Web3 in Fintech: How Decentralization Can Benefit Financial Institutions

Fintech is evolving faster than any other industry. To make things even better, the recent developments in Fintech give an outstanding edge for creating a better environment in finance all around the world.

With the latest rendition of Web3, the internet is all set to maximize its capabilities in the financial world. With this new addition to the landscape certain challenges rise as well. In order to know what these challenges are and how they can be passed through, you must get a good read of this blog.

What is Web3 in Fintech Landscape?

Web3 is predicated upon the principles of decentralization and the utilization of blockchain technology in order to cultivate an internet ecosystem that is characterized by transparency and inclusivity. The key difference in payment infrastructure between Web2 and Web3 is decentralization. Web2 relies on centralized banking systems for payments, while Web3 in Finance enables money exchange without intermediaries.

Understanding Web3 and Its Impact on Fintech

Web3 enhances user understanding through increased connectivity and intelligence. The blend of user experience and intelligent agents empowers fintech companies, both large and small, to deliver personalized financial services with minimal human involvement.

Fintech startups have automated financial advisors, aiding users in making cost-effective financial decisions. Some cater to High-Net-Worth Individuals (HNWIs) with digital wealth management advisory services. As per various experts and market reports, it is found that Web3 in Finance will reach approximately $81.5 billion in 2030 at a CAGR of 43.7%.

Furthermore, ‘smart wallets’ can adapt to users’ habits, promoting positive changes in personal financial spending and saving behavior.

The Shift towards Decentralization in Financial Services

DeFi empowers individuals with greater asset control than the traditional financial system. It grants people the freedom to choose how to invest their assets independently, bypassing intermediaries.

This does not cancel out the necessity for financial advice or render conventional institutions obsolete. Nevertheless, it is possible for the dynamics of human and institutional relationships and financial decision-making to undergo substantial changes.

The impact of DeFi extends to relationships between businesses. As institutions become integrated into the blockchain ecosystem and the process of tokenizing financial assets such as derivatives and securities advances, it is conceivable that decentralized applications backed by smart contracts might potentially function as intermediates between these institutions.

For instance, institutions could trade tokenized securities instantly in an open marketplace facilitated by internet-based smart contracts, potentially replacing traditional entities.

Read Also: How to Build a Fintech App in 2024

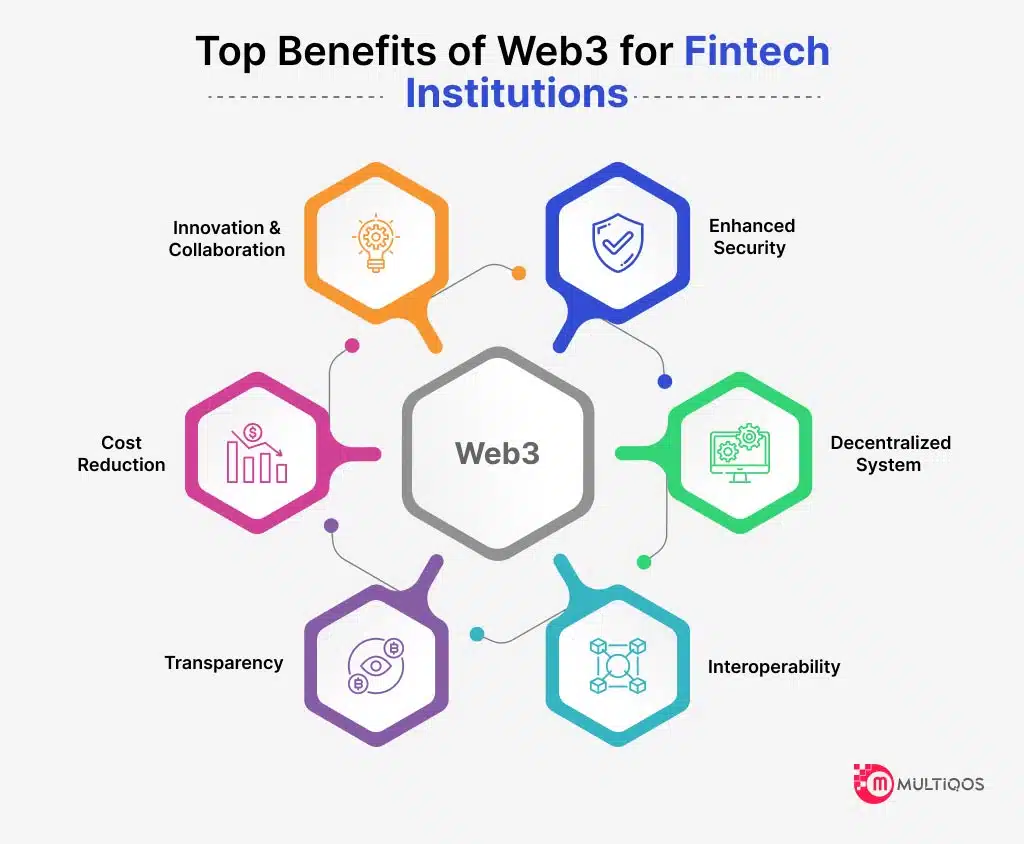

How can Financial Institutions Benefit from the Web3 Revolution?

