How To Create A Money Transfer App: Like Venmo, Cash App, Zelle

Overview

The market is evolving at a brisk pace for money transfer apps. According to some studies, the overall transaction value of online payments was expected to reach the US $78,60,739 million in 2022. So if you are wondering about how to start a money transfer business, it is the best time when you put your thoughts and investments into it. The market is clearly growing, and so does the opportunities for entrepreneurship.

However, one of the crucial parameters that should be kept in mind while creating the best app for money transfer is secure. If you can offer secure money transfer app solutions to your users, then be rest assured that you will make a lot of money out of your app. You need to win the market and stay ahead of competitors with the most reliable solutions.

Also, the transfer from one account to the other should be seamless and faster regardless of its purpose and type. Additionally, the user’s personal information needs to be encrypted.

What Is Money Transfer App?

A money transfer app enables users to send and receive payments from business colleagues, family members, or friends. A money transfer app can be described as an extension of a traditional bank account or an autonomous service that allows users to send payments directly from their phone’s contact list.

Different Types of Money Transfer Apps

Standalone Services

These vendors have their own peer-to-peer mobile app solutions that facilitate money transfers. They all have a wallet feature that assists the users in keeping their money before they send it to their peer network. Venmo and PayPal are the leading financial services in this category.

Bank Centric

The P2P apps that involve banks as one of the parties in the online transactions are called bank-centric money transfer apps. Further, this category can be divided into two types:

- Bank has their own mobile application

- P2P payment applications transfer funds through different financial sectors like partner banks, financial institutions, credit unions, etc.

Social Media-Centric

Recently, many social networks have developed mobile payment apps. In 2015, Facebook launched its own payment feature where users can transfer money without leaving the app. Following Facebook, Google acquired Softcard, a mobile wallet in a joint venture with AT&T, T Mobile, and Verizon.

Mobile OS Focused Systems

Nowadays, mobile OS systems have become a flourishing trend as they make a faster and easier transactions for the users. Many users pay their bills and do other banking-related transactions on their smart mobile phones across the globe. With this method, service providers stay aware of cyber threats in real-time and alert the customers as soon as they happen. This reduces the likelihood of payment larceny.

Industries That Have Powered Money Transfer App

Here are a few companies leveraging this technology of money transfer services:

- Abra (US)

- Align Commerce (US)

- Bitspark (Hong-Kong)

- Coins.ph (Philippines)

- Rebit (Philippines)

- CoinPip (Singapore)

- Hellobit

- TransferB

- BitPesa (Africa)

- Romit (US) (earlier known as Robocoin)

- Volabit (Mexico)

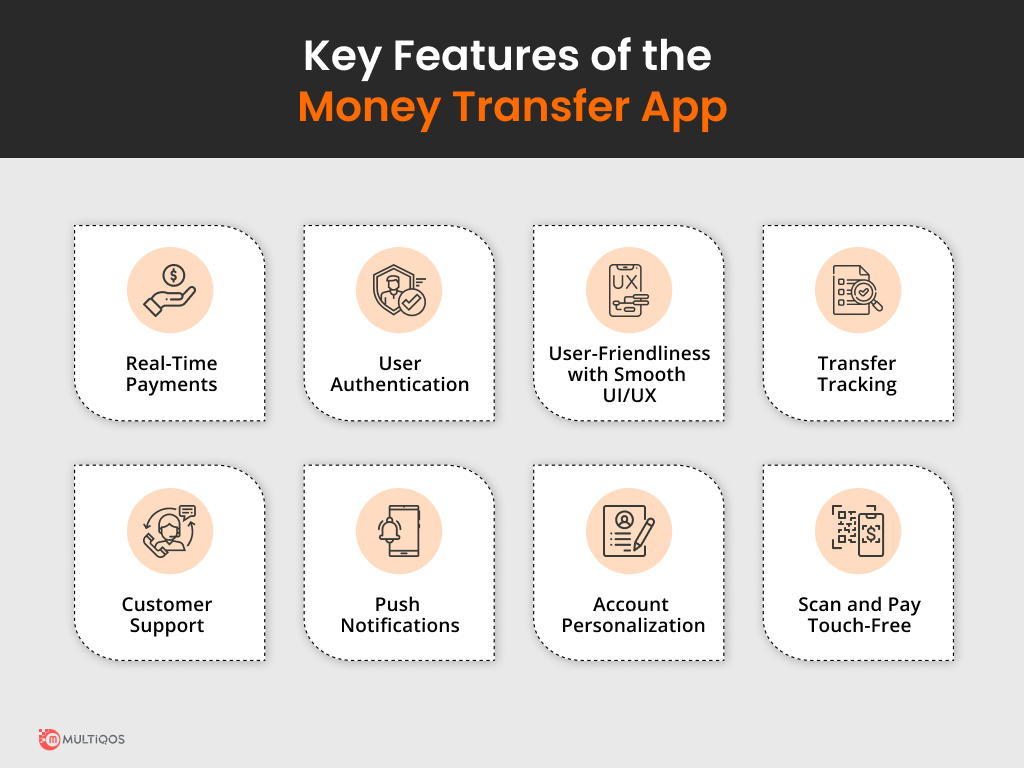

The Main Features of the Money Transfer App

Payment apps like Venmo, Cash App, and Zelle should definitely include the following features to be on-demand and stay ahead in the market of competitors:

Real-Time Payments

This feature enables the consumers to make payments to accounts and debit/credit cards in real-time and without transaction fees. It also ensures that the consumers’ time doesn’t get wasted while waiting for a transaction to be successful. You need to keep in mind that speed is the priority when digital cash has to be received and sent.

