Transforming Fintech Industry Through Artificial Intelligence

Today Artificial intelligence is revolutionizing the fintech sector by providing them with automated processes. AI development services provider have started using advanced algorithms such as machine learning to streamline tasks, increase efficiency and reduce manual efforts.

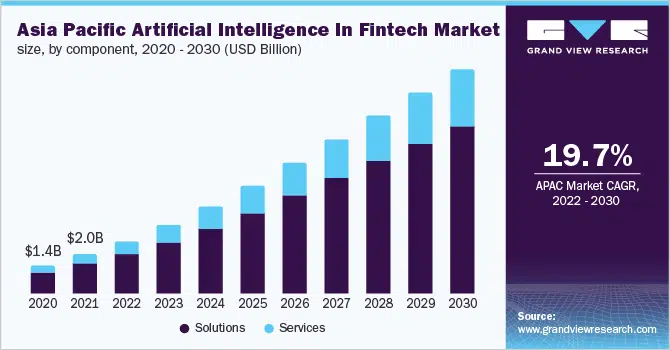

Among them one such benefit includes AI automation in financial transactions which generates massive amounts of data with helping them enhance the tasks with providing accurate results. According to the study by ‘Grand view research’ the global AI in fintech market size was valued USD 9.45 billion in 2021 and is expected to grow at 16.5% of CDGR till 2030.

The role of AI in Fintech industry

Artificial intelligence is transforming the fintech sector significantly by altering the landscape. Few of the reasons how AI helps to revolutionized the fintech is explain below,

To boost efficiency and automate the tasks

There are a lot of repetitive tasks including data entry and other customer service requests which can be easily handled by AI-powered systems along with freeing up human tasks and helping them resolve complex tasks with ease. Later, this automation in fintech will lead to fewer errors and faster processes.

To offer personalized customer experience

There was a study by McKinsey which says, customers will always demand a personalized and seamless experience. This is where AI-powered virtual assistants and chatbots will provide more customized advice to them. With AI in fintech, get customer support 24/7 and solve basic issues quickly. The companies have started using AI to analyze customer data and provide personalized financial recommendations.

To provide smart fraud detection with strengthening cybersecurity

AI algorithms can detect large amounts of data to identify any suspicious activities happening in real-time. It can significantly reduce the risk of fraudulent transactions which ultimately helps to keep your money safe. Additionally, businesses will start saving more than $10.4 billion by 2027 by using fraud detection techniques and providing system prevention.

To enhance investment management

Use the AI powered tool to analyze the market trends, automate the tasks, and predict the future performance. This can allow users to make excellent data-driven decisions with potentially improving their returns.

To analyze risk management

AI is mainly used in risk management to access and analyze a wide range of data and mitigate financial risks. It comes with using machine learning models to evaluate credit risks, predict market trends, and determine the default likelihood of loan. This ultimately helps various financial institutions to make informed decisions with reducing the potential risk.

To increase safety of Fintech industry

Today, artificial intelligence is used by most financial industries to improve security and drive better solutions. Let’s say, a bank offers apps that can only be accessed using fingerprint or face recognition. These solutions AI offer are based on the customer’s behavior and data collected. For instance, if a customer withdraws 5000 Rs from his account multiple times from an unknown location , AI can detect and block the transaction as they found the pattern to be fraudulent activity.