Financial companies can derive significant benefits by joining the Web3 revolution:

- Enhanced Security: With blockchain as its backbone, Web3 in Fintech offers superior security in contrast to traditional financial systems, crucial in the cyber-threat-laden online world.

- Decentralized System: Web3’s absence of central authorities ensures robust security, freedom from internet censorship, data ownership, privacy, and cost-effective financial services.

- Interoperability: Web3 champions open standards and protocols, enabling decentralized exchanges (DEXs) and seamless synergy among numerous financial applications.

- Transparency: As a decentralized system, Web3 delivers total transparency and control over financial records, bolstering accountability and diminishing fraud risks.

- Cost Reduction: The Web3 ecosystem leverages emerging technologies like AI/ML and blockchain to automate financial processes, slashing transaction costs and elevating efficiency.

- Innovation and Collaboration: Adopting Web3 technology cultivates a culture of financial innovation and collaboration, with the added potential of implementing decentralized applications to enrich financial services.

Decentralization and Its Role in Fintech Innovation

Cutting out middlemen minimizes transaction costs and accelerates financial processes, benefiting both users and businesses. Decentralized finance (DeFi) opens avenues for seamless cross-border payments, reducing remittance fees and delays.

Transparent, immutable ledgers instill trust among users, reducing fraud and ensuring accountability. Decentralization fosters a fertile ground for fintech startups to pioneer innovative solutions without bureaucratic hurdles.

Decentralized platforms allow individuals to lend and borrow directly, expanding financial opportunities. Traditional banks are adapting Fintech Solutions by integrating decentralized elements, digital transformation in fintech are offering clients more choices and flexibility.

Opportunities of Web3 Adoption for Financial Institutions

Cryptoassets and related solutions facilitate the storage and transfer of financial value among individuals and entities. These encompass stablecoins tied to fiat currencies (e.g., the U.S. dollar), tokens for cross-border payments, remittances, and microtransactions, along with merchant point-of-sale tools.

Decentralized finance (DeFi) encompasses a range of Web3-based financial solutions employing smart contracts instead of traditional intermediaries like banks or insurers. Key DeFi applications include asset management, lending, decentralized exchanges, derivatives, and insurance.

This category also features hybrid firms merging Web3 and Web2 models, known as centralized DeFi (CeDeFi) or Web2.5 companies, such as crypto banks and centralized exchanges. Global smartphone penetration is set to hit 83% by 2022.

Advocates of stablecoins and DeFi believe this opens avenues for a substantial portion of the global population to transact, spend, and utilize digital currency without the constraints of traditional bank regulations. Additionally, anonymous web3 accounts provide added flexibility.

Challenges and Considerations in Embracing Web3 In Fintech Solutions

Web2 had its challenges, and Web3, though promising, faces its own hurdles. This blog delves into these Web3 challenges and explores potential solutions.

- Scalability: Web3’s decentralized nature, governed by nodes, can struggle to match centralized web systems’ scalability. The “scalability trilemma” means blockchain can only prioritize two of security, decentralization, and scalability at a time.

- Energy Consumption: The energy demands of decentralized web hinder sustainable scalability. Solutions like layer2 and new consensus mechanisms are being explored.

- Interoperability: Inter-blockchain data transfer remains a challenge, affecting asset utilization and security. Projects like Injective, Cosmos, and Polkadot aim to resolve this with innovative methods.

- Development: Diverse blockchains lead to development complexities. Developers require specific skills for each network. Ethereum and Solana serve as examples.

- Accessibility: Web3 struggles with accessibility compared to user-friendly Web2 platforms. Security versus convenience trade-offs must be addressed to make Web3 more mainstream.

To address these Web3 challenges, improving user interfaces, creating user-friendly bridges between platforms, streamlining smart contract audits, timely issue resolution, third-party testing, and educational content are essential steps. Increased awareness will boost Web3’s accessibility and adoption.

The Future Landscape of Fintech in the Web3 Era

Web3.0 signifies a shift away from the traditional, centralized financial system controlled by a select few institutions. Instead, it will embrace decentralization, opening doors to innovation and paving the path for a more democratic and inclusive financial landscape.

These technologies have only begun to reveal their potential. In the future, they are poised to become the predominant means of engaging with financial services. Traditional infrastructure will steadily diminish in significance, making room for a more accessible, inclusive, and democratic financial realm to flourish.

