crunch due to specific emergencies. Getting a loan from the bank is out of the question as banks will take ages to do the processing. So, for the convenience of the people, there has been a sudden surge of Loan lending apps. It can easily connect the lender and the borrower.

A loan lending app is one of the best fintech startup ideas to give you an ideal platform to start and monetize your business. However, it would be best if you connected with the right lender who can offer attractive rates to its borrowers.

RegTech App

One of the best and most recent mobile app ideas is RegTech applications. The app is ideal for financial companies as they efficiently provide mobility solutions.

It helps financial companies automate their processes, including monitoring the customer’s identity and transactions.

Investment and Trading App

Many do not get the right platform to invest in stocks and shares. It can primarily be due to the lack of time. Hence one of the best On-demand applications is developing an investment and trading app. It will help them to invest their savings efficiently in shares, stocks, forex, and similar areas.

Users are more inclined to apps that give them a comprehensive knowledge of the various investments. So, if you are planning to start an investment and trading app, you must clearly know the stocks and shares.

Digital Wallets

The latest trend is digital wallets. The reason is the popularity of Bitcoins and other cryptocurrencies. It is because digital wallets provide a safe and secure haven for your investment. One does not have to carry physical cash or plastic cards to make transactions. Digital wallets are more convenient as they allow users to make payments with just a button.

Since cryptocurrencies are the latest trend in the financial market, it is worth investing in Digital wallet apps. You can get the services of companies that are professionals in e-wallet app development. It will allow your business to compete in the digital world with big financial giants.

Blockchain Applications

One of the best financial business ideas is starting a blockchain application. People are gradually moving toward investing and transacting in various cryptocurrencies. Sooner or later, it will capture the financial market.

Blockchains are more secure and reliable than any other trading platform. Therefore, if you are witnessing the growth of digital currency, investing in Blockchain applications is one of the best business ideas in finance.

Bill Reminder App

We are so engaged with the daily hustles and bustles of life that we often fail to pay some essential monthly bills. Therefore, one of the best mobile app ideas is to create a bill reminder app that will ease the pressure on people.

So, now users will get a reminder to pay for their monthly bills like electricity bills, mobile bills, credit card payments, and similar bills. Hence, you should make an app that will remind the users to pay the bills before the due date.

Financial Record Maintenance

Often, we fail to keep a record of our financial transactions. It is one of the best financial services for startups in 2025. The app can help users keep the payment receipts, tax invoices, and other financial records in perfect order.

What Does the Finance App Development Cost?

With the help of Fintech app development services, you can develop various financial apps for the convenience of the customers. However, the cost of developing financial apps depends mainly on the type of app you want to launch in the market.

So, before you start developing an application with a top mobile app development company in florida, it is advisable to check the rates of the various types of apps that are trending presently in the financial market.

How Much Does It Take to Develop a Fintech Application?

The cost of developing a fintech application depends mainly on two factors; time and the rate of the company. Moreover, the cost also varies with various mobile app ideas. There is a team of expert professionals skilled in their respective fields.

Hence, a successful mobile app is the result of the team effort of the professionals who ensure that your app meets the needs and requirements of the customers. Therefore, developing a Fintech application is costly but worth an investment. It is because, in the future, you will monetize your business with the app’s help.

Conclusion

The financial world is changing for the better. There has been an influx of various financial apps for the convenience of the customers. Hence, creating an appropriate fintech app is one of the best financial services business ideas. Various on-demand App development companies can offer fintech ideas to help your business reach new horizons.

However, before you start up your business in fintech apps, you must have complete knowledge and expertise in the services you are going to offer. A slight error can disrupt your business instantly. Hence, it would be best if you bridged the gap by offering the utmost security in transactions to your customers.

Want to Build a Custom Fintech Mobile App?

Get a Free Consultation from the Mobile App Development Experts.

FAQs About Fintech App Ideas

Fintech is a financial transaction app that helps businesses and consumers make transactions quickly and provides high security during transactions. Hence, the market for Fintech is gradually rising to the top.

Fintech usually functions in four primary areas:

The development of a fintech app largely depends on the type of the app and the time taken. Hence, there is a difference in the cost according to various financial business ideas. But it is worth an investment as it will help your company to reach new horizons.

The reason why people are more inclined towards Fintech is that the transacting time is less. Moreover, there is a vast difference in the operating cost.

Get In Touch