What Is Insurtech and How Will It Transform the Insurance Industry?

What is Insurtech?

With the evolution of some advanced technologies like Artificial Intelligence, Cloud Computing, Big Data, and blockchain technology, there has been a huge positive impact made on the insurance industry. Not only has the digitization process resulted in process automation, but it has also improved the customer experience fintech application development services.

Coming Insurtech, Insuretech are the next generation companies that facilitate the optimization of operations in the Insurance industry by leveraging the technologies. Also, it helps the insurers to unlock the complete potential of the data analytics that makes the process quite cost-effective and without any human intervention.

Insuretech plays an important role between customers and insurance companies. They offer complete support by allowing companies to leverage some of the advanced technologies for services like fraud detection, decision-making, and much more.

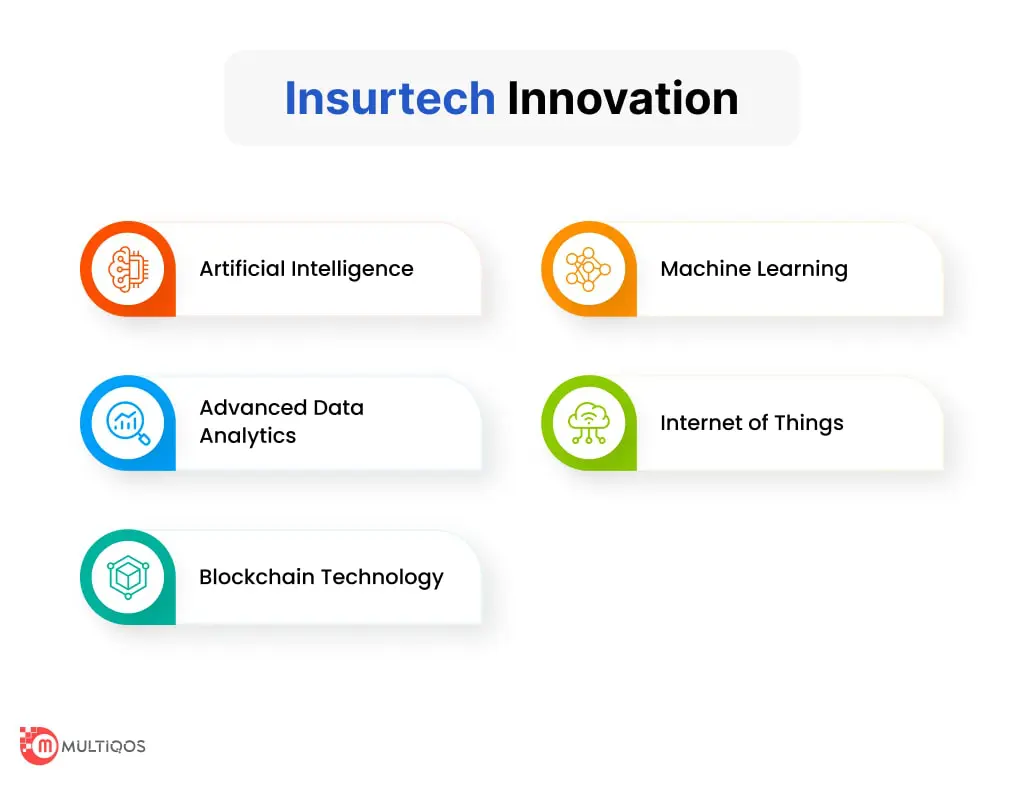

Innovations Driving Through Insurtech Transform

A handful of technologies have played an important role to transform the nature of how insurance companies work today. For example, in the automobile insurance Industry, with the help of AI technology, companies can calculate the risks with much more accuracy, and based on that they can provide the benefits.

Most of these technologies have potentially impacted the insurance core products and functionalities. In the upcoming section, we will discuss some of these technologies and how they have impacted the insurance Industry.

Artificial Intelligence

Artificial Intelligence has played an important role to impact the insurance Industry. In recent years insurance companies have adopted AI to improve their customer experience and operations. Some of the key areas where it impacted are the following.

- Fraud Detection

Accounting to PWC, AI-based fraud detection systems have helped companies to reduce false negative rates by 90 percent and favorable rates by almost 50 percent.

- Customer Service

AI is much more effective when it comes to handling customers. AI-based chatbots can answer common questions or provide standardized information to users.

- Personalization

AI can be widely used for analyzing a large amount of customer data and doing analysis on them to making better decisions based on customer requirements.

Machine Learning

Machine learning has played a significant role in making the insurance industry much more impactful and helped companies to hire application developers and improvise the decision-making and analysis of the customers’ data.

Some of the key areas where it played an important role are the following.

- Pricing

Machine learning can play a major role in analyzing the data based on different factors like policy history, and demographics to provide much more competitive and accurate pricing for insurance products. As per the study by Deloitte ML based pricing has helped customers and businesses save up to 25% of costs.

