How to Build a Fast and Highly Secure Fintech App – Features & Costs

Overview

Technology has now penetrated practically every corner of every recognized sector worldwide as a result of global digital transformation. So, it comes as no surprise that the banking industry has also witnessed a considerable digital transformation. As a result, the financial technology business, also known as fintech, arose to fulfill the customer demands a user-friendly, simpler, faster, and better financial transaction platform that is secured.

Fintech is growing at a rapid pace in 2020 and will continue to do so. According to the Global FinTech Industry Size, Status, and Forecast 2018-2025 research, the global fintech market is expected to reach USD 124.3 billion by the year 2025, growing at a CAGR of 23.84 per cent. As a result, there are numerous investment options for fintech startups and businesses, and thus, this showcases a potential area where investments can be done.

What Are Fintech Apps?

Fintech apps are financial technology solutions related to organizations that use software to offer monetary services to end clients. Fintech is the outcome of a digital change that benefits a wide range of industries while also revealing new corporate growth potential. Fintech attempts to provide easy-to-use analytical tools for organizing financial data and keeping track of transactions. It also creates financial software that allows consumers to have a simple user interface. Real-time monitoring for recording and tracing money should indeed be required for all Fintech applications, and thus, companies will be able to produce more income as a result of this.

What Are the Types of Fintech Apps?

The different types of fintech applications are:

Insurance Apps:

The insurance sector has also undergone digitalization and has depended mainly on mobile technologies. One such fintech startup is Lemonade, which operates exclusively through a self-serve application that uses machine learning to provide users with customized insurance coverage. Thus, this indicates that the criteria for Mobile Application Development Services have become fairly demanding, necessitating the use of a fintech development agency.

Cryptocurrency Exchange Apps:

The principal platforms for exchanging cryptocurrencies and fiat currencies are cryptocurrency exchange applications. The users may quickly and easily transfer their tokens into cash owing to the efficient functioning of the applications. However, because exchanges are required for the cryptocurrency industry to flourish, intense competition exists among organizations operating in this space. As a result, having a mobile app development services plan that helps you separate from your opponents is critical.

E-Commerce Apps:

E-commerce platforms have primarily based their business on the applications that have fuelled their rapid growth. Many fintech startups are now concentrating on solutions to make mobile payment and e-commerce simpler for customers and businesses equally. Mobile commerce now contributes to over 30% of all retail expenditure in countries like the United States. Thus, it can be said that the standards for fintech mobile app development services India have become fairly demanding, necessitating the use of a fintech development business.

Lending Apps:

Peer-to-peer lending has become quite popular over the years. People these days are fed up with banks and other financial organizations refusing to lend them money whenever they need it most. As a result, firms like Lending Club have grown in popularity as investment opportunities, where customers may participate in various loans and receive income without having to wait for them to settle. As a result, the criteria for mobile app development have become rather severe. The COVID-19 problem has resulted in a 23 percent surge in the proportion of users on investment and loan sites, respectively.

Budgeting Apps:

Budgeting applications aren’t new, but with the emergence of cryptocurrency, they have also become one popular fintech app over the years. Incorporating cryptocurrency is critical when businesses are seeking methods to increase effectiveness and performance and simultaneously save money. A fintech development company with experience and expertise in both Blockchain technology and mobile app development can assist your company in successfully integrating cryptocurrency into its budgeting framework.

Stock Tracking Apps:

The stock trading business has grown in popularity with the emergence of the fintech industry. Moreover, traders and investors have evolved to use a variety of technologies in an attempt to benefit from the fall and rise of cryptocurrency. As a result, fintech businesses are currently on the rise, primarily aiming to make the entire process simpler and more convenient using mobile apps, which are appealing to users due to their slick appearance and immediate access.

