How to Develop a Neobank App from Scratch – Features & Cost

Table of Contents

- Overview

- What is Neobank?

- Differences between Neobanks and Online Banks

- Benefits of Neobanking

- Investing in a Neobank for Business

- Step-by-Step Guide to Develop a Neobank in 2024

- Neobank App Development Features

- Cost of Creating a Neobank App in 2024

- MultiQoS Expertise in Banking App Development

- Final Thoughts

- FAQ

Overview

The epidemic has significantly changed how people seek answers, from food delivery to online doctor consultations. Banks are also no different. We have been accustomed to using traditional bank websites and apps for mobile banking. Younger people may now fix practically any problem without going to work. So why not capitalize on the digitization trend and establish your neobank?

Introducing a Neo banking app is advantageous from a commercial perspective, but there is still the issue of creating a NeoBank in 2024. This blog will teach us to develop a NeoBank and start afresh in digitized banking.

What is Neobank?

Unlike traditional banks, NeoBanks operate digitally, making them digital banks. Neobanks are often regulated financial companies that use independently of offline banks and engage in financial transactions.

Neobanks are intermediary companies that work with offline financial institutions to offer their services remotely. However, this only happens in a small number of instances. Fintech firms manage these neobanks and do not have any branches. They provide services through mobile applications that anybody can easily download and utilize.

What Sets Neobanks Differ from Online Banks?

Conventional digital banking is constantly connected to the bank. Customers must go to the offline bank to sign documents and complete tasks. On the other hand, creating your own neobank fintech mobile app entails creating a digital user interface to offer a fully virtualized set of standard services.

A NeoBank is also constantly focused on offering a wide range of financial services, including automatic reporting of revenue and expenses. The app is more valuable than the majority of financial businesses that we typically work with. It is primarily because a neobank collaborates with a regular bank to provide banking services to the neobank’s clients or because it is subject to the same regulatory framework as a traditional bank.

The primary concept of a successful neobank is to conduct market research on customers’ demands and offer soother functions through technically inventive ways. Thus, the neobank API’s focus on meeting client demands is essential.

What Are the Benefits of Neobanking?

Neobank app development has several advantages that extend beyond those for clients and companies, which include:

- Reduced Operational Cost: Neobanking is more advantageous than traditional banking because of its low operating costs. Savings accounts attract more attention from users.

- Convenience: The Neobanks operate similarly to traditional banks while not having physical locations. Instead, they are present online or virtually. Customers may utilize banking anytime because it is accessible via a mobile app.

- Agility: In comparison to traditional banks, neobanks can adapt to new technology more quickly. It has an added advantage due to its agility.

- Streamlined Experience: Users have a smooth banking experience, and the services remain simplified. Also, user onboarding is quick.

- Limitless: Since Neobanks are unlimited, they are not subject to the same restrictions as local banks.

Why Should You Invest in a Neobank for Business?

Neobanks are responsible for the growing acceptance of banking services, as seen by the rise in online bank account openings and customers’ increased interest in digital technology. Thus, you must certainly invest in finance app development services from scratch if you have determined that certain people have specific banking needs. Even without a physical office, you can locate your clients.

Furthermore, since people are now more likely to utilize banks that only accept payments online, it opens up avenues for digitized banking services. For instance, 13.7% of Americans now have these types of bank accounts, and by 2025, that percentage is expected to rise to 20%.

Time to get a fully functional app!

Step-by-Step Guide to Develop a Neobank from Scratch in 2024

You may turn your neobank concept into a mobile application by taking a few crucial steps. So, the steps to build an app for mobile banking from scratch are listed below.

Step 1: Determine Your Audience

Do you know who your target demographic is? Identifying your target audience is the first step if you still need to. As neobank is distinct from conventional banks, so are its users and clients. Thus, knowing your target audience inside and out might be beneficial.

Step 2: Determine the Consumers’ Current Requirements

The next stage after determining the target market is to determine the demands of current users and what features they require to enhance their neobanking experience. The goal must be to fix the Nedbank app’s current problems and win over the trust of the user base. You can hire dedicated developers with experience in creating banking & financial applications, and understanding neo-banking is the best option.

