Insurance App Development: Key Features That Enhance Customer Experience

Summary:

Effective insurance app development requires more than basic functionality; it demands features that truly enhance customer experience. Key elements include seamless onboarding, policy management, instant digital claims, integrated payments, and 24/7 support. Advanced capabilities like AI-powered personalization, telematics, multilingual support, and secure document storage further elevate user satisfaction.

Security and compliance remain essential, ensuring data protection and trust. By focusing on usability, speed, and personalization, insurers can create apps that not only streamline operations but also drive customer loyalty. This blog outlines the must-have features for building user-focused insurance apps that meet modern expectations and stand out in a competitive market.

Introduction

Insurance app development is revamping customer engagement in the insurance industry. When digital expectations increase, insurance companies should not only introduce more than political access; they require a comfortable, practical mobile solution.

In fact, the global insurance market is expected to reach $8.4 trillion by 2026, making it a prominent player in the digital landscape, according to Statista. In order to remain competitive, insurance providers must focus on the manufacture of apps that strengthen tasks such as onboarding, requirements submission, payment, and customer assistance.

This blog examines the necessary features that not only meet the user’s expectations, but also improve the customer experience, increase the drive storage, and quickly strengthen branding confidence in the mobile-first market.

Why Customer Experience Matters in Insurance App Development?

In the modern insurance industry, a company’s app has become a primary customer point. The quality of the customer experience provided through the app is now an important factor in gaining market share and building loyalty. A poorly designed app can remove customers, while a user-friendly app that simplifies complex features makes a flexible, long-term relationship. Preference to a positive app experience can lead to frequent interaction and positive commitment, which can help your brand stand out of the competition.

- Boosts Customer loyalty: A well-designed app with spontaneous features makes it easy for customers to interact with their brand, reduce friction and encourage them to stay longer with the service.

- Increases Efficiency: App’s complex process as treatment and renewal of the policy for needs, to save customer time and flow to eliminate the need for direct contact with customer service, which in turn reduces operating costs.

- Generates Positive Word-of-Mouth: Satisfied customers are more likely to recommend an app that provides a better experience, which helps achieve new customers through positive reviews and referrals.

- Provides Valuable Data Insights: App collects user data on behavior and preferences, which can be analyzed to customize services, develop new products, and refine marketing strategies.

- Establishes Brand Modernity: Providing a high-quality app shows that your company is able to think and is committed to meeting the needs of today’s digital consumers, which sets you apart from traditional competitors.