Money Transfer and Payment Systems:

Ever since blockchain’s inception, the premise of faster and more efficient payments has gained some traction, particularly in terms of financial services. Fintech businesses like Ripple could use blockchain technologies to create international transactions easier and faster than old systems (like SWIFT) could be. As a result, fintech businesses have made transferring small to vast amounts of money rapid and cheap, posing a serious threat to established financial service providers.

Some Example Fintech Apps a Highly Secure

Paypal:

Paypal is the digital portfolio, which is also part of the fintech industry, which is also more comprehensive than the other two because it enables households and corporations to conduct a variety of transactions, and it also includes a programmer and partner service that will resolve issues related to customer payments and provide quick assistance. PayPal also enables you to access the financial details of the bank accounts you have open and linked to the app, permitting you to complete any transaction most simply and quickly as possible.

Source: Mobile Wallet App Design

Amazon Pay:

Amazon Pay provides buyers with a 90-day claim period for protection against any failed transactions. It allows you to pay with your smartphone or tablet, and it also assures the user of this well-known internet site.

Stripe:

One of the best features of Stripe is that as a customer, you do not have to pay anything for using their service; rather, only one commission is made for each sale result. These commissions are significantly less expensive than those of its competitors, and there are no monthly “fixed” expenses tied to banks. The notion that the consumer must pay on the merchant’s web page is beneficial since it substantially facilitates financial transactions. Still, it can also be negative because certain users may not be comfortable doing so.

Vapulus:

Vapulus is another such application created in 2016 and is an Egyptian internet payment startup. Its goal is to make modern technology more available to everyone to create a more economically inclusive society. It serves as a middleman between the business and the customer and provides various services. Vapulus is an app that enables you to conduct numerous financial transactions with both end-users and merchants.

