Want to Develop a Digital Wallet App Like a Cash App? Cost, Features, and Process

Introduction

Mobile payments are among the most desirable trends in the rapidly growing e-commerce environment for businesses and consumers. In addition to mobile payments, products that enable users to send money, pay bills, and even make purchases have become popular recently due to the availability of digital wallets such as cash Apps.

If you are planning to proceed with eWallet app development like Cash App, it is important to learn about the cost, the process, and other aspects of creating the most effective platform. Your business can effectively target this market with the right features and a clear strategy since the mobile payment market is projected to have a CAGR of 28.4% from 2023 to 2030.

In this blog, we will explain how hard and how much it will cost to create the app, and step-by-step guide you through the process so that your digital wallet app will be outstanding from its competitors.

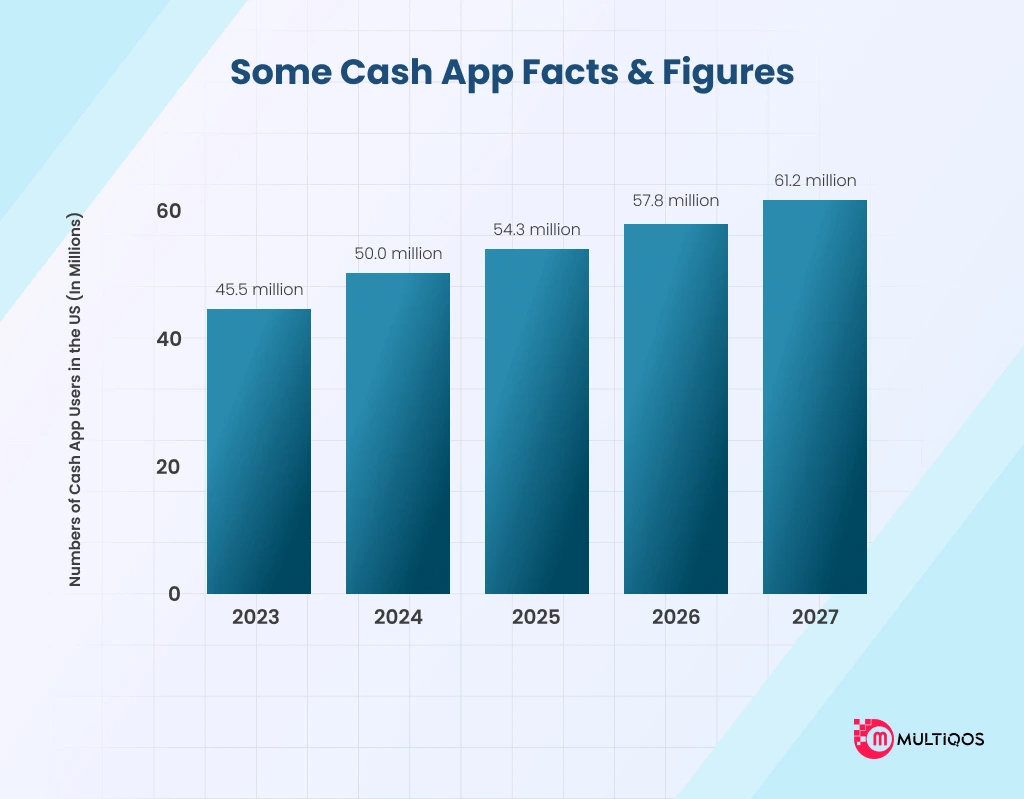

Some Cash App Facts & Figures

- According to Wikipedia, as of 2024, Cash App reports 57 million users and $14.7 billion in annual revenue.

- Cash App made $14.3 billion in revenue in 2023, a 34.9% increase from the previous year.

- Cash App’s payment volume in 2023 was $53 billion.

- 22 million people had a Cash Card in the previous year and is expected to increase in 2025.

- A subset of users can borrow up to $200 from the app for personal loan.

- The global mobile payments are expected to be worth $9.6 trillion in the next 5 years.