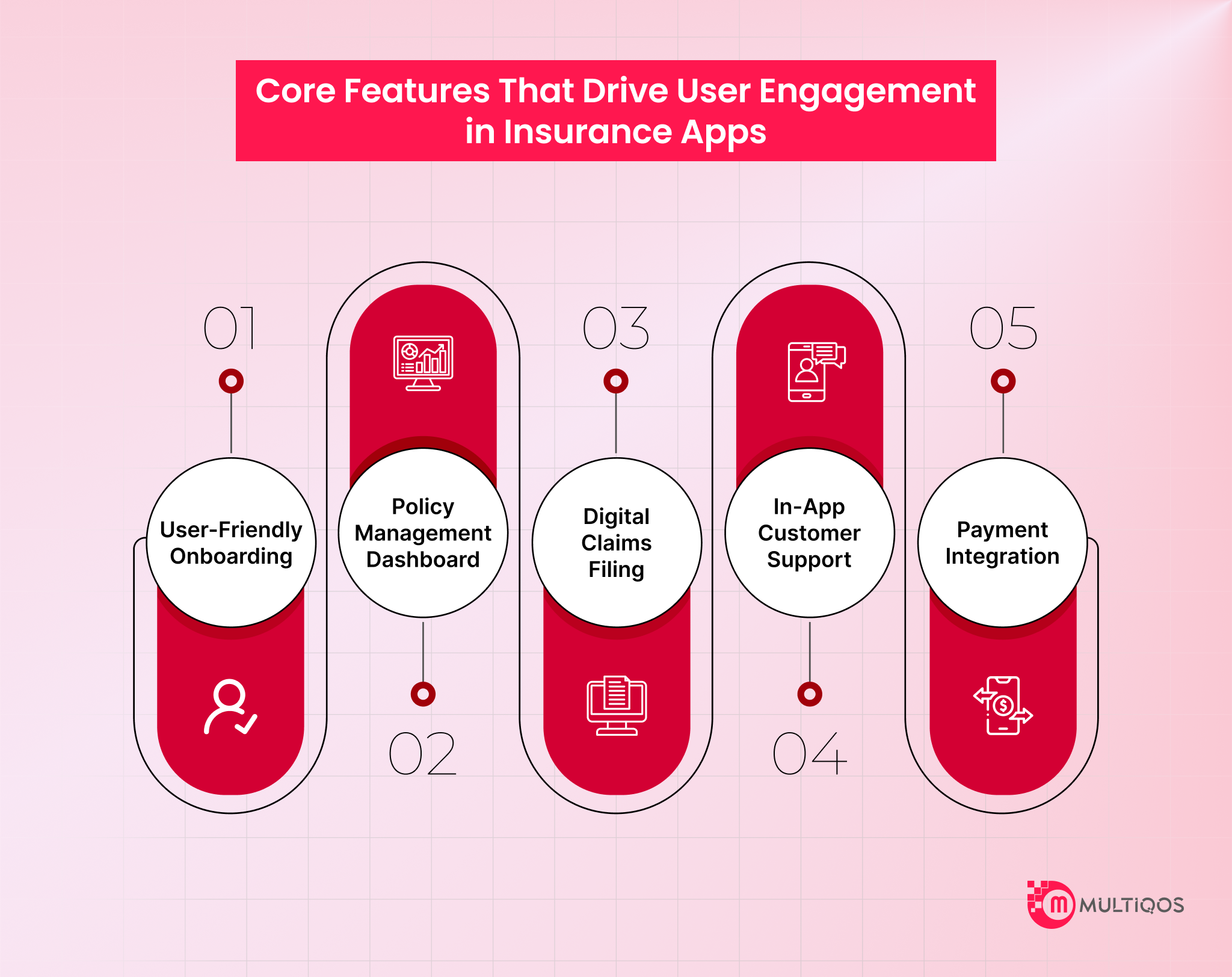

Core Features That Drive User Engagement in Insurance Apps

User experience and functionality of insurance apps are important factors in creating permanent customer relationships in development. By taking advantage of mobile app development services, companies can integrate important features that simplify complex insurance processes, making policy control more comfortable and less problematic for users.

1. User-Friendly Onboarding

A smooth onboard process is the first step for a positive user experience. An app will guide new users through clear, simple steps for account setup. This includes features such as the social login option and a rapid verification process that immediately shows the value of the app. A hassle-free start is important to engage a new user.

2. Policy Management Dashboard

When a user is in the app, a comprehensive policy dashboard is required. This feature acts as a central hub where customers can see all their active guidelines at a moment, with large details such as coverage and renewal date. Users can also download digital policy documents, making it easier to use evidence. This dashboard strengthens customers by providing full control and visibility of their guidelines.

3. Digital Claims Filing

The claims process is often a major pain point, but a well-designed feature within the app can be a game-changer. As part of the future of mobile app development, insurance apps should be able to upload images to users and fill in the required forms directly from their smartphones. This digital approach eliminates papers and telephone calls, usually making the stressful situation a more managed experience by providing real-time updates on the requirement.

4. In-App Customer Support

Providing easy access to support is important for user storage. An app should integrate a variety of support options, including a chatbot for immediate answers to normal questions and a straight line for a human representative for more complex problems. The basis for a knowledge of the app or the FAQ section can allow users to find solutions on their own.

5. Payment Integration

A safe and direct payment system is an important function. Users should be able to look at their payment history without paying a premium, manage billing cycles, and leave the app. The ability to offer many payment options and install automatic payments ensures that the price is never missed, increasing customer satisfaction.

