AI Consulting ROI Explained: What Businesses Can Realistically Expect in the First 6 Months

Table of Content

- What Does ROI Mean in AI Consulting?

- Why Early ROI is Operational, not Transformational?

- Why AI Consulting ROI Looks Different from Traditional IT Projects

- The 6-Month AI Consulting ROI Timeline

- Measuring and Tracking AI ROI Effectively

- Role of AI Consulting Services vs. In-House Teams: The Strategic Decision

- How MultiQoS Ensures Optimal AI Consulting ROI for Your Business?

- FAQs

Summary

This guide explores the financial reality of implementing artificial intelligence strategies. You will discover why many pilot programs struggle to show value and how to bridge the gap between technical accuracy and fiscal impact. The article outlines a clear timeline for turning costs into value by focusing on operational wins first.

It also compares traditional software projects with adaptive intelligent systems to highlight necessary changes in budgeting. You will learn to identify the right metrics for success and determine whether internal teams or external partners offer better speed to value.

In 2026, the novelty of “implementing AI” has been replaced by a cold, hard interrogation of the balance sheet. While pilot programs and FOMO-driven investments defined the previous two years, the current market reveals a stark divide. Organizations that treat AI as a speculative science project versus those that treat it as a rigorous financial discipline.

The challenge most leaders face is not the technology itself, but a persistent “Metric Gap.” They are applying deterministic, 20th-century ROI frameworks to probabilistic, 21st-century assets. Often overlooked is the fact that AI consulting ROI is not a linear surge in revenue. It is a complex calculation of cost avoidance, value-realization speed, and “human-in-the-loop” economics.

Over the last 48 months, the “Pilot Trap” has claimed 95% of initiatives because they lacked a bridge between technical accuracy and fiscal impact. This alignment is the difference between an expensive science project and a scalable competitive advantage.

This article delivers a definitive understanding of how to move beyond vanity metrics to track real AI ROI. You will discover why your early wins must be operational rather than transformational, and receive a 180-day roadmap to turn AI from a cost center into a value engine.

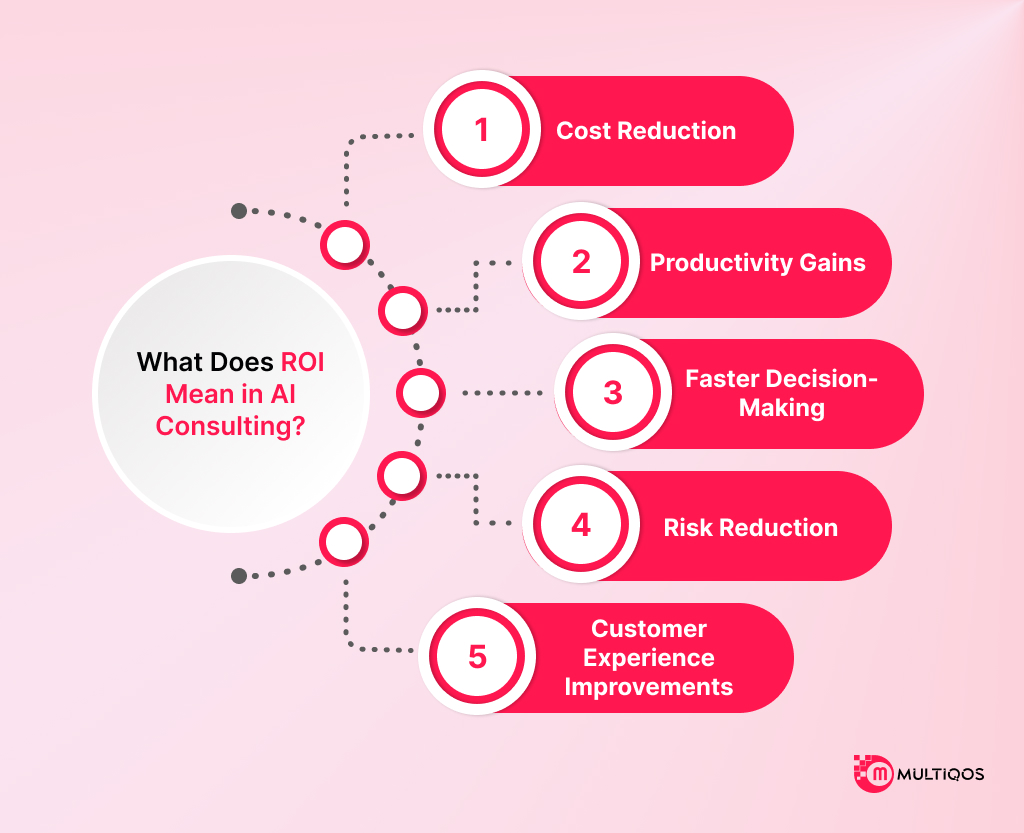

What Does ROI Mean in AI Consulting?