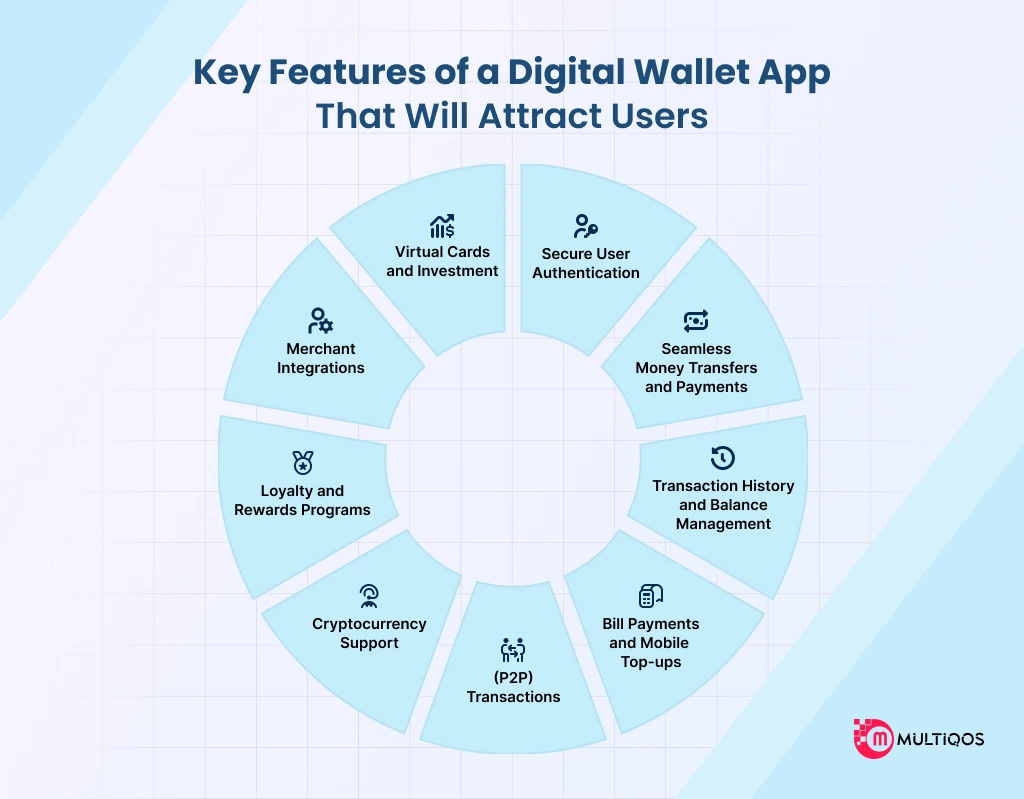

Key Features of a Digital Wallet App That Will Attract Users

Mobile app development for a digital wallet app should aim to offer users the basic functionalities they expect from wallet apps for convenience, security, and utility. A good app has to not only assist the users in carrying out financial activities but also guarantee that they always return to the app.

Whether you are designing a new app from the ground up, or improving upon an existing platform, the right features can segment the difference between engagement and retention.

Here are the key features that can make your digital wallet app both attractive and highly functional for users:

1). Secure User Authentication

Security is the foundation of any eWallet app development. Since the service is to protect users’ private data, the process of user identification has to be secure. Use multi-factor authentication like passwords and tokens or the incorporation of gadgets such as face or thumbprint identification.

It also serves to enhance the level of security thus making it difficult for an outsider to gain access. As cybercrime cases continue to emerge, those who intend to use the app can develop confidence in the security measures employed thus making them comfortable when using the application.

2). Seamless Money Transfers and Payments

A digital wallet application is designed keeping the user’s goal in mind as it enables users to transfer money, make payments, and fund transfers. For your application to be a competitor to amazing apps such as Cash App, it should allow users to easily and swiftly transfer money cost-effectively.

Paying for products and services, transfer of money to family and friends, or purchase of goods and products should be able to complete with just a few taps.

3). Transaction History and Balance Management

Convenient transaction history allows users to better understand their expenses, review their accounts’ activity, and maintain a proper financial flow. It allows users to view previously made transactions in a categorized form, and create categories for expenses, and the current balance.

Reporting the real-time account status in terms of available amounts, and transactions that have either been approved or are pending approval is also useful for the user.

4). Bill Payments and Mobile Top-ups

Ensure your digital wallet app handles everything to do with money by enabling users to pay bills, top up their smartphones, and even pay utility bills. That is why, in addition to making payments for electricity bills, water bills, insurance premiums, and much more directly from the app, you can increase interest in the app and make the users more satisfied.

Apart from this, it also enables them to recharge their mobile phone accounts to avail a simplified process for their daily financial transactions.

5). Peer-to-Peer (P2P) Transactions

P2P payments are one of the most basic functionalities to integrate into a digital wallet app. It allows users to send and receive money instantly to anyone with an account on the platform.

