A Detailed Guide on E-Wallet App Development: Cost & Features

Table of Contents

- Overview

- What Is eWallet?

- Industries Depending on the Development of Mobile Wallet Apps

- the Vital Features of eWallet Mobile App

- Mobile eWallet Application Types

- Tech Stack Requirement for eWallet App Development

- How Much Does It Cost to Make an eWallet App for iOS and Android

- eWallet Website Development Cost

- MultiQoS Expertise in App Development

- Conclusion

- FAQ

Overview

Everything in this fast-paced world is fuelled by technology, from hiring a taxi to getting food and groceries delivered. The emergence of e-wallets has made the journey easier and more convenient in this process. The development of mobile e-wallet applications has brought widespread use amongst the masses since it has made the payment method easier and more efficient, where payments are swifter and secured. These applications have changed the economic and financial sectors with the paradigm shift into a new revolutionary digital world where we are no more required to carry cash.

Online wallet applications such as Amazon Pay or Google Pay are examples of some popular e-wallet applications that provide users with the preferred mode of online payments. People these days prefer to go cashless and make payments online, which has been one of the primary causes for the surge in demand for eWallet mobile app development among small and large businesses.

Let us further discuss the process of development of eWallet applications as well as the must-have features to add to your eWallet apps. Furthermore, we will discuss the factors affecting the cost of mobile applications and the cost of development of the application.

What Is eWallet?

The term “e-Wallet” refers to a digital or mobile wallet that is used to hold the money via online mode. These wallets function in a similar manner to that of online banking; however, users are required to store money in their wallets prior to using them. Alternatively, the users can link their bank accounts to the e-wallets and start with their transactions. The users can make the payment by searching for the payee’s name or by scanning the QR code. The initiative of e-wallet has brought in a significant change by reducing the time limit for the transactions, allowing people to be more productive when using them, thereby saving their time. Our financial information is stored in digital form, thus any payment gateways used to process our transactions should utilise encryption to ensure the security of our data.

As per Statista data, the overall transaction value in the digital wallet segment is predicted to reach US$6,685,102 million in 2021, with a 12-percent annual growth rate (CAGR 2021-2025) culminating in a total sum of US$10,520,219 million by 2025. In addition, by 2025, the number of users is predicted to reach 1,890.3 million.

These days, digital wallet app creation is in high demand since around 48.53 percent of the global population possesses a smartphone. People between the ages of 15 and 45 make the most significant contribution to the application’s use. The bank account details and information are stored in cryptic form, and thus, they are safe and secured. Moreover, the users have the additional advantage of creating their biometrics or passwords to provide additional security. Compared to making payments with cards, e-wallets are more efficient and convenient for use and enable quick and secured money transfers.

Industries Depending on the Development of Mobile Wallet Apps

Some of the important industries that depend on the development of mobile wallet applications are:

- eCommerce Industry: Smartphones are an indispensable component of everyone’s life, and with only a few clicks, people can get anything delivered easily to their doorstep. The eCommerce business has recently grown in popularity and has aided in bringing merchants and buyers closer together, where the online marketplace has made business easier. The emergence of e-wallet software has helped increase the performance and efficiency of start-ups and small businesses. With the rise of eWallet applications, payments have become safe, secure, and easier.

- Online Bill Payments: The Mobile e-wallet feature is one of the most accepted and widely popular features amongst users. Businesses, companies, and people largely accept online bill payments, and this feature also makes it easier for the customers to remember the schedule and make payments at a regular interval.

- On-demand Food and Grocery Delivery: The on-demand food and grocery delivery sector is booming and widely popular in the modern-day world. People find it extremely easy and convenient to get their foods and groceries delivered to their homes, and what makes it more convenient is the easy e-wallet method of payments. Incorporating e-wallet functionality into your on-demand grocery and food delivery applications will make it much simpler for clients to make the payments and increase earnings.

