How Machine Learning in Finance is Transforming Risk Assessment?

Summary:

Machine learning (ML) changes risk assessment in finance by moving towards traditional, static models, future systems. To provide a more comprehensive approach to the ML algorithmic risk, you can analyze the huge amounts of both structured and unstructured data.

This increases the accuracy and speed of the credit risk assessment, helps to detect real-time scams by identifying microanomalies, and improves market risk analysis by modeling dynamic correlations. Ultimately, ML provides a significant competitive advantage for machine learning in finance and financial institutions by enabling more informed decisions and active risk management, which creates a stronger and agile financial ecosystem.

Introduction

You are ahead of a quiet revolution in the financial world, and its driving force is machine learning. For decades, the risk assessment depended on static models and historical data, which were slow to be suitable for new threats. Today, with machine learning in finance, you move towards a dynamic and future that stems from a reactive perspective.

By taking advantage of large amounts of data and advanced algorithms, you can identify patterns and deviations that would be beyond human analysis and traditional systems. This is not just an improvement; this is a whole deal of how to control risk.

According to a recent report, 85% of financial institutions globally have implemented AI to increase operations, with large applications in risk management, fraud detection, and regulatory compliance. This emphasizes the important role you can play in running efficiency and innovation.

Understanding Risk Assessment in Finance

Finance includes the ability to evaluate financial losses in risk assessment and develop strategies to reduce the risk. This is an important process for financial institutions, as it helps them make informed loans, investments, and management of their portfolio. From the customer’s credit history to the macroeconomic indicator, economic analysts can create a comprehensive risk profile by analyzing a wide range of data points.

This process is quickly becoming sophisticated with the integration of machine learning into finance, which allows rapid analysis of giant datasets to identify gigantic patterns and predict the decline in the market with more accuracy than traditional methods.

An important component of modern risk assessment is the use of advanced analysis tools and models. Many financial companies are turning to machine learning development services to create customized algorithms that can automate parts of the risk analysis process. These services provide competence to create models that not only consider current risks, but are also compatible with the changed market conditions.