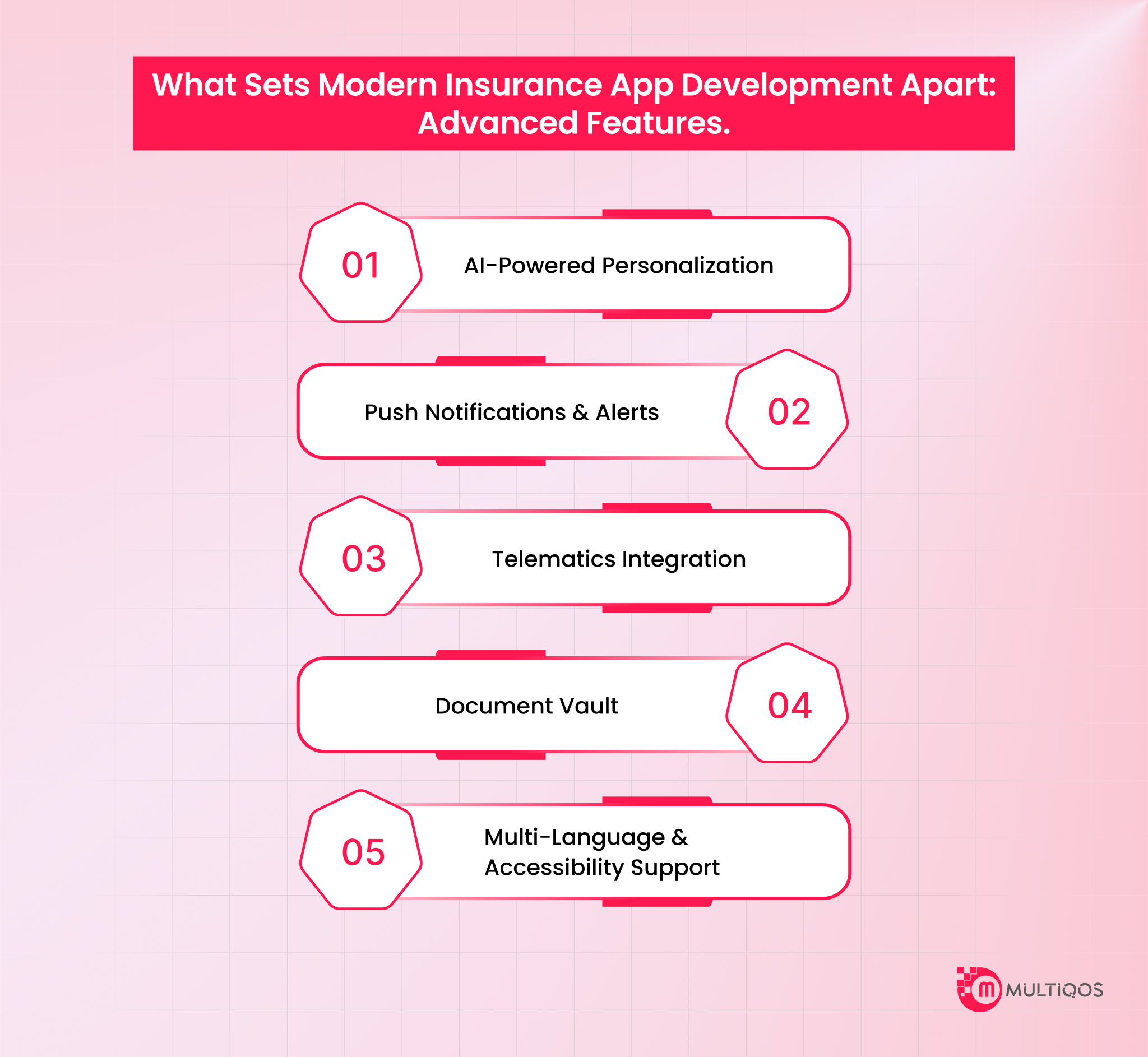

What Sets Modern Insurance App Development Apart: Advanced Features

Insurance apps need to offer more than just basic functionality to meet rising user expectations. Android app development services enable insurance companies to deliver seamless, intelligent, and highly personalized mobile experiences. Here are some advanced features that set modern insurance app development apart:

1. AI-Powered Personalization

Artificial intelligence allows insurance apps to provide an equipped experience based on user behavior, preferences, and policy data. By recommending the appropriate coverage schemes to offer active risk management tips, AI ensures that users receive relevant and timely information, increasing the obligation and satisfaction.

2. Push Notifications & Alerts

Push notifications in real-time inform users of policy updates, reminders of payment, claim status, and personal offers. It promotes active communication, fosters trust, and ensures that customers never miss significant actions or deadlines.

3. Telematics Integration

By integrating telematics, car insurance apps can track driving behavior and the use of vehicles to offer usage-based insurance (UBI). This not only promotes secure driving habits but also provides opportunities for appropriate, data-driven premium prices based on real risk.

4. Document Vault

A safe digital document allows vault users to save, access, and manage their insurance documents in one place. This feature simplifies document management, increases openness, and eliminates the problem of handling manual paperwork.

5. Multi-Language & Accessibility Support

To serve a broad and more diverse customer base, the modern insurance app includes multilingual capacity and access facilities. This ensures that users of different linguistic and physical backgrounds can navigate and use the app with ease and confidence.

Final Thoughts

Creating a high-performance insurance app is out of basic functionality; This requires intensive attention to user experience, speed, security, and personalization. Features such as digital claims, real-time policy steering, app support, and AI-driven recommendations are no longer optional; they are expected of today’s users.

When it comes to creating an app that actually meets these requirements, it becomes important to hire mobile app developers who are well-versed in building insurance solutions. The right expertise can help you convert complex workflows into an attractive and visually appealing digital experiences that engage customers and boost customer satisfaction.

FAQs

An insurance app should contain facilities such as streamlined claim processing, secure payment in applications, and personal policy management tools. Integration of push notifications for timely updates and a 24/7 chatbot for immediate support also improves the user experience.

We understand that change can be difficult. This is why our apps are designed with a spontaneous interface and easy navigation to make the transition comfortable. We have created the app to make it as easy as possible, so that handling guidelines and archiving requirements seem less like a core function and more like a function.

Begin by identifying the most important pain points of your customers, then prefer the properties that directly address problems, such as simplified submission of requirements and access to digital policy. Working with an experienced app development team specializing in the insurance sector is the next important step.

At MultiQoS, we focus on integrating advanced analysis and AI to actually create an individual app experience. Our approach is beyond the basic properties, including predictive risk management and value-added services to meet customer needs and build permanent loyalty.

Get In Touch