- Claim Processing

ML can be majorly used for automating several claims processing such as acquiring the relevant information. As per Genpact, Businesses have saved up to 30 percent of the cost while processing the claims for their customers.

- Risk Management

Several Machine learning modules can help businesses to identify traffic patterns, weather patterns, and various other variables to do an accurate risk assessment for the instance companies and implement the proper risk management strategies.

Advanced Data Analytics

In recent years, data analytics has had a significant impact on several insurance industries. A lot of insurance companies are widely adopting advanced data analytics concepts for several reasons.

- Customer Segmentation

Most of the data analytics concepts are useful for customer segmentation based on different factors like insurance needs, demographics, and behavior. This can allow insurance companies to target the correct audience and optimize the sales funnel.

- Strategic Planning

Advanced data analytics can be used for decision-making and strategic planning at any sort of insurance company. Some of the areas where it could be worth applying data analytics are customer behavior, market trends, various other data for innovation and growth, risk management, and optimization of resources.

- Data Privacy and Security

Several algorithms for data analytics can be also used for protecting the customer’s data and sensitive information. With the help of techniques like de-identification, encryption, and data masking this can be easily implemented.

Internet of Things(IoT)

IoT has recently become a trending technology. It helps to collect a lot of data through different devices, and sensors placed in electronic devices. Also, it has impacted the insurance industry in the recent few years. Most insurance companies are now partnering with electronic wearable device companies to help with customer-centric insurance plans. Some of the key areas where it has impacted are the following.

- Supply Chain Management

IoT companies can help insurance companies with the real-time tracking of goods and materials to enhance the efficiency of the complete supply chain and reduce risks. Some of the tasks it can help with are tracking the exact location of shipments and analyzing the performance of any device or machinery.

- Predictive Maintenance

IOT can be useful to provide information or data related to the performance and condition of any equipment, vehicle, or device that can be further analyzed to predict potential breakdowns and failures. This enables insurance companies to offer better plans to customers.

Blockchain Technology

Blockchain technology refers to the decentralized and distributed network that secures data and verifies transactions without any centralized authority. The impact of Blockchain technology on the insurance industry is commendable. Some of the ways blockchain technology has impacted the Insurance industry are the following.

- Enhanced Security

Blockchain technology can offer enhanced security for the sensitive data of the users such as medical information. This can help to reduce the chances of identity theft or data breaches.

- Increases Transparency

Any data or information stored on the blockchain is always accessible by the people who are part of that network. This not only helps to increase the trust among the users but also enhances accountability.

Also Read: FinTech Startup Ideas to Consider in 2024

Why is Insurtech the Future of the Insurance Sector?

Insuretech leverages all the technologies like AI, ML, data analytics, blockchain, and much more to revolutionize the insurance sector in numerous ways. Some of the ways are listed below.

- Improvised Customer Experience

Insurance companies can now offer personalized and customer-centric services and products. As we mentioned before, with the help of AI and data analytics, insurance companies can understand the customer and provide products based on their needs.

- New Business Models

Insuretech has given birth to new business models that insurance companies can adopt. Some examples are peer-to-peer insurance, parametric insurance, and smart contracts. This allows companies to reach new segments of customers.

- Highly Efficient

Insuretech allows companies to enhance their processes by automating them. This can include risk assessment, claim processing, and underwriting for the customers.

Bottom Line

In a nutshell, Insuretech, by leveraging technologies like AI and machine learning can improvise and transform the insurance industry. Insurtech has the great potential to bring significant changes in how we buy insurance or claim them.

It not only helps fintech app development company to improve their processes but also enhances the customer experience with improvised risk management and assessment, efficient buying processes, new business models, and much more. By leveraging technology, insurance companies can bring a new paradigm shift and competitiveness to the market.

Want to Expand Your Insurance Business?

Our insurance app development solutions will help you automate and streamline your insurance business process.

FAQs on Insurtech Trends

Insurtech refers to the utilization of technology such as blockchain, IOT, and data analytics to improve the insurance industry. This helps to enable personalized and customer-centric products and services. Also, it streamlines the administrative processes.

Insurtech has a major impact on insurance companies. It has facilitated the emergence of new players that help the challenged insurance companies by offering them more cost-effective products and innovative services.

Insuretech allows insurance companies to offer the best in class and cost-effective services and products. Moreover, it enhances the customer experience by digitizing the application process for everything. Customers can now maintain their policies online from anywhere.

Insuretech is here to stay for a longer time to drive significant improvement and changes in the insurance industry. A lot of insurance companies are now adopting these technologies to help them understand their customers in a better way, while it also increases the efficiency and competitiveness in the industry.

Some of the challenges of Insurtech are compliance issues, regulations, data privacy, and security issues and helping customers to adapt to the paradigm shift. Also, several Insurtech companies face challenges in terms of collaborations, building partnerships, and talent acquisition.

Get In Touch