The Ultimate Guide to Digital Transformation in Fintech Industry

Introduction

Fintech is not an exception to the disruption caused by digital transformation in practically every sector. The industry has become more technologically relevant and customer-focused as a result of the advent of digital technology.

Financial institutions may successfully provide the experiences that their stakeholders and end users need by delivering services online. Additionally, they may anticipate an increase in corporate innovation, consumer involvement, and staff happiness. Fintech’s can also operate more quickly and effectively to compete better in the market.

In this blog, we’ll talk about how extraordinary advantages of digital transformation are changing consumer experience and speeding developments in the finance industry. So, let’s get going!

Fintech Market Aspect

The epidemic has produced a new image, even if we are aware that the financial services sector has a conventional viewpoint and takes time to react to innovation. It has embraced fast physical and digital transformation in finance, which has hastened real change. The fintech sector must meet the challenge of providing companies with potent computing solutions. Changes are also primarily attributable to the quick shift in consumer behavior and the emergence of new patterns driven by the overt preference for cashless and contactless transactions.

The swift acceptance of financial digital transformation is seen in the statistics below:

- The percentage of Americans who use digital banking is expected to increase from 61% in 2018 to 65.3% by the end of 2022, according to Statista.

- Only 14% of banks that are at least halfway through their digital transformation projects, according to Forbes, have implemented machine learning technologies yet.

- By 2025, the market for digital transformation is anticipated to grow at a CAGR of 23% and reach $3.3 trillion.

The number is quite intriguing, isn’t it? While it surely is, it is also vital to understand why digital transformation has become so vital for Fintech Services.

Why Is Digital Transformation Crucial to Fintech Services?

There are two strong currents that are driving developments in the global financial services ecosystem. Here are the forces that are pushing the banking sector’s digital transformation:

-

More Options

People may instantly scroll through hundreds or even thousands of possibilities when searching for terms like “home loan” or “high-interest savings account,” many of which are directly accessible via their digital device. No geographic boundaries or conventional banking hours limit decisions.

-

Less Resistance

Changes to banking habits may now be made online rather than in person at a branch. They may log in and acquire a loan on their phone, or they can touch their phone to transfer money. Banking is now more instantaneous and quicker than ever in a variety of ways.

Now that you know about the influencing factors, it is time for you to further learn about how it is transforming the FinTech business!

How is Fintech Digital Transformation Making SMEs & Startups Efficient?

You must put digital finance efforts to stay up with the pace of current innovation. It will allow you to maintain your finance organization’s competitiveness in the market and satisfy customer requests. In light of this, the following are the main advantages of the Digital Transformation in Fintech:

-

Greater Freedom In Financing:

Traditional lending strategies appear to provide a barrier to SMEs’ ability to generate money in the existing system. It is because they are not meant to scale and are not designed to measure. As most of their activities are neither automatic nor paperless, legacy systems are more costly and less flexible. Here’s where a cloud-based financing strategy may help. Developing an application programming interface (API) that will work with asset systems without a hitch will deliver a fantastic, long-lasting digital model. It can power a well-thought-out lending solution.

-

Using Digital Fintech Products:

Digital payment platforms, digital wallets, and credit cards have all witnessed an increase in demand due to the pandemic’s accelerating rate of digital platform acquisition. Furthermore, SMEs and entrepreneurs from all over the world have begun to benefit from the digital earnings and loans offered by easy, quick, and secure fintech software solutions supported by reliable infrastructure operations. The Fintech sector is well-positioned to benefit from digital transformation with rising consumer awareness and SMEs coming up with the notion of leveraging digital finance solutions to power their financial operations.

-

Data Processing For Operational Effectiveness:

Financial consultants may readily access consumer data and obtain their permission with the addition of cutting-edge capabilities. Digital lending platforms, such as video-based, social security-based, and personal identification verification are all responsible to increase efficiency. For improved credit processing, greater client portfolio comprehension may be achieved by outsourcing Data Analytics services. Customer behavior is tracked and utilized to assess probable fraud in the identification of fraudulent activity, which is another important application of data.