- Taxi Booking Applications: Sometimes, you might run out of cash for a taxi, but there is nothing to be bothered about since almost every taxi booking service software includes an eWallet option that will allow you to relax and enjoy your cab ride. This enables you to go cashless, make payments and reach your destination without any hustle.

- Ticket Booking Applications: You can also incorporate a ticket booking application with the e-wallet app when using Google Pay or PayTM. This enables you to make tickets easily and travel simply.

The Vital Features of eWallet Mobile App

Creating two different panels ensures that both the users and the admin can easily navigate the app and utilize all of its features. Here are some of the features you should request from your eWallet app developers for these panels:

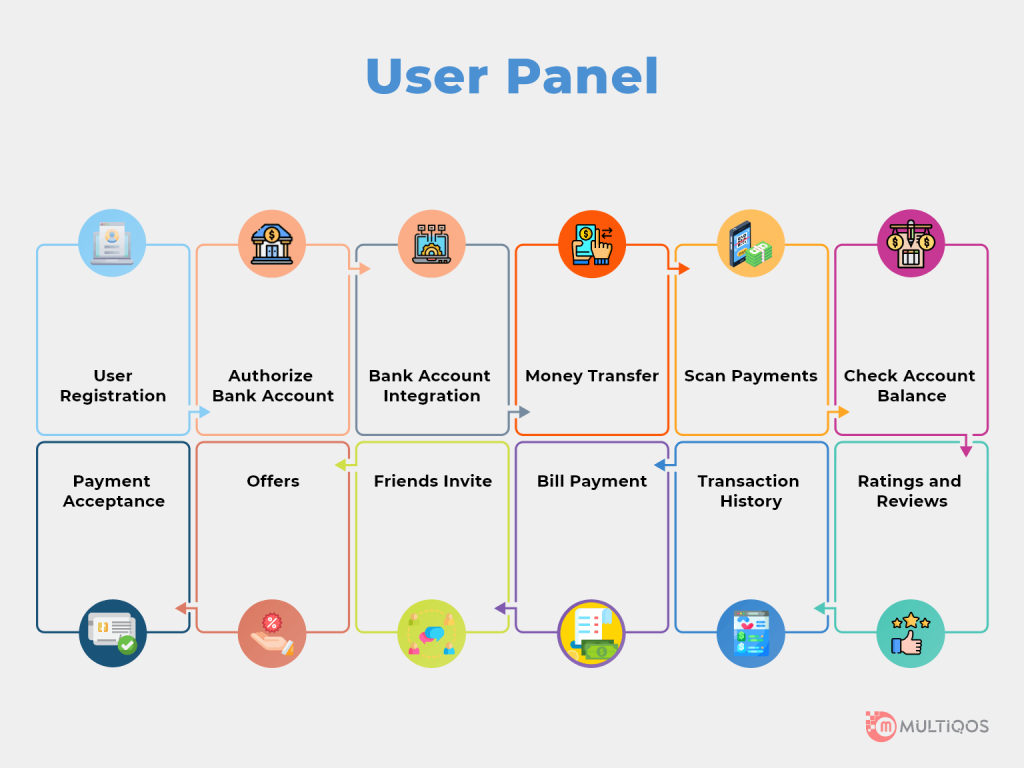

User Panel

These are some of the necessary elements to include in the user panel so that app users may easily access all of the services available.

- User Registration: User registration is an important part of an app; the user can sign in using credentials from a social network or an email account.

- Authorize Bank Account: A user’s choice of bank account is available for transactions. They can set up a specific bank account and use it to make payments at any time.

- Bank Account Integration: In a Digital Wallet App, the customer will want to sync their approved ledger with their digital wallet account using a credit/debit card or internet banking.

- Money Transfer: The client will wish to shift the money around in various ways. This action will take some specific information about a collector and do an exchange sum. The money could be transferred to the ledger or another wallet. Users can send cash to other users by providing their account information, making transactions more efficient and convenient.

- Scan Payments: A QR code will be assigned to every registered client. That QR code contains some useful information. After scanning this QR code, the client will actually desire to pay the associated clients.