Cash Transfer Security and User Authentication

When you think about how to construct a money transfer website, the most common thing to remember is the encryption of fintech data through the security of connection and data protection with blockchain technology. Moreover, the authentication option should be confirmed by a unique pin code or fingerprints implemented by the money transfer app developer. This feature eliminates the possibility of cybercrimes.

The Simplicity of Usage with Seamless UI/UX

Ease of use and convenience in the money transfer app should be a priority when you think about how to create a money transfer app. When an app is easy to navigate through, the actions are logical; it becomes popular among the users. The money transfer app design should be app-specific and contain a digital card or prototype of a mobile wallet.

Transfer Tracking

When you want to build a money transfer app, enabling tracking of the user’s money transfers based on days, weeks, months, and so on should be kept in mind. If any user makes a payment through your app to a merchant and doesn’t receive the money, the seller won’t send the products the user has ordered. In that case, your app should be able to make the transaction visible in the history so they can deal with the issue and understand when and where they have made other payments.

Customer Support

To make your app extra approachable, customer support is the best option. Users feel taken care of while asking about transaction status, unexpected technical issues, or any transaction-related queries. Customer support is what makes your app extra approachable. Moreover, if you wish to enlist your money transfer app in the Google Play or Apple Store, the customer support feature is one of the crucial factors that lets you get listed on these storage platforms.

Push Notifications

This feature informs the consumer about the successful transaction and unsuccessful ones both in sending and receiving cash. This is actually a great feature that notifies the consumer instead of making them wonder about the transaction. Accordingly, they can take the next step without wasting time.

Account Personalization

Account settings personalization makes it easier for users to set up their personal accounts, choose preferred payment options, and manage personal details like location, status, age, etc.

Scan and Pay Touch-Free

Contactless payment method for products and services is the technology of today. Your device should support NFC (Near Field Communication) to receive payments from smartphones. Just set up an online P2P payment account to get the benefits of this technology.

Required Technologies in Money Transfer App Development

Mobile Wallet Apps

Mobile wallet alternatives for credit/debit cards, cryptocurrency, or online cash options like points, coupons, rewards, etc. Apps like Google Pay, Paytm, PayPal, etc., where the user can keep money and use it whenever necessary. The user can connect their bank account to these wallets and directly transfer money to them.

NFC

NFC, i.e., Near Field Communication, is an entirely contactless chip-based payment method. One doesn’t need to contact any device but be in the vicinity, so the receiver’s device reads the pay pad. Within 2-4 inches of distance, one can make payment. This technology is only available in new smartphones where payment mode is integrated to avoid contact between parties.

Net Banking

For quite a few years, internet banking has been in use. Most banks have made this process imperative these days. The users must first add a beneficiary to their account with all the correct information. Next, an OTP is sent to their mobile through which they should allow the payee, and after a few hours of adding the payee, the user can do the transaction.

Sound Waves Payment Method

This unique method allows a person to make transactions using innovative waves released from an intelligent device. This feature can be incorporated into smartphones, card swipe machines, etc., and complete the transaction within a few minutes.

How Much Does It Cost to Make Your Money Transfer App?

Creating a money transfer app for the banking sector usually costs $11500. However, the total cost for this kind of mobile app development can be as low as $8000 or as high as $15000. It all depends on the features and functionality. Generally, a money transfer application for the banking sector with low features known as a “minimum viable product’ or MVP is more affordable than an app with many proposed functionalities.

Conclusion

Now, while wondering about how to create an app similar to Cash App, Venmo, and Zelle, you must know what should be kept in mind in the first place in your p2p money transfer mobile application development. Creating a money transfer app that transfers the consumer’s money in the fastest, safest, and most convenient way is essential. So, hire a mobile app developer capable of creating a money transfer app for ios app development and android app development with the best quality.

We at MultiQoS are ready to provide you with professional solutions and guidance on mobile application development on the way. Our software engineers and app developers are experts in converting your requirements and ideas on how to create a peer-to-peer payment app into a viable and effective product. So, contact us to get the best money transfer app developers and make your presence seen in the fintech industry.

Seeking Experts for E-wallet App Development?

Connect with our e-wallet app development for an innovative digital payment solution.

FAQs on Money Transfer App Development

Apps for international money transfer allow you to transfer money quickly and easily. The service of any money transfer app depends on the money transfer app’s design. Some hold your money and let you use it whenever you need while others transfer your money from one bank to another. The services of these apps are specifically designed to cater to consumer needs.

Generally, money transfer applications offer robust security features to safeguard your money. However, it is essential to keep in mind that if you send your money to the wrong recipient, there are chances of not getting back your money. The providers might not help to recover misallocated funds.

It is usually based on the software used for money transfer, and the time it takes varies. Some transfers occur immediately, and some can take up to a few days. So, while choosing the best app for money transfer, keep your needs in mind and check for each app’s timeframe to transfer your money.

You need to research different money transfer applications. Take a look at each app’s store ratings, and test each app for transaction speed and ease of use. Then analyze each app’s compatible systems and evaluate their security features. Then to narrow down your research, calculate each app’s maximum and minimum transfer amount.

Get In Touch