Predicting Trends and Innovations

-

Zero-Knowledge Proofs (ZK)

Zero-Knowledge proofs authenticate data without data collection. Passwords, typically stored as hashes, can now be used for sign-ins without data collection. There are interactive and non-interactive methods. ZK is essential for Web3 decentralization and a key 2023 Web3 trend, enhancing on-chain interactions’ scalability and security.

-

Regenerative Finance (ReFi)

An extension of DeFi, ReFi merges regenerative economics with decentralized finance. It assigns monetary value to natural assets, allowing Web3 users to invest or trade them via wallets. ReFi promotes sustainability, aligning with UN Sustainable Development Goals, curbing carbon footprints, and championing community-driven climate and ecosystem preservation.

-

Custody of Assets

FTX’s recent collapse emphasized “not your keys, not your coins.” Decentralized custody solutions rise, addressing security gaps in some firms. Leading companies offer asset custody, adhering to banking-grade compliance, and secure key storage. Customized assets are now monetizable through decentralized on-chain applications.

Shaping the Path Forward for Financial Institutions

NEO-banks attempted internet banking but struggled to establish personal connections with customers, hindering robust relationships. Web 3.0 aims to reshape this dynamic via the #metaverse.

Incorporating artificial intelligence in financial services enhances customer service possibilities. Personalized experiences may revolutionize internet banking, potentially shifting to AR/VR for virtual bank visits from home.

Despite the 21st century, our tech infrastructure sometimes lags, as seen in delayed offshore settlements. Blockchain technology, notably Ripple Network, offers near-instantaneous settlements, transforming a 5-7 day process into seconds.

Ripple LABS has notably boosted global supply chains with rapid, cost-effective settlements, unlike traditional SWIFT banking. It also shields economies from stringent sanctions, exemplified during Iran’s nuclear program and Russia’s Ukraine invasion. Web 3.0 provides scalable, rapid decentralized solutions for international trade.

Why Choose MultiQoS As Your Strategic Partner for Web3 Fintech Solutions?

Selecting MultiQoS as their strategic partner for Web3 Fintech Solutions presents various compelling reasons:

- Expertise in Web3 Fintech: MultiQoS is home to a team of Best Fintech App Developers seasoned and well-versed in the intricacies of Web3 and fintech. Their deep understanding of blockchain, decentralized finance (DeFi), and emerging technologies ensures top-notch solutions.

- Proven Track Record: MultiQoS has a history of delivering successful Web3 fintech solutions, showcasing their ability to translate innovative ideas into practical, scalable, and secure solutions.

- Cutting-Edge Technology: MultiQoS stays at the forefront of technology trends. They leverage the latest advancements in Web3, blockchain, and AI to develop solutions that set their clients apart in the fintech landscape.

- Customized Solutions: MultiQoS understands that each fintech project is unique. They tailor solutions to specific needs, ensuring they align seamlessly with clients’ business goals and objectives.

- Security and Compliance: Security is paramount in fintech. MultiQoS prioritizes the highest standards of security and compliance to safeguard assets and data, providing peace of mind to both clients and their customers.

- Scalability: Since MultiQoS is essentially a software development company designs solutions with scalability in mind. As clients’ businesses grow, their Web3 Fintech solutions adapt and expand, ensuring they remain effective and efficient.

- Cost Efficiency: MultiQoS optimized costs without compromising quality, allowing clients to achieve their fintech goals within budget constraints.

- Customer-Centric Approach: MultiQoS places a strong emphasis on the user experience. They design user-friendly interfaces and intuitive platforms, enhancing customer engagement and satisfaction.

- Global Perspective: MultiQoS understands the global nature of fintech. Their solutions are equipped to navigate international markets, compliance requirements, and diverse customer needs.

- Continuous Support: Beyond project delivery, MultiQoS provides ongoing support and maintenance, ensuring clients’ Web3 Fintech solutions remain operational and up to date.

Conclusion

Web3 is reshaping the fintech landscape with decentralization and blockchain technology. It enhances user experiences, empowers fintech innovation, and revolutionizes financial services. DeFi empowers individuals, while businesses explore new opportunities. Despite challenges like scalability and accessibility, Web3’s future looks promising. Zero-Knowledge Proofs, Regenerative Finance, and Custody of Assets are driving trends, while Ripple Network accelerates international trade.

Want to Build Fintech Software?

Our fintech software development team, with our expert developers, is ready to collaborate with you and ensure a successful launch.

FAQ on Web3 in Fintech Industry

Web3 is a decentralized, blockchain-powered internet transforming fintech with secure, transparent transactions and enhanced user experiences.

Financial institutions gain security, transparency, cost reduction, and innovation opportunities by embracing Web3’s decentralized system.

Challenges include scalability, energy consumption, interoperability, development complexity, and accessibility, which can be addressed through improved interfaces, education, and streamlined processes.

Get In Touch