-

Reduction Of Complexity:

Making online operations very safe, user-friendly, and efficient is essential in today’s cutthroat financial environment. And here is where financial services’ digital revolution comes into play. In addition to streamlining the financial industry’s complexity, advanced digital technologies also make operations more user-friendly. For instance, a fintech application with plenty of features may be used for many things, automate procedures, and improve user experience. Therefore, digital transformation in banking and financial services is a must.

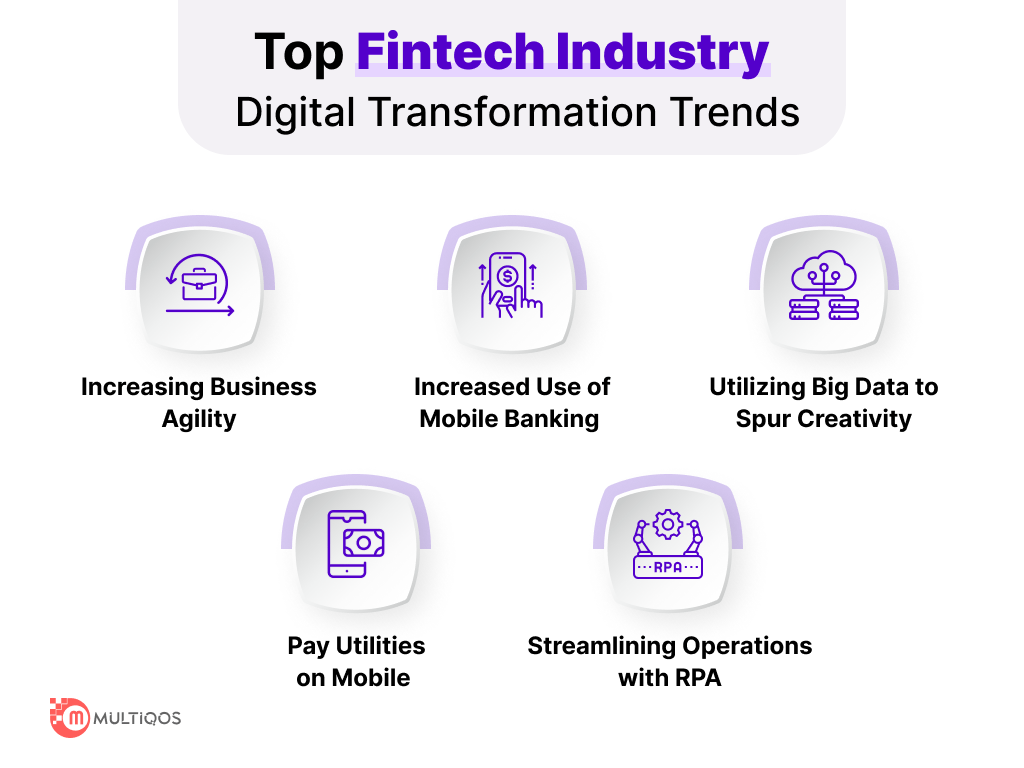

Top Fintech Industry Digital Transformation Trends

The banking industry had one of the most pronounced transformations among all industries impacted by the epidemic and altered by the digital revolution wave. The path to fintech’s digital transformation has been a novel one for this industry, which is one of those reliant on physical labor and interpersonal interaction. Through the creation of new goods and services, the rise of digital transformation in the fintech sector has turned into a commercial need.

In light of this, the following are a few fintech developments that are reshaping the future of the finance industry:

Trend #1: Increasing Business Agility

After learning from the past financial crisis, an organization’s capacity to increase its agility has emerged as a crucial industry trend. Financial businesses, however, require rapid, dependable access to expanding volumes of information without implementing time-consuming manual work procedures in order to enable the kind of continuous advancement and development that forms the basis of agility.