From splitting dinner bills to paying rent or sending money to their loved ones, a seamless P2P feature increases the app’s worth. To increase the attractiveness of the service maintain clarity, speed, and non-usage of any hidden fees.

6). Cryptocurrency Support

Cryptocurrency has become mainstream in our lives, and adding support for digital currencies such as Bitcoin, Ethereum, or stablecoins can attract an audience. Allowing customers to purchase, sell, and exchange cryptocurrencies within the application brings extra revenue-generating opportunities and adds one more unique element.

The world’s cryptocurrency market is set to grow beyond $2.4 trillion by 2028, and integrating this feature can massively boost your app’s performance.

7). Loyalty and Rewards Programs

Mobile apps’ loyalty programs and rewards are helpful to motivate and encourage users to use the app frequently. Implementing some of the important features such as cashback, exclusive offers, rewards, and discounts will incentivize users to keep making their financial needs on the app.

Rewarding users on their purchases, money transfers, or when they invite a friend to use the app, gradually increases both retention and promotes word-of-mouth marketing.

8). Merchant and Business Integrations

To gain a competitive edge, your digital wallet app should provide solutions for individual users as well as for businesses. Merchant and/or business integration provides the ability to pay directly to stores, restaurants, or any other service providers.

This creates a new source of revenue for your application and allows businesses to collect digital payments without a POS terminal. With payment gateway integration and other business tools, your app becomes a necessity for both the consumer and merchants.

9). Virtual Cards and Investment Options

Your app will surely stand out from the rest if it offers solutions to enterprises and individual users. To enhance the usability of the application, users can create virtual cards and make transactions on the Internet securely.

Also, adding features like stocks and even savings plans can make your app more beneficial as it provides all needed functions for user’s money management. Investment tools ensure that people who can invest, have the opportunity to build their wealth through your app, adding that extra layer of purpose and use.

Cost Breakdown: How Much Does It Cost to Build a Digital Wallet App?

Planning to develop a Cash app like a digital wallet app? Yes, then make sure you have a significant investment because the application cost can range anything between $30,000 to $300,000 depending on the project’s complexity and features.

Have a sneak peek at the factors influencing these costs:

Factors That Influence Development Costs

- Features and Functionalities: The more options you add – security, P2P transfers, cryptocurrency integration, and transaction histories – the higher the price. Deluxe features can add a cost as high as or more than $10,000 to $50,000 in most cases when embedded in applications.

- Platform Choice (iOS, Android, or Both): The cost is lower when you create an app for only one operating system: iOS or Android. A single-platform application itself could range between $30,000 – $80,000 and a cross-platform app can range around $80,000 — $150,000 based on the features integration and project complexity.

- Design and User Experience: Intuitive interfaces are important for users: the better the design, the more likely a user will stick with the app. Still, the best UI design can cost you anywhere between $5,000 and $20,000 added to your total expenses.

- Security and Compliance: Sending regular security updates, using strong encryption, and multi-factor authentication, and meeting the requirements of regulations such as the PCI-DSS cost between $10,000 and $50,000 depending on the level of complexity of the security measures required.

Understanding Ongoing Costs

- Maintenance and Updates: Daily updates are required to correct errors and adapt to new devices. The cost of maintenance is expected to be around 15 – 20 % of the initial development cost in the first year.

- Security and Compliance: Keeping your app secure and in line with the requirements set by the financial industry will eventually call for updates, plan on shelling out between $5,000 and $20,000 annually.

- Marketing and Customer Support: Customer acquisition and retention take center stage, and the expense differs depending on the level which can range anywhere between $10000 to $50000 per year.