AI consulting ROI is not limited to a simple revenue surge. Instead, it is calculated based on factors such as cost savings, revenue, employee experience, brand reputation, and strategic gains.

While many organizations consider abstract categories such as productivity to be key drivers of ROI, the true value of AI consulting lies in quantifiable results.

Let’s understand a few of them.

-

Cost Reduction

Cost reduction is one of the first AI consulting ROI metrics every company measures. But does it deliver hard ROI? Here is an example,

A mid-sized healthcare provider uses an AI agent to automate user authorization requests. It helps the company reduce manual time per authorization from 45 minutes to 22 minutes.

The use of AI agents is also helping the organization save $25,000 per month in administrative costs. What this example shows is that the AI consulting ROI in terms of cost reduction lies in

- Reduced administrative costs

- Quicker payback of invested capital (6 Months)

-

Productivity Gains

Productivity in AI consulting is often buzzword-heavy, but real ROI is measured by “value-realization speed,” the velocity at which an organization executes tasks that were previously bottlenecks.

For example, a mortgage company that deployed AI agents to automate document classification and extraction for loan applications moved beyond simple task assistance to full process automation.

The results redefined their operational baseline:

- 80% reduction in loan processing costs.

- 20x faster application approvals. This demonstrates that productivity ROI is found in throughput capacity, not just individual worker output.

-

Faster Decision-Making

Speed is currency. AI systems deliver ROI by reducing latency between data ingestion and actionable insights, enabling businesses to respond to market or operational changes instantly rather than retrospectively.

Consider a major copper producer that integrated an AI tool, OptimusAI, to interpret data from thousands of field sensors. Rather than waiting for weekly reports, the system optimized grinding mill capacity in real-time.

The financial impact of this decision speed was immediate:

- 10-15% improvement in throughput.

- 2-4 percentage point increase in copper recovery.

Here, ROI is calculated based on the asset utilization rate achieved through millisecond-level adjustments.

-

Risk Reduction

In high-stakes industries, ROI is often defined as “cost avoidance” meaning the capital saved by preventing regulatory fines, fraud losses, or equipment failures. But can we put a price tag on safety?

For a bank generating 100,000 monthly Anti-Money Laundering (AML) alerts, the cost of manual review is exorbitant. By implementing an AI system to filter transactions, the bank reduced false-positive alerts by 60%.

This translation of risk management into hard currency resulted in:

- $1.8 million saved monthly in manual review costs.

- Reallocation of compliance staff to higher-value investigation tasks.

-

Customer Experience Improvements

Customer experience is frequently dismissed as a “soft” metric. However, in the AI consulting framework, it is strictly quantified by conversion efficacy and revenue uplift.

A global beauty products company proved this by deploying a virtual beauty assistant across 20 markets. This wasn’t just a support tool; it was a sales channel.

The data highlights a massive shift in value generation:

- $100 million in expected incremental revenue.

- 2x the ROI compared to their traditional e-commerce pathways. This confirms that CX ROI is driven by personalization at scale, which directly influences purchase decisions.

Why Early ROI is Operational, not Transformational?

A consistent finding in the current market analysis is that early AI ROI is almost exclusively operational (efficiency-focused) rather than transformational (business model reinvention).

- The “Low-Hanging Fruit” Strategy: Early wins are concentrated in “back-office” functions such as IT, finance, and procurement, where data is structured, and risks are low. Automating the process of invoicing gives a predictable measurement point as opposed to the fluctuation of inventing a product line.

- The Transformation Lag: 66 % of the organizations say that they see increased productivity, but only 34 % actually reimagined business models. Transformational ROI involves a process that needs a big organizational change, which, in general, takes two to four years to give satisfactory returns.

- The Complexity of the Scale: Large organizations frequently cannot separate ROI due to the gridlock of legacy infrastructure. On the contrary, agile companies realize quicker ROI in operations through the introduction of AI into the workflows without any serious friction of bureaucracy.