Trend #2: Increased Use of Mobile Banking

Customers have flocked to mobile services in response to the global epidemic, speeding up the banking sector’s transition to digital finance. Although the idea of mobile banking is not new, Fidelity National Information Services (FIS) reports that when the first lockdown was implemented in April 2020, there was a 200% increase in new mobile banking registrations. The rise in mobile banking traffic of 85% has made the banking industry more in need of digitization.

Due to the widespread use of smartphones in daily life, we are increasingly choosing digital banking for standard banking services like fast transfers, shared payments, and electronic bill payments. According to Deloitte, 72% of individuals currently use their mobile phones to reach their main bank.

Trend #3: Utilizing Big Data to Spur Creativity

Big data analytics’ promise has already been recognized by the financial industry. Banks and financial institutions are now coming up with innovative methods to selling their products and leverage big data to provide more individualized services to their clients. One of the most important ways the fintech industry will be able to make use of the massive amounts of customer data is to utilize it to train machine learning (ML) algorithms that will automate their procedures, saving the staff hours of labor.

Trend #4: Pay Utilities on Mobile

Mobile wallets were a completely novel idea to the public ten years ago. The ways that money is saved and paid out are evolving over time as well. Mobile wallets are becoming the standard for making payments. Businesses, shopping centers, and other vendors all prefer using mobile payments to standard cash and cheques. All thanks to the convenience, security, and accessibility provided by mobile wallets, which over time have opened up a path for digital development in the banking industry.

Trend #5: Streamlining Operations with RPA

Financial institutions are under intense pressure to reduce costs, increase returns on investment, and increase productivity. Their savior, RPA, is already boosting production across the board and generating more efficiency.

RPA streamlines organizations by automating tedious, repetitive office processes that are typically done by bank employees. Additionally, it aids in reducing frequent mistakes and inefficiencies. Around 80% of financial leaders, according to Gartner, have already adopted RPA or have plans to do so. RPA is therefore essential to the digitization of the banking industry.

How MultiQoS Helped Startups to Digitally Transform its Business?

The Digital Banking app needed a way to allow basic advanced wire operations together with buying and selling cryptocurrency. Additionally, the software required assistance with wallet recharge and transactions made with cryptocurrencies like Bitcoin and Ethereum.

As a mobile app development company, the main goal of MultiQoS was to expand the Asian Bank’s app horizon for cryptocurrency use. We began by creating a central ledger to record transactions and then added a system that supported the identification of both FIAT and crypto user funds. We offered startups with a core banking solution by solving the major issue of synchronizing all third-party systems within an already-existing app. The outcomes? More than 250k downloads and 50k cryptocurrency transactions have been made using the app as of late.

Conclusion

Bank digital transformation is not as simple as it seems, and it initially seems fairly complicated. A number of banks are still failing at their own transformational efforts. In order to succeed, banks will need to adapt their approach to the current market. Start from replacing outmoded frameworks, and making peace with the new era of informed clients.

As a result, many different one-time-use digital features will be developed, and eventually, a framework that is entirely digital will be accessible. Banks and the sector as a whole will be able to provide purchasers with more significant value once the digital transition is complete, especially when supported by a team of transparent, intelligent technology.

Need a FinTech Solution?

Our Fintech team can digitally adapt your bespoke or white label Fintech idea.

FAQs on Fintech App Development

In actuality, the area of interest from investors that relates to payment is the greatest. Payment services include point of sale systems, card issuance, merchant acquiring, mobile payments, seamless solutions, and payment back-end infrastructure.

The following are the 4 Key Areas in Digital Transformation:

Information processing, or how digital data may be leveraged to streamline workflows by automating current procedures, is what digitalization is all about. In order to increase engagement and generate new value, digital transformation is all about using knowledge and integrating it across all business sectors.

Get In Touch