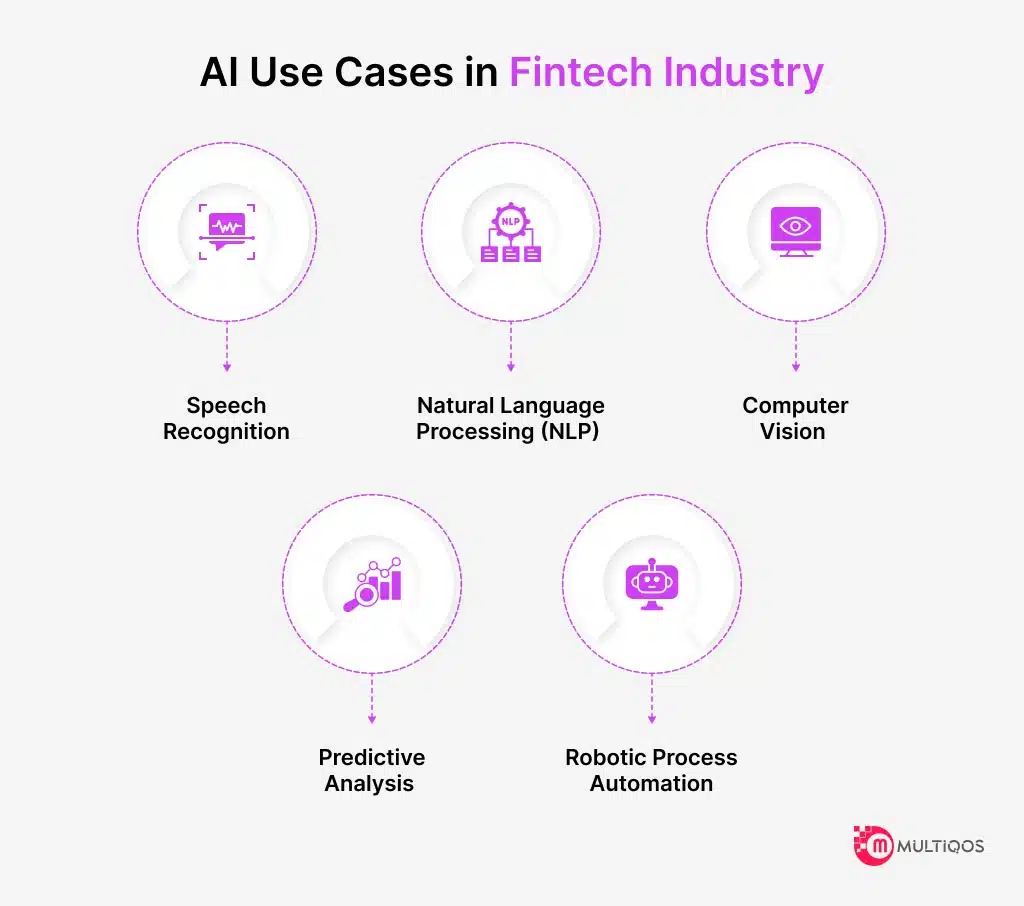

AI use cases in Fintech industry

AI technology comes with excellent solutions as it helps to enhance operational efficiency with offering more personalized and secure financial experience for various customers. Few of the opportunities that AI technologies brings in fintech are listed here.

Speech recognition

Most fintech companies use speech recognition to power voice-activated virtual assistants to provide users the instant access to account data, know transaction history, and later execute financial transactions through using NLP commands. This technology not only limits customer service but also helps in security issues like biometrics, enabling secure, and convenient user authentication.

Natural language processing (NLP)

NLP is the core of AI technology that increasingly uses fintech to analyze vast amounts of data to make informed investment decisions. Moreover, it uses AI-powered tools to track news and social media around financial assets along with helping traders and investors to market trends and news events. Not only this, but NLP-driven chatbots can understand and enhance customer inquiries with adding more personalized experience.

Computer vision

Lot of fintech companies use computer vision to verify information like passports, IDs, and financial statements. It’s a technology that helps to streamline customer onboarding, with reducing the risk of identifying fraud, along with ensuring regulatory requirements. By using the algorithm of computer vision, organizations can extract and analyze text with improving efficiency in the financial sector.

Predictive analysis

The AI-powered system uses language models to analyze financial data and forecast future investment patterns, empowering investors to make well-informed decisions with maximum ROIs. An LLM offers specialized training that serves a particular sector. Additionally, various technologies including data statistical algorithms, and machine learning techniques use predictive analytics to determine the future outcome of your industry and predict based on the customer behavior, opportunities, and investment.

Robotic process automation

Using RPA technology automates the routine tasks as it helps the financial industry to automate the back office functions including data entry along with freeing up employee time to focus more on complex tasks. Automation helps in customer onboarding, verify the documentation, process leads, and support in cost savings for financial business.

Understanding AI challenges and ethics

While we acknowledge that AI provides excellent Fintech solutions, it also brings reliability and room for improvement. However, there are experts who express concerns about the actual issues and challenges associated with AI-powered tools. These problems may continue to evolve and could restrict the scope of AI applications in the Fintech sector. Discover more about these challenges here.

- Regulatory challenges – New technologies prompt the government to enact laws governing the use of sensitive data and ensuring transparency.

- Machine logic and fairness – AI decisions may exhibit biases due to flaws in algorithms or learning strategies, raising concerns about fairness.

- Data privacy concerns – AI’s collection and storage of vast amounts of data pose risks of theft by hackers, necessitating robust security measures.

- Impact on human employment – With AI’s ability to perform tasks faster than humans, there is a potential for job displacement, leading to concerns about reduced human employment.

Future of AI in Fintech

The future of AI in FinTech is very bright as it brings exciting changes with time. We will be seeing better customer service with chatbots and virtual assistants that personalize experiences. It helps detect fraud faster, improve trading strategies and make getting loans easier by offering more accurate risk assessments.

With robo-advisors, financial planning will become more accessible to everyone. And importantly, AI will make sure that financial institutions follow the rules and keep our data safe. Overall, AI is all set to make the FinTech industry more efficient, innovative, and user-friendly.

Conclusion

As AI revolutionizes industries globally, it offers improved automation, advanced data analysis, and better customer service. Choose MultiQoS for tailored digital solutions and to meet your custom requirements. Explore our software development expertise and client portfolio to unite your business with AI.

FAQ on AI in Fintech

As we know, AI comes with great innovation and efficiency in the fintech industry, it certainly has few challenges. There are issues regarding data security and privacy, machine logic as AI decisions can be biased due to flaws in algorithms, and other regulatory challenges with less human involvement.

AI helps to save money for businesses and users along with making the financial goals more accessible. Additionally, it provides reliable investment that gives accurate information regarding credit scoring and helps in analyzing spending.

The benefits of using AI in fintech comes with superior handling of data and creating model capabilities of people. But also, the technology comes with several drawbacks including in-depth knowledge and financial regulation.

As one of the leading software development companies, there is no specific timeline for AI fintech projects as the requirements, size, and features of the platform differ. As our development team understands your demand, we provide an estimated scope, time and AI development cost.

Get In Touch