Why AI Consulting ROI Looks Different from Traditional IT Projects

Calculating ROI for AI consulting requires a fundamental departure from legacy IT frameworks. While traditional software projects are deterministic, you build X to get Y. AI initiatives are probabilistic and adaptive.

The error many organizations make is applying a “fixed-scope” mindset to a variable-outcome technology. To understand the true value of AI, we must dissect the structural differences in how returns are generated.

Experimentation vs. Fixed Scope

Legacy IT projects typically operate on a strict “waterfall” of requirements: the outcome (an ERP upgrade) is defined before the first line of code is written. In contrast, AI development functions more like R&D, where the solution evolves based on data performance.

Consider the “Pilot Trap.” A staggering 95% of AI pilots fail to reach production because they are treated as plug-and-play installations rather than hypothesis-driven experiments.

Successful AI consulting flips the script by deploying a “Minimum Viable AI” (MVAI):

- Legacy Approach: Launch only when functionality is near 100%.

- AI Approach: Launch at 70-80% accuracy to gather critical feedback data.

- The Result: Faster failure identification and a pivot speed that is 3x higher than traditional software cycles.

Data Readiness Dependency

In traditional IT, data is merely an input. In AI, data is the engine itself. A primary driver of the extended “time-to-value” in AI projects is the wide gap between “business-ready” and “AI-ready” data.

But how much resource does this actually consume?

- 40-60% of the total project budget is often strictly allocated to data cleaning, context management, and lineage tracking.

- Unlike static analytics, AI models require outliers and rich metadata to avoid hallucinations.

This means the ROI calculation must account for a heavy front-loaded investment in data infrastructure before a single prediction is made.

Model Iteration and Learning Curves

A defining characteristic of AI assets is that they do not remain static. While legacy software is “stable” after deployment, AI models suffer from “drift” as real-world data shifts.

This brings about the concept of the Learning Gap. Artificial ROI is common to be low early on due to the system needing human involvement (Human-in-the-Loop or HITL) to rectify the error.

But when the model has attained sufficient autonomy, the economics is completely transformed:

- Phase 1 (Learning): Phase 1 is characterized by high OPEX because of the expenses human verification.

- Phase 2 (Autonomy): OPEX levels off, output increases exponentially.

Net Result: This is because a system that becomes better with use is a better system than a traditional software which loses value.

Why ROI Emerges in Increments (The J-Curve)

AI ROI does not follow the linear payback line of a server upgrade. It follows a “J-Curve,” a dip in value followed by exponential growth.

Market analysis reveals three distinct phases of financial realization:

- Pilot (Months 0-6): Net Negative ROI. Capital is consumed by infrastructure and feasibility testing.

- MVP/Production (Months 6-12): Break-even to 30% ROI. The system handles a limited volume.

- Scale (Months 18+): 150-400% ROI. The model is applied to broader use cases without proportional cost increases.

Traditional IT vs. AI Consulting

Here is a breakdown of the core financial and operational characteristics for Traditional IT vs. AI Consulting ROI comparison.

| Feature | Traditional IT Project | AI Consulting Initiative |

| Primary Goal | Process stability & digitization | Prediction accuracy & automation |

| Scope Definition | Fixed requirements | Probabilistic, hypothesis-driven |

| Time to Value | Linear; immediate upon deployment | J-Curve: value compounds over time |

| Cost Structure | High CAPEX, Low Marginal Cost | High OPEX (Compute/Tokens) |

| Success Metric | Uptime & User Adoption | Decision Accuracy & Autonomy Rate |

| ROI Horizon | 6–12 Months | 18–24 Months (Transformational) |

Achieving a measurable return on investment within a six-month window requires a disciplined AI implementation roadmap. The most common error firms make is attempting “big bang” transformations rather than prioritizing speed to value.