How to Build a Modern Fintech App

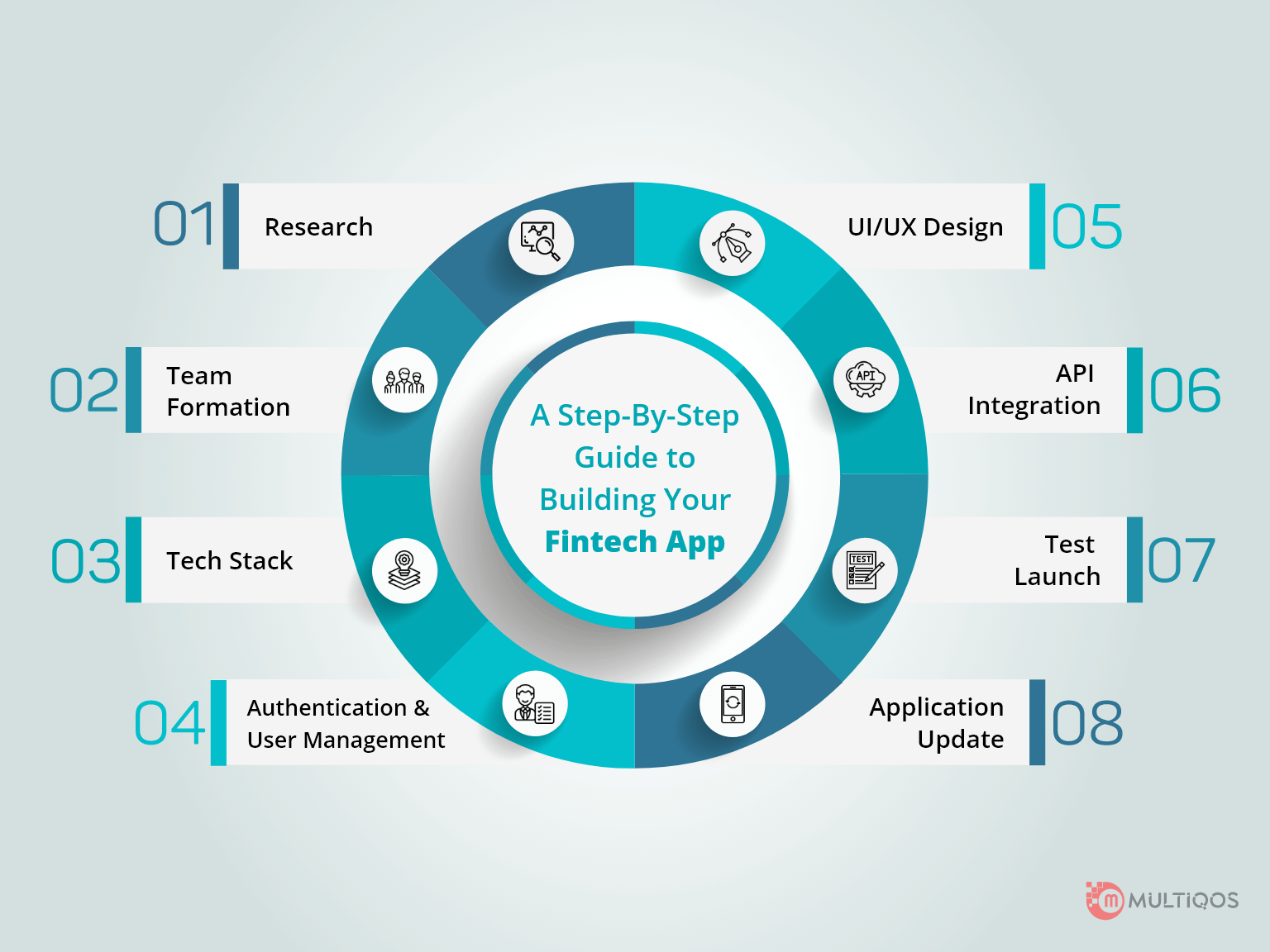

Below-mentioned is some of the stages of developing a fintech application for best cross-platform app development:

Research:

Start your development process by researching your project and ideas. The Mobile App Developers you hire must conduct extensive research. You must create a map to establish a strategy for finalizing the interface’s appearance and features. Research on the market and similar applications should be conducted to understand their strategies and design your application differently and uniquely. You should also define your MVP or minimum viable product. It is your call to decide if you want to go for iOS App Development or Android App Development.

Team Formation:

You can outsource your project to fintech mobile app development services or form an in-house team. However, ensure that whatever option you choose, you communicate your objective and demands properly and that the custom Fintech React or Flutter Mobile App Development should fulfill all basic operations.

Authentication and User Management:

Consider a framework on which your application should be biased since this is a preferred architecture tool for developing apps. It also offers user login, management, and crash reporting securely.

UI/UX Design:

Make your app stand out by using attractive and appealing designs. The fintech mobile application development should be skilled at UI/UX designing services. Ensure to add functionalities that are easy to use. Filling your UI with additional functionality is a bad idea. However, consider that all essential elements should be accessible from the dashboard without requiring the user to do a time-consuming search.

API Integration:

Your fintech app must include various features, such as bill tracking and budgeting. If you operate a company that already provides these solutions, you can take advantage of these fundamental features. However, it would help to construct them from the ground up for a startup. Therefore, it is vital to establish APIs for easy and fluent access across the website, regardless of whatever route you take.

Test Launch:

It’s critical to release a Beta version of your program before it goes live. You can control access to only your customer base or individuals who work at your company. The input will assist you in correcting several inconsistencies. Your application is prepared to be formally launched once it is bug-free.

Application Update:

You need to update the application regularly to keep your customers hooked to the content. You need to embrace technological advancements and keep yourself updated to engage your customers further and attract more potential customers.

Select the Right Technology Stack to Build a Fintech App:

App development and design can be done in various languages. You can start with the fundamental technologies (Java and Kotlin for Android, Objective C, or Swift for iOS). There’s also a different method to take. It’s known as a Progressive Web App (PWA). It’s a solid alternative, albeit you won’t be able to use some of your phone’s built-in capabilities. You can also go for a cross-platform app development process.