- Check Account Balance: Users can monitor their account balance and verify all incoming and outgoing cash flows once all operations have been completed.

- Payment Acceptance: Users can take payments safely by sharing their corresponding account credentials.

- Offers: Users may see the offers when making transactions in this section and redeem the points.

- Friends Invite: This feature enables the users to invite their friends to send and receive money through the platform. This makes it much easier for them to transfer funds as needed without asking for account information every day.

- Bill Payment: This application will simplify the user to pay various bills. The program will truly wish to bring the bill details linked with a set.

- Transaction History: All transactions made by the users are generally logged and tracked. This sophisticated feature shall enable the user to search for the transactions required.

- Ratings and Reviews: Ratings and reviews are a fantastic option to include. This will assure user pleasure while also alerting you to areas that may improve.

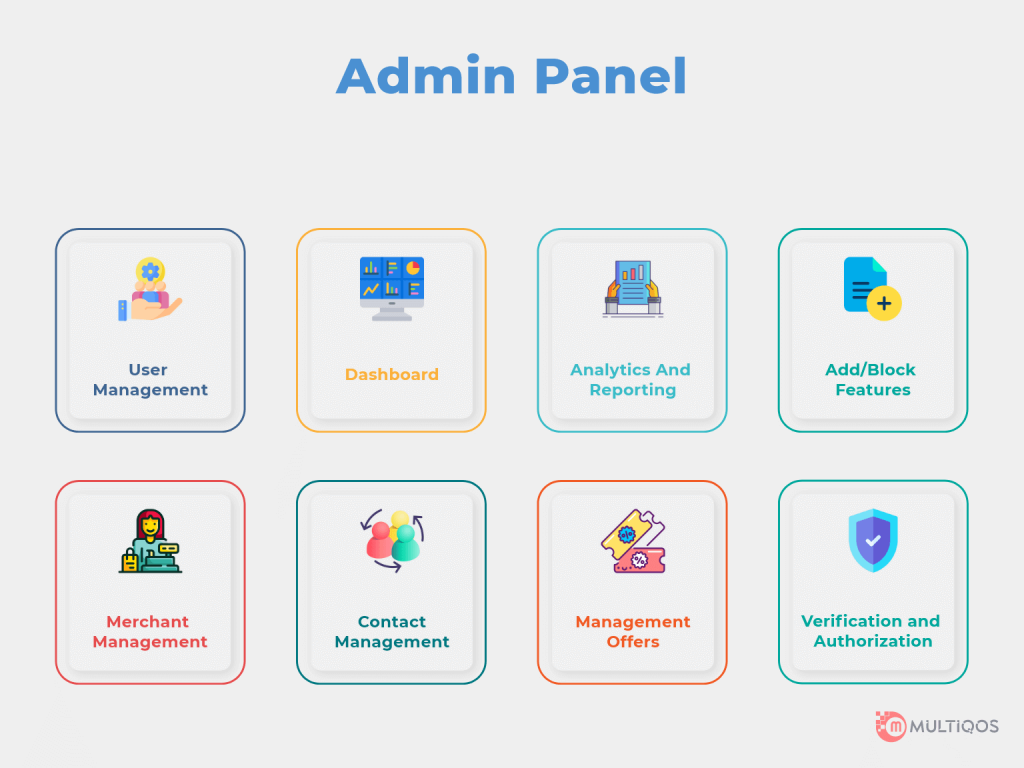

Admin Panel

Like the user panel, the admin panel contains some vital elements that assist the admin handle all of the app’s functionalities.

- User Management: Supervisors would want to engage with all of the customers who have signed up for the application and the exchanges and have the choice to follow the activities on the application. Similarly, the administrator will wish to block and add a specific client.

- Dashboard: The dashboard will provide the administrator with a quick figure and characteristics about the application’s overall progress in the form of tables, figures, and outlines.

- Analytics and Reporting: All statistics correlated with the number of customers, the most popular offers, the number of transactions, app usage, bounce rates, and other relevant information are generated. Admin may next verify all of the reports and propose options for increasing the exposure of the eWallet Mobile App.