Step 3: Create a Neobank Fintech Mobile Application

Before creating the app, ask yourself: What features does my Neobank app need? Pay special attention to the UI/UX, backend, and front end of the FinTech Chase mobile app. Further, you can also include features like instant registration, user verification, profile construction, investment, transaction history, money deposit, and more.

Step 4: Core and Backend Infrastructure

A robust backend capable of handling all the operations is needed to create the Neobank app. It consists of three primary parts: a Card Processing app for debit or credit card transactions, an API for integrating payment gateways with the Neo banking app, and back-office tools for handling back-office duties. You may get help from the top financial app development firm in putting it into practice.

Step 5: Compliance & Security

The first issue for any provider of banking services, whether Neobank or traditional, is keeping client data safe and secure. So, you must create a solid architecture with mobile app development services that can protect the Neobank app and its operations.

Step 6: Testing the App

Once the security infrastructure has been implemented, test your application to identify security and execution flaws. A real-world test of the program will make sure there are no problems later on.

Step 7: User Onboarding and Promotion

The last stage is to market the app so that people know it. You can attract more users to your neobanking app with the proper advertising. Make sure user onboarding is seamless.

Also Read: Top Fintech App Ideas For Startup in 2024

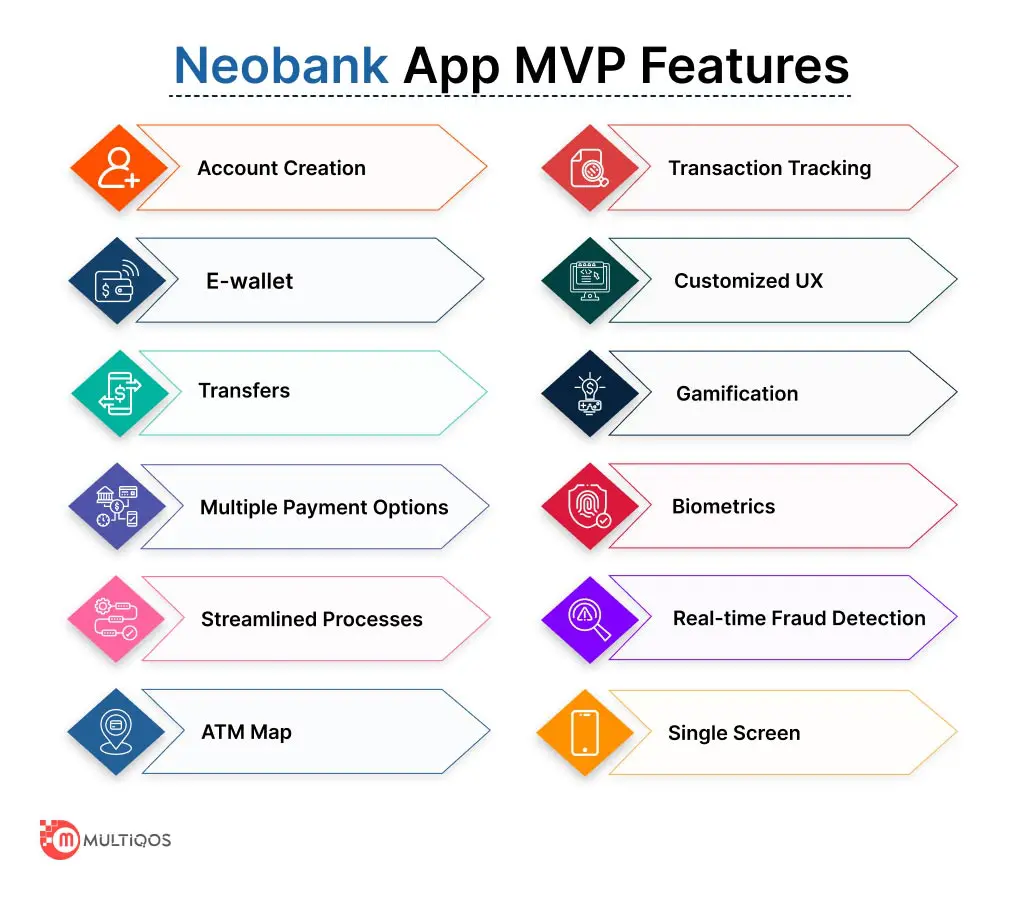

What Features should you include in Neobank App Development?