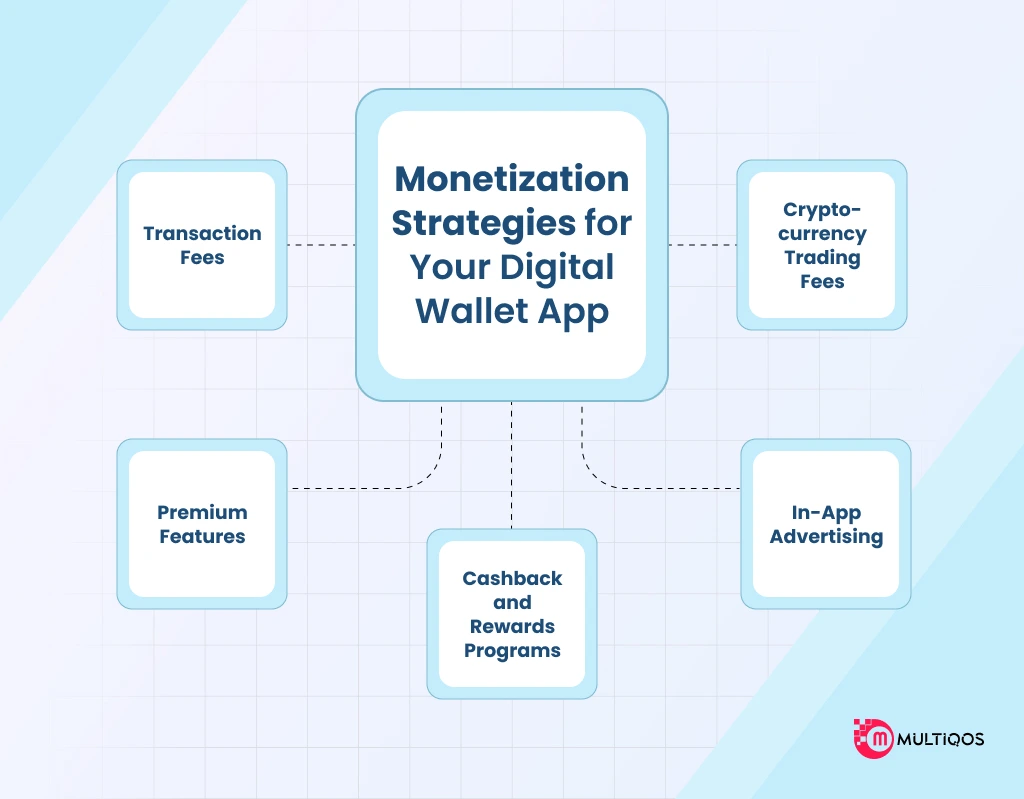

Monetization Strategies for Your Digital Wallet App

1). Transaction Fees

One of the best strategies that any digital wallet app provider can adopt is charging fees for the transactions made through the provided app by others. This can be any fee that is charged on a money transfer, payment, or any transfer of money to a bank account.

For instance, it can either be a fixed rate fee or a percentage of the transaction value. Thus, people may expect some level of fees for particular types of transactions while it is necessary to keep these fees resonable to ensure continued app usage.

2). Premium Features

Providing user’s a premium model is a great method to generate revenue by charging users for access to premium features. For instance, you could let your customers perform such functions as money transfers at no extra cost but would ask for a subscription fee for such additional features as higher limits on weekly cash transfers, premium support, or cash-back, among others.

Here you have even more opportunities to create more value and people will be willing to pay for it.

3). Cashback and Rewards Programs

Integrating cashback options and rewards programs is the best way to keep users engaged and generate income. It can be achieved if you partner with merchants and businesses to offer the users cash back or discounts when they make any purchases.

In turn, you can make actual money by becoming an affiliate of merchants to drive customers to their services. Such a strategy is advantageous for both users and merchants while helping retain users within an app and increasing app usage.

4). In-App Advertising

Another way of making money is in-app advertising. You can monetize your app from third-party advertising platforms like Google AdMob or Facebook Audience network by posting adverts.

This strategy is useful when your app is extremely popular and has millions of active users. When it comes to the frequency of ads, it has to be regulated in a way that won’t have an adverse effect on users.

Signing up for further service is another way of making the customers happier, although retaining the regular ad section in the application.

5). Cryptocurrency Trading Fees

If your app facilitates transactions in cryptocurrencies, you can charge a nominal fee for buying, selling, or exchanging within your app. Thanks to the growing interest use of digital currencies, this can be a potentially big source of income.

In addition to integrating a crypto wallet and enabling low trading fees, you will also benefit from a commission on each trade made by that individual.

The Importance of User Acquisition and Retention

User acquisition is essential for growth, but getting new users is necessary for long-term success. Users are more engaged when the retention cost is less and can engage more loyal users with your app regularly.

As a result, growth and profitability for your digital wallet app will be a result of a balanced approach aimed at both acquiring new users and retaining existing ones.

1). Building Trust and Credibility in the Market

Trust is the most essential when it comes to financial apps like Cash App. For credibility, it should secured with encryption and multiple authentications and to make it friendly on financial regulatory measures such as PCI-DSS and GDPR.

Such use of positive comments, customer reviews and Testimonials, and endorsements by key players also build credibility within the market.