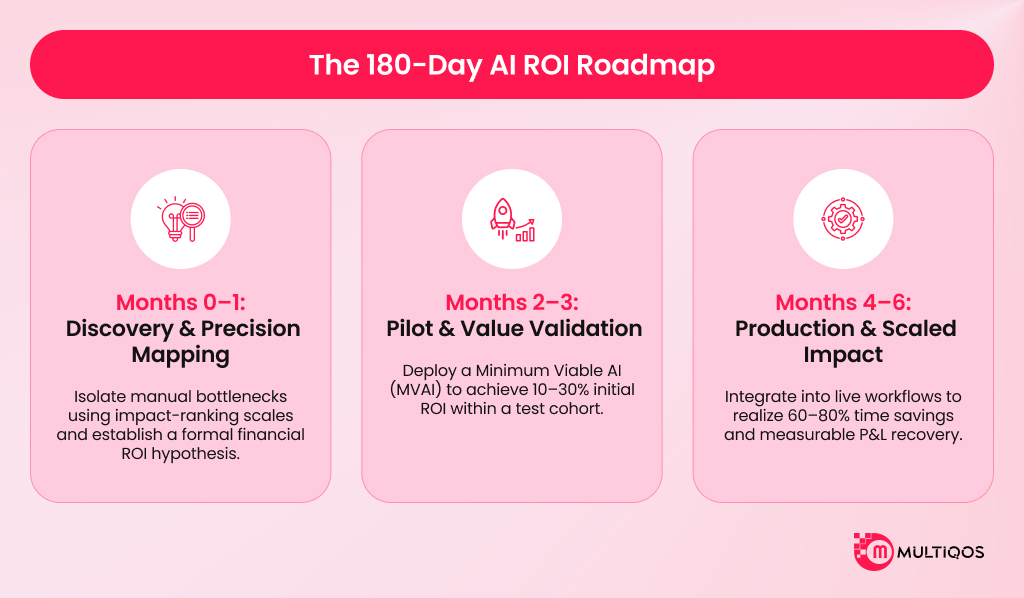

The 6-Month AI Consulting ROI Timeline

An effective ROI timeline shifts from theoretical strategy to tangible short-term ROI from AI initiatives by following a strict 180-day schedule.

Month 0–1: Discovery & Value Identification

This phase defines the “North Star.” It assesses whether the organization is actually “AI-ready” or if it is heading toward “pilot purgatory,” where 95% of projects fail.

AI consulting services typically deploy an “hour-by-hour” time mapping strategy here. Instead of vague goals, they isolate manual bottlenecks and rank opportunities on a 1–10 scale based on impact versus implementation difficulty.

The focus is rigorous financial validation:

- Data Audit: Consultants verify context, lineage, and representativeness, not just basic quality.

- ROI Hypothesis: A formal AI cost vs benefit analysis is established, defining break-even points.

- Financial Reality: At this stage, AI ROI expectations are net negative as capital is deployed.

Month 2–3: Pilot & Proof of Value

The focus now shifts to building a “Minimum Viable AI” (MVAI) to validate technical feasibility.

Development teams often leverage vendor-based solutions to accelerate build times, aiming for 70–80% accuracy. This is sufficient for back-office functions when paired with human oversight.

The value proposition is tested on a small cohort (5–10 users):

- Productivity Uplift: Value is measured by time saved and capacity released.

- Baseline Comparison: Measuring AI business impact begins by benchmarking pilot performance against Month 1 data.

- Initial Returns: This phase typically yields 10–30% ROI within the test cohort.

Month 4–6: Production & Optimization

A successful AI pilot-to-production transition occurs here. The system is integrated into live workflows (CRM or ERP) to deliver P&L impact.

By Month 6, organizations should see a measurable break-even or positive return. For example, document extraction projects often show payback in 2–4 months.

The operational shift is significant:

- Scale: The solution expands to 50% of the target team.

- Hard Metrics: 60–80% time savings are realized for high-velocity tasks.

- Future Proofing: Feedback loops are solidified to handle model drift.

Early ROI Use Cases That Deliver Fast Wins

To ensure short-term ROI from AI initiatives, AI development services recommend value-driven processes that are high-volume, rules-based, and data-rich.

These use cases accelerate the time to value in AI projects because they avoid subjective quality measures.

|

AI Use Case |

Estimated Time to Value | ROI Metrics & Impact | Why It Wins Early |

|

Process Automation ( Invoice Processing) |

4–8 Weeks | 60–80% time savings= 2–4 month payback. | Relies on existing documents; high frequency; immediate removal of manual bottlenecks. |

|

Customer Support ( Ticket Routing) |

2–4 Weeks | 30–50% cost reduction= 2–3x faster response. |

High data availability; clear success metrics; low risk if supervised. |

| Forecasting (Inventory/Fraud) | 8–12 Weeks | 15% inventory accuracy= 35% reduction in excess. |

Directly impacts P&L by stopping leakage (waste/fraud) rather than just saving time. |

| Personalization ( Sales Outreach) | 3–6 Weeks | 10–15% revenue uplift =increased conversion. |

Directly tied to revenue, high volume allows for rapid A/B testing. |

Measuring and Tracking AI ROI Effectively

To transition from experimental sandboxes to “accountable acceleration,” organizations must stop treating AI as a speculative science project and start treating it as a rigorous business discipline. Effective measurement mandates a departure from purely technical benchmarks toward tangible business outcomes.