Your Neobanking app’s features will be its heart, so pick wisely. Together with basic features, you can add certain fundamental features while fintech app development including:

- Account Opening: Establishing accounts is one of Neobank’s essential functions. Users must enter their first and last names, Social Security numbers (SSN), email addresses, and passwords when creating an account.

- E-wallet: E-wallets make it easier for consumers to pay instantly. That is an awesome feature from a safety standpoint to leverage business.

- Single Screen Transfers: Every banking app’s ability to allow user money transfers is critical to its success. Hence, implementing a single-screen transfer facility would be fantastic. It guarantees a better user experience.

- Multi-Payment Option: The most straightforward approach to incorporate numerous payment alternatives is third-party API integration. You can include P2P, A2A, ACH, and other channels.

- Simplified Procedures: This process is more frictionless than conventional banking applications. The finest examples include free account opening and synchronizing ATMs with international networks.

- Map of ATMs: The Neobanking app getting this functionality will be unique. Users get access to a map of all the ATMs nearby, making it easy to find one anytime they need one.

- Tracking Transactions: Users must be able to view all transactions, including the history, in a single window. It must include the name, bank account, transaction account, currency, and other beneficiary details.

- Personalized UX: The user experience is more important than anything else. Thus, it is OK if you implement the app. Users engage with your app while using it. Therefore, it needs to be a great experience.

- Gamification: The approach of gamification intriguingly uses procedures. Gamification in this context indicates that users may customize their accounts, increasing client loyalty and engagement.

- Biometrics: Biometrics verification and validation features are included in most modern apps, reducing cyber dangers.

- Detection of Fraud in Real Time: The fraud detection system is crucial for all sorts of banking apps. Neobank app development may be novel, but it is still essential. That will make it easier to recognize legitimate users and spot any fraudulent activities.

How Much Does It Cost to Create a Neobank Application in 2024?

The features, UX/UI, backend & frontend development, testing, and integration of third-party payment gateways affect how much it will cost to build a Neobank mobile app. The price for developing a basic Neobank app can run you between $20,000 and $30,000, but if you require advanced neobanking software for your business, expect to pay between $50,000 and $70,000. In other words, the price increases with increasing app complexity and functionality.

MultiQoS Expertise in Banking App Development

While mobile banking app development may sound easy, it can be pretty challenging. You can hire MultiQoS to assist if you choose to move to Neobank or create a mobile banking app to create a successful marketing plan for a product.

We will evaluate the corporate values and the target market with our cutting-edge bank apps that will change the industry with our solid technical assistance. Get in touch with us right now to start developing future-proof solutions for your company’s expansion!

The Final Thoughts

As a result of the need to adapt to changing consumer behavior, traditional banks today compete not just with one another but also with fintech firms. Neobank APIs can swiftly grow their market share since a sizable personnel base and high capital expenses do not constrain them.

So, the sooner you, as a company owner, become aware of the changes happening and begin creating your neobank by hiring a fintech app development company in India, the better your chances of surviving in this competitive market.

Want an innovative Fintech solution for your start-up?

Resolve sector challenges with our expert fintech team and software services.

FAQ about Fintech App like Neobank

Including the research process, business app development, iteration modifications, testing, and market launch, creating your own neobank application can take two to three months.

New users are drawn in via onboarding techniques like “Get to Know Your Prospective Users” and approachable strategies, including referral schemes, engagement programs, and social media advertisements.

The most common monetization strategy utilized by neobanks is exchanged. You can also offer subscription models as a neobank owner, including premium features, AI assistants, market services, and paid memberships.

Get In Touch