2). Creating a Seamless User Experience

To keep users engaged while using your app, having a seamless user experience becomes necessary. Make your app easy-to-use, ensure fast performance, and optimize functionalities like sign-ups and payments.

A visually appealing and smooth experience leads to better retention, while regular user feedback helps identify areas for improvement.

3). Retaining Customers Through Engagement and Loyalty Programs

To retain users, encourage them to make frequent transactions by offering gift vouchers, cashbacks, and loyalty points.

Other examples of engagement-promoting factors include game design features, referral incentives, and personalized promotions that would keep users coming back.

4). Marketing Strategies to Promote Your Digital Wallet

To effectively promote your app, consider:

- Influencer Partnerships: Leverage influencers in the finance or tech space.

- Referral Programs: Offers rewards when users refer your app to others.

- Social Media Campaigns: Use targeted ads on platforms like Facebook and Instagram.

- App Store Optimization (ASO): Improve visibility with optimized descriptions and keywords.

- Content Marketing: Create educational content to promote your app’s value.

Combining these strategies will help grow your user base and increase app engagement.

Potential Challenges and How to Overcome Them

1). Handling Competition in the Digital Wallet Space

The global digital wallet industry is still emerging and highly competitive with leading companies such as PayPal, Cash App, and Apple Pay. To stay ahead of the crowd, one should emphasize the benefits that no other service or product can provide to its client.

Offer excellent use experience, innovative features, and targeted rewards programs like enhanced security, and cryptocurrency support to have an edge over competitors.

2). Ensuring Scalability as Your User Base Grows

When the number of users of your app increases, there is a requirement for efficient performance. For scalability purposes, if the site is to progress in terms of transactions, it needs to have solid fine-tuned cloud and backend facilities that would still be able to accommodate more transactions without considerable lag.

There are various cloud services available as AWS or Google Cloud services which provide facilities to scale up the capacity of apps according to the demand, and should always keep an eye on it to identify the bottlenecks.

3). Managing Security Threats and Fraud Risks

The most important concern that has to be addressed when talking about businesses that offer digital wallet services is security. To prevent fraud and hacking, utilize robust encryption, two-factor authorization, and continuous tracking of transactions. Ensure fair updating of your security procedures and always try to perform a vulnerability test.

Working with cybersecurity professionals will allow determining possible threats and potential consequences from getting out of control and compromising the users’ information and the funds they deposit with us.

4). Adapting to Changing Regulations and Technology

The digital payments industry is constantly under the pressure of dynamic regulation changes and emergent technologies. Keep abreast with the different local and international legal demands like GDPR or the PCI-DSS.

Your app should be designed for updates fitting new tech trends like blockchain or AI, and apply them as soon as possible to stay ahead. Another advantage is regular audits and an extensive approach to compliance to help you navigate regulatory changes efficiently.

Conclusion

Developing an app like Cash App is an interesting project to start in a rapidly advancing field. Defining the features of the app, guaranteeing the security level, and considering the possible costs as well as the app’s functionality can help you have a unique and feature-rich platform for the users.

Long-term customers can be retained despite the complicated though outlined development process by working on user experience and keeping the audience engaged.

When you are ready to bring the idea into existence, you should hire dedicated mobile app developers who are experienced in the fintech industry. Promoting the app can make your digital wallet platform essential for the users and profitable for you as its owner.

People Also Ask

Depending on the number of features, including design, platform (iOS, Android, or both), and location of developers, the cost of creating a digital wallet will cost between $30, 000 to $300, 000 to more than $ 300, 000.

Other contributory aspects such as the level of security needed, adherence to industry standards, and the ability to interface with third parties may also affect the cost.

Indeed, most of the digital wallet apps available in the market provide services for managing cryptocurrencies such as Bitcoin and Ethereum. However, the adoption of cryptocurrencies needs finances covering market regulations, such as Anti-Money Laundering (AML) and Know Your Customer (KYC).

For this, you’ll need a partner with reliable crypto exchanges and implement strict security measures to prevent funds loss.

This of course depends on the audience you wish to target; iOS is highly recommended for a niche market since Apple users are much inclined towards digital commerce. Android has the ability to reach a larger and more diverse number of users around the world.

You can also consider building a cross-platform app which will make sure your program will have an audience from iOS and Android consumers immediately.

It takes around 6 to 12 months to develop a digital wallet app, depending on the complexity of features and the platform.

Get In Touch