This requires engaging AI Development Services not just for code, but for establishing clear baselines and maintaining ROI calculation as a dynamic, ongoing process. Whether leveraging internal teams or external AI consulting, the imperative is the same: align the AI implementation roadmap with fiscal reality.

Define Business KPIs Before Models: The ROI Hypothesis

The primary vector of failure in AI initiatives is the “solution-first” fallacy, engineering complex architectures before defining the problem space. Successful organizations begin with a strict “ROI Hypothesis,” prioritizing business objectives over technological novelty. This is the cornerstone of AI adoption for business planning.

- Problem-First Architecture: Avoid the “shiny object trap.” Operationalizing AI use cases requires identifying high-friction, high-frequency tasks where automation yields deterministic savings.

- Quantifiable Success Vectors: Before a single line of code is committed, define the “definition of done” in financial terms. Is the goal to reduce invoice processing latency by 40% or to suppress support ticket volume by 30%?

- Hypothesis Testing: Formulate a falsifiable hypothesis. This ensures the project targets a concrete AI cost vs benefit analysis outcome.

Track Baseline vs. Post-AI Metrics: The Counterfactual Imperative

It is impossible to manage what you cannot measure, and impossible to improve without documentation of the baseline. One of the most common ways of failure in estimating the business impact of AI is that there is no pre-implementation data, and, therefore, the ROI timeline becomes uncertain.

- Clean Counterfactuals: Establish a “clean counterfactual” by baselining the pre-AI process. What is the current cost per transaction, error rate, or cycle time?

- Controlled Rollouts: Implement A/B testing or controlled rollouts to isolate the short-term ROI from AI initiatives. This separates the signal of the technology’s impact from the noise of external variables.

- Data Collection Windows: Allocate specific phases, often 2 to 4 weeks, for collecting baseline data. This creates a defensible position when calculating how long it takes to see ROI from AI.

Combine Financial and Operational Indicators

A robust ROI framework acts as the connective tissue between “hard” financial metrics and “soft” strategic indicators. This holistic view is often emphasized in AI Consulting Services to justify the total cost of ownership.

- Financial Benefits (Hard ROI): These are direct P&L impacts, material waste reduction, and revenue surge ( conversion rate optimization).

- Operational Improvements: Track the efficiency gains that drive financial value, such as throughput velocity and error rate reduction.

- Soft & Strategic ROI: Do not ignore “squishy” metrics like employee satisfaction or decision-making velocity. While harder to quantify, these are leading indicators for AI ROI expectations and long-term viability.

Avoid Vanity Metrics: The Accuracy Trap

Technical success is not synonymous with business success. An AI model boasting 95% accuracy can still destroy value if it optimizes for a non-critical outcome or introduces workflow friction.

- Impact Over Accuracy: Shift the interrogation from “what is the model’s accuracy?” to “what changed in the enterprise once this shipped?”

- Cost of Errors: A model with lower technical precision may yield a superior AI consulting ROI if it is calibrated to minimize expensive errors (false negatives in fraud detection) rather than maximizing global accuracy.

- Usage vs. Capability: An unused model has an ROI of zero. Metrics must track adoption rates and autonomous task completion to validate the move from AI pilot to production.

Position Measurement as a Continuous Discipline

The AI ROI is not a fixed value, but a longitudinal indicator, which changes over a period as the models learn and the markets change.

- Ongoing Re-assessment: When there are changes in the data patterns (model drift), the performance decreases. ROI has to be recorded on an ongoing basis, and this will give an indication of when retraining has to be done.

- Iterative Optimization: Use quarterly reviews to pivot resources. This agility is critical when scaling AI after pilot success to higher-yield use cases.

- Lifecycle Costing: Effective measurement accounts for the TCO over time, including MLOps and change management. This is the only way to accurately answer time to value in AI projects.

Role of AI Consulting Services vs. In-House Teams: The Strategic Decision

Deciding between AI Consulting Services and In-house teams is not merely a resourcing question. It is a fundamental exercise in capital allocation and risk arbitrage. The choice is governed by cost structures, time-to-market urgency, and the organization’s risk tolerance.