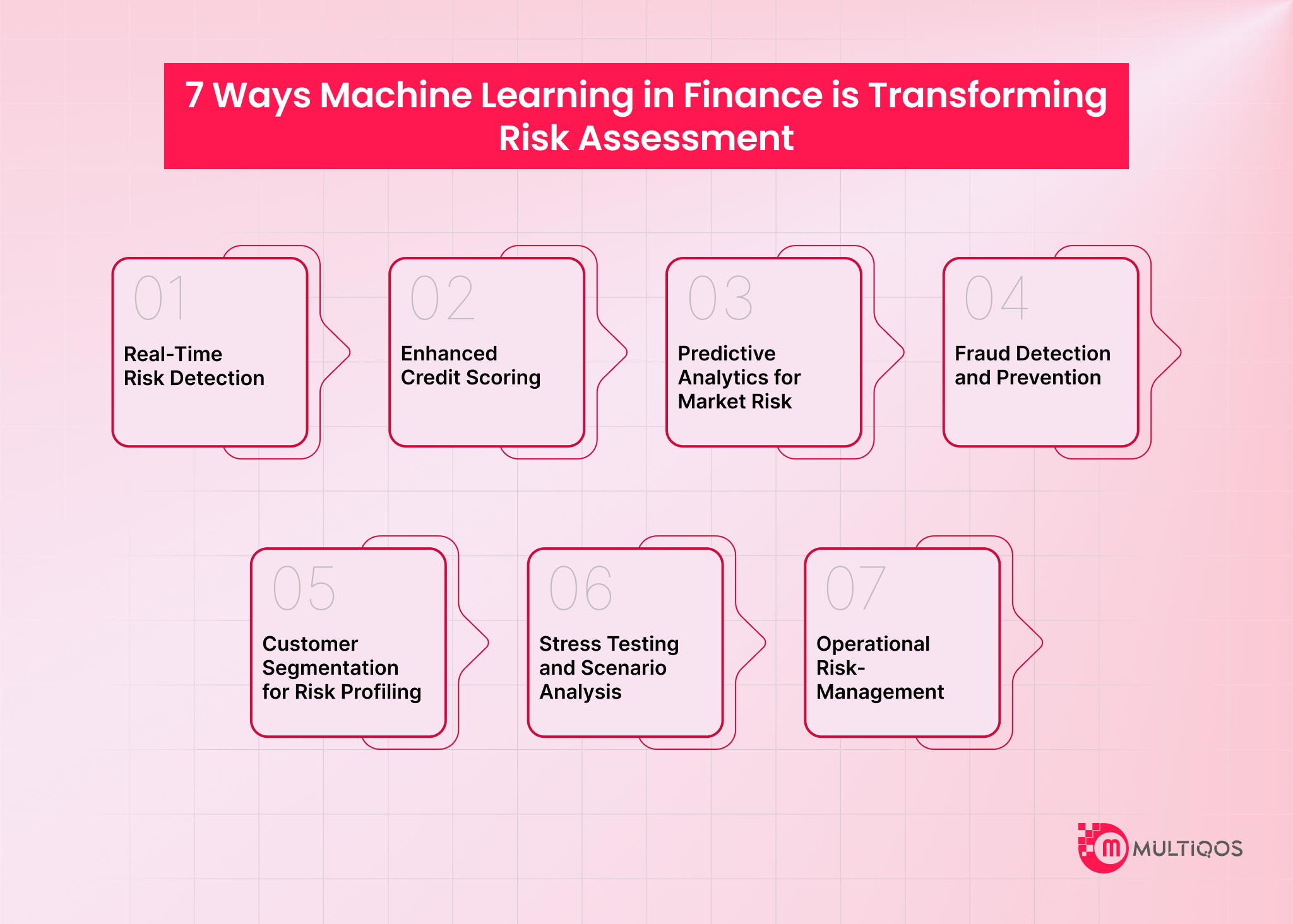

7 Ways Machine Learning in Finance is Transforming Risk Assessment

1. Real-Time Risk Detection

Traditional risk assessment often depends on historical, batch-developed data, which can delay in identification of new dangers. With machine learning in finance, financial institutions can analyze transactions and behavioral data as they are. The algorithm can immediately flag the anomalies, such as an unusual transaction location or change in a user’s habits, allowing instant measures to prevent sudden changes, fraud, or other financial losses.

2. Enhanced Credit Scoring

Traditional credit scoring models are often based on a limited set of data, such as payment history and debt-to-income ratios. The machine learning in finance enables the use of “alternative data” sources, such as equipment payments, rental history, or even online purchasing behavior. By treating this wide dataset, the ML models can provide more nuanced and accurate credit assessments and help lenders serve a comprehensive population, including limited credit history.

3. Predictive Analytics for Market Risk

Market risk, which is a risk of loss in the investment portfolio due to market price movement, is a complex challenge. When it comes to machine learning in finance, it helps future analysis to analyze market data, news articles, and large amounts of financial reports. These models can identify subtle correlations and patterns that humans can remember, provide more accurate forecasts to potential market volatility, and help adapt portfolio strategies to reduce risk.

4. Fraud Detection and Prevention

Fraud detection is one of the most well-known applications of machine learning in finance. ML algorithms are trained on datasets with both fraudulent and legitimate transactions. They learn to identify the scam pattern of scams, from a single suspected transaction to complex, mutual scam networks. This capacity allows institutions not only to detect existing fraudulent schemes but also to adapt and prevent new ones.

5. Customer Segmentation for Risk Profiling

Machine learning in finance provides the opportunity for a more sophisticated customer division than before. Instead of grouping customers only by age or income, ML models can group them on the basis of their unique behavioral patterns, transaction history, and risk tolerance. It creates dynamic risk profiles that allow financial institutions to offer individual products and services by assessing and managing the risk associated with each customer correctly.

6. Stress Testing and Scenario Analysis

A stress test evaluates the flexibility for extreme, but admirable events in a financial institution, such as an economic recession or a sudden market crash. Machine learning in finance improves this process by enabling the simulation of more complex and realistic scenarios. ML models can generate synthetic data and detect a large number of potential consequences, and provide a stronger and comprehensive approach to the firm’s vulnerabilities and capital adequacy.

7. Operational Risk Management

Operating risk stems from internal processes failure, people, and systems. It can analyze huge, unnecessary data sets such as e-mail for employees, internal logs, and financial reports to identify possible match problems, system failure, or human errors before it lead to significant damage. This active approach helps to make financial companies more flexible and efficient in their operations.

Wrapping Up

The shift in machine learning is not just a technological upgrade; this is a fundamental change in how you see the risk. Now you not only react to previous events, but also guess about future people. This change requires not only new equipment, but also new talent. To fully use AIS power, you need a team that understands the complex algorithms and can translate data into action-rich strategies.

To remain competitive, consider a strategic initiative to hire machine learning developers and data researchers who can produce and distribute these advanced models. By investing in this expertise, you not only use a new technology; you create a more flexible, intelligent, and profitable future for your organization.

FAQs

Static rules are used to detect traditional fraud. In contrast, ML-based systems are used to detect anomalies to learn the user’s general behavior and to identify any significant deviation, use new and developed fraud to quickly develop a strategy.

Yes. ML analyzes large structured and unstructured data in real time, such as news articles and sentiment in social media. This helps identify important indicators of market change and predict potential shocks with greater speed and accuracy.

No. ML acts as a powerful tool to automate data analysis and generate future insights, but human expertise is still necessary. Analysts require analyses to explain the results, validate the model, and make nice decisions that require moral decisions.

The most important challenges are data quality and model clarity. The ML model requires that high-quality data is effective, and “Black Box” for some advanced models can be a problem for natural regulation, which often requires clarification.

Get In Touch