Also Read: What is the cost of a mobile app?

Know the Must-Have Core Features of a Modern Fintech App

Some of the must-have features of a modern Fintech application during the Android or iOS mobile application development for fintech are:

Customer Support:

When businesses and consumers require assistance, they frequently turn to applications for immediate help. While you develop, ensure that a live chat or support option is available for the customers 24/7. Many people are at ease conversing with other people, while others are not. Furthermore, include the option of using chatbots to assist individuals who are unable to do so. Alternatively, you can blend these solutions to create a dependable customer service platform that can be reached quickly in an emergency.

Voice Integration:

This feature ensures that customers will be able to access their greatest commonly utilized services using voice assistants such as Apple Siri, Google Assistant, and Bixby. Without the need to start the app, customers are more inclined to utilize it.

Security:

Every fintech application must meet the security criteria to shield customers’ financial data. Blockchain, cryptography, biometrics and two-factor authentication, data minimization, encryption, and other security methods are used by fintech developers to accomplish this.

Payment Gateway Integration:

Transactions and payments for the quintessential part of the fintech application development. You can use services like Stripe, PayPal, or Zelle to offer transaction and payment capability, or you can use bank APIs.

Cashback:

This is one of the most important features since your customers would generally benefit from this feature by making payments. In case your customer sends more money or transacts more money, you can offer them money as cashback which can encourage them to continue using your platform over another platform.

QR Code and Card Number Scanning:

With this feature, the payment methods would be a lot easier and more efficient. The customers can easily scan the QR code and the card number rather than manually typing all the digits, which gives your users a substantial benefit.

Machine Learning:

In fintech systems, Artificial intelligence or AI became a requirement rather than an add-on feature. Machine learning techniques take data from various sources, analyze it, and offer recommendations.

Personal Finance Management:

Not all fintech applications include this feature during the app development. This feature can include tracking features for savings and better budgeting. Furthermore, consumers will appreciate managing many accounts in one location.

Custom Notifications:

Custom notifications are essential for creating a more appealing user experience. Everyone enjoys individuality when it comes to their lifestyle. So allow your customers to pick when and how they obtain information, whether periodic transfers or customized offers.

What Technologies Are Required to Develop a Mobile Fintech App?

To build a successful fintech app, you must align your company goals with the effective technology stack. Therefore, it’s also crucial to be up to date on the latest technological developments. Below-mentioned is some of the technological trends that you should align your application with:

AI Technology:

Neural networks are used in AI Technology to recognize and evaluate patterns in the input data. Artificial intelligence (AI) has shown to be a useful tool for analyzing and identifying trends based on real-time streaming data. Furthermore, this also allows AI to be used to a wide range of financial problems. One such instance can be the creation of financial advisory services or identifying possible fraud.

Microservices:

Microservices can be defined as a means of organizing an application into a collection of interconnected services. Fintech applications become distributed platforms with decentralized managing data in this fashion. As a result, service creation becomes faster because you can easily incorporate any essential service into your infrastructure. Microservices, moreover also, go hand in hand with AI and Blockchain. Understanding and adopting this trend is a crucial, pivotal step in lowering the cost of developing a fintech app.

Big Data:

Big data is gathered from a variety of electrical gadgets. Each day, 2.5 quintillion bytes of data are created and collected. Thanks to data analytics, this avalanche of data might provide critical insight into corporate development potential. For example, big data can assist in the development of a financial app that will be the only alternative for its consumers. In addition, you can predict customer behavior and create effective marketing campaigns with big data.

Blockchain:

A blockchain is a collection of time-stamped and immutable data blocks. Once a new block has been added to the chain, it cannot be modified or withdrawn. Because of these characteristics, blockchain is a very trustworthy option for transparent data transmission and transactional recording in fintech. Furthermore, data security is ensured through a decentralized data storing approach.