The Execution Matrix: Defining Operational Modes

In order to prevent misaligned expectations, the stakeholders should differentiate the three main delivery vectors.

- AI Consulting Services (The Architects): The main service offered by them is strategy, roadmap definition, and governance. They provide ROI estimation and preparedness audits and make sure that the initiative addresses a legitimate business issue prior to the commencement of any engineering.

- AI Development Services (The Builders): These are companies that specialize in technical implementation, coding, model training, and integration of systems.

Speed to Value: The Agility Gap

External partners consistently outperform internal teams in “speed to value metrics,” typically delivering actionable outcomes in 4–12 weeks. In contrast, internal capability building often requires a 6–18 month runway to achieve comparable maturity.

- The Recruiting Lag: Establishing a competent internal unit ( Head of AI, ML Engineers) involves a 6–9 month recruitment cycle, followed by a 3–6 month ramp-up period. This latency is often fatal to short-term ROI from AI initiatives.

- Immediate Deployment: Consulting firms provide instant liquidity in talent. By accessing pre-vetted tech stacks, projects bypass the friction of recruitment and onboarding.

- Agility Metrics: Data indicates mid-market companies utilizing external partners achieve a “Pilot-to-Production” timeline of 90 days. Conversely, enterprises attempting organic internal builds frequently experience timelines exceeding nine months.

Cost Efficiency: The Hidden Price Tag of “In-House”

While internal salaries may appear optically cheaper than consulting rates, the TCO often reveals a “hidden price tag” that makes internal builds significantly more expensive for early-stage initiatives.

- The 90% Overrun: A nominal $1.5M internal AI budget often balloons to ~$2.85M in Year 1. This variance is driven by recruitment fees ($150k), productivity loss during onboarding ($300k), and management overhead.

- Underutilization Waste: Internal workflows are “lumpy,” characterized by intense build phases followed by maintenance lulls. A fixed-cost team typically operates at 100% utilization for only four months annually, creating significant capital inefficiency.

- Fixed vs. Variable Arbitrage: Consulting converts high fixed costs into variable costs (project fees). This financial flexibility is advantageous until the organization sustains enough continuous volume (typically 5–15 production models) to justify permanent headcount.

How MultiQoS Ensures Optimal AI Consulting ROI for Your Business?

As enterprises gear up for AI adoption in 2026, the era of unmeasured experimentation is over. The market has shifted towards accountable acceleration rather than depending on vanity metrics. Without proper measurement, the chances of failure increase. Especially when you are opting for AI consulting services to ensure optimal adoption and digital transformations, it becomes crucial to have a roadmap.

This is where MultiQoS helps you with a robust 180-day roadmap derived from the expertise of more than 15 years in delivering digital transformation solutions. Plus, our AI experts offer scalable development solutions that ensure optimal ROI.

With MultiQoS AI development solutions, you get

- Production-Ready AI Agentic Workflows: We deploy autonomous agents that have the ability to perform complex business logic.

- Predictive Analytics & Forecasting: Our models give us the vision to do what the competition can’t, but by offering predictive capabilities.

- Flawless Legacy Interoperability: We will ensure the seamless integration of the current infrastructure with the state-of-the-art LLMs to make sure that the ecosystem is coherent and that the data is intact.

- Transparent Governance and Ethics: We give complete transparency on model performance and decision making, we do not have the risk of black box.

Consult with our experts now and get your 180-day roadmap for improved AI adoption ROI.

FAQs

The majority of initiatives are committed to the Pilot Trap as the leaders perceive AI as a definite IT installation instead of a probabilistic experiment. They do not balance the technical precision and financial effect; they tend to hang in the feasibility tests without necessarily creating a bridge to the operational reality.

In contrast to the linear payback in conventional software, AI is J-curved, meaning that the value decreases at the beginning because of infrastructure expenses. The returns are not instant, as they only start compounding exponentially once the model has crossed the so-called Learning Gap and has become independent of human control.

In-house development is usually accompanied by hidden costs, such as delays in recruitment and waste in carrying out the repair process. AI consulting services offer instant liquidity in terms of talent and transform high fixed costs into variable ones, and they avoid the onboarding friction that slows time-to-value.

You have probably fallen into the trap of Accuracy, paying attention to vanity metrics instead of business performance. An extremely precise model that is applied to a non-critical problem will give a zero ROI, whereas a more inaccurate model that prevents costly errors in its operations can result in high cost avoidance.

Get In Touch