Cybersecurity:

The digital world’s constant issue is cybersecurity, and this is especially true for fintech applications that hold and handle sensitive consumer information. Financial institutions need to use a wide range of security strategies to reduce the risk of data breaches and data theft. Dynamic Application Security Testing (DAST), Automated Regression Testing, Source Code Analysis (SCA), Penetration Testing, Static Application Security Testing (SAST), Runtime Analysis, and cutting-edge DevSecOps approaches are among them.

What Are the Legal Requirements a Fintech App Must Comply With?

There are various legal criteria and compliances that a Fintech startup in India must meet. The following is a list of them:

Business Structure:

One of the primary steps for a financial startup is figuring out how it will operate. You can choose to either function as an OPC or one-person company or an LLP or Limited Liability Partnership, or a Private Limited Company.

GST Registration:

A fintech business or an online finance company must register for GST and obtain a GSTN.

Agreements and Contracts:

To create a fintech company, several legal paperwork must be obtained. An attorney or your lawyer can assist you in drafting tailored legal documents to meet your specific business needs. This paperwork includes a co-founder agreement, Privacy policy or IP Licensing agreement or website user policy, vendor or employee agreement, Product development agreement, etc.

Intellectual Property Registration:

Copyright, Patent, Trademark, and Design are examples of intellectual properties that need to be necessarily obtained for intellectual property registration. Since this will aid in protecting your brand, website, and mobile app, among other things.

Licensing:

The sort of service offered by the Fintech Startup in India will determine licensing and regulation. This is because the payment services necessitate registration with the Reserve Bank of India. Moreover, the process of licensing is quintessential for retail fintech to perform loan and depository services for MSMEs in the case of retail service providers. Therefore, fintech companies should be registered as NBFCs with the Reserve Bank for financial management and investment.

Domain Registration:

A technology-based corporation would want to establish a presence on the internet; thus, a domain name and a fully constructed website are required. Consider developing a mobile app if you’re a small business.

Final Thoughts

Fintech apps are simple to use, low-maintenance, and provide cutting-edge security. However, financial application development necessitates technical knowledge. Hiring a team of skilled professionals to guide you through the procedure is your best bet since you can get the best guidance throughout the entire developmental process. There is an unprecedented increase in the fintech market. The customers choose intrinsically digital Neo banks, Intelligent budgeting software, online insurance firms, electronic wallets, and online trading platforms that cover a broad range of traditional and cryptocurrencies. This success of fintech indicates the best time to join the ranks of the numerous organizations for mobile application development in India for fintech, which shall ultimately aid in influencing the all-digital economy. Keeping in mind the information above and following a proper procedure, developing a game-changing financial app will be easier.

Let’s Create Big Stories Together

Mobile is in our nerves. We don’t just build apps, we create brand. Choosing us will be your best decision.

FAQ About Fintech App Development

The financial app development cost can range from $50,000 to $300,000. However, the cost is dictated by various things, including how tech-savvy you want your finished product to be, so be sure to plan ahead of time.

The duration of time it takes to create a fintech application is mostly determined by the app’s objective and purpose, the project’s aims, and the level of customization sought by the customer. In India, a completely functional prototype for your concept takes about six weeks on average.

Fintech apps can assist you with various tasks, including money management, loans, investing, bills, and taxation. In most cases, these apps can handle both physical and digital transactions. However, a Banking App whilst is limited to online transactions.

Fintech apps offer a variety of advantages to companies, such as:

- Improved workplace productivity and efficiency

- Reduced operating expenses.

- Transactions that can be completed in real-time are known as accelerated transactions.

- Customer convenience — financial services are available anytime and from any location.

- Increased return on investment (ROI) for existing consumers and increased engagement with new ones.

A FinTech strategy is a step-by-step approach for turning your concept into reality. It entails identifying, organizing, and coordinating resources to meet company objectives while increasing profitability.

Get In Touch