- Add/Block Features: The administrator can prohibit users based on their conduct and the number of failed or illegitimate payments transactions. Similarly, he can introduce additional user requests based on the amount of people who have already signed up for the app.

- Merchant Management: Using this function, the admin may create, remove, and change merchant profiles.

- Contact Management: The admin is in charge of all app users, especially those who make frequent purchases and all user retention and acquisition strategies.

- Management Offers: Administrators can create deals and coupons, and they will also want to monitor and supervise them. Referrals, prizes, and frequent transactions are all managed and tracked in this way. The administrator is in charge of all new offers. Referrals, prizes, and frequent transactions are all managed and tracked in this way.

- Verification and Authorization: It is your job as the operator of your eWallet software to safeguard the security of your users. To guarantee that everything is running smoothly, verification and authentication must be performed at each step.

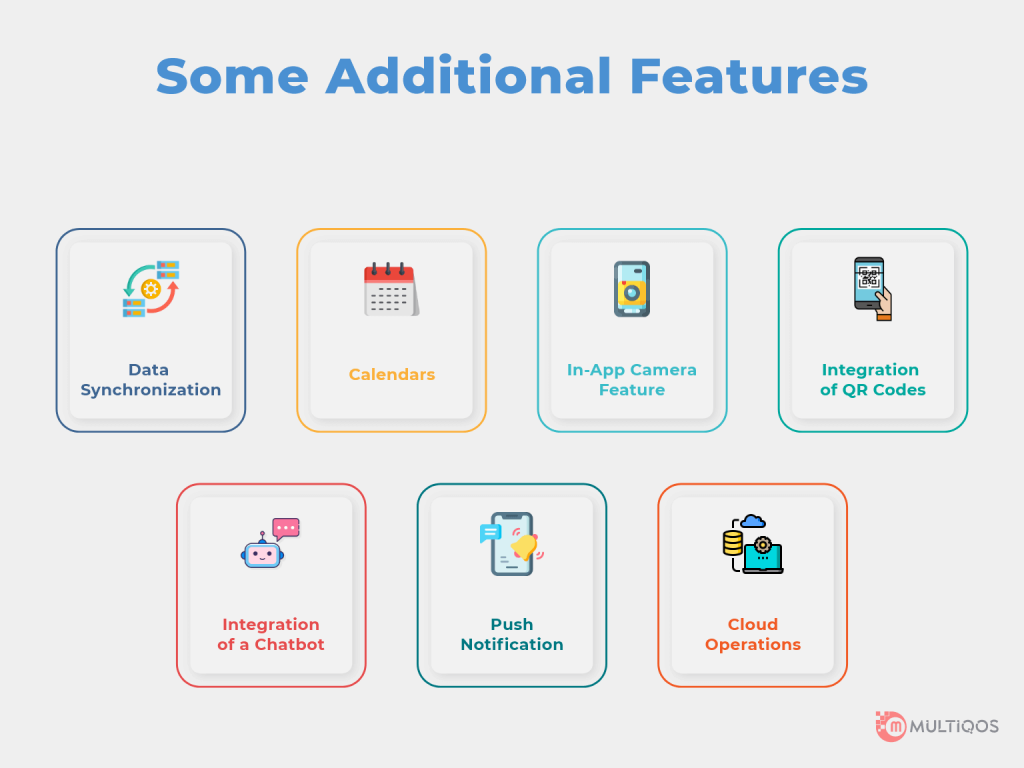

General Features

Besides these basic functions, you should ask your app developers to add additional features to your digital wallet.

- Data Synchronization: Data Synchronization feature allows the app to synchronize the client’s information with their registered social media accounts and mobile phone number. As a result, we can communicate precision and a high level of security.

- Calendars: The schedule aids clients in remembering the next exchange or bill payment date in order to reduce human intellectual endeavors. The client can essentially highlight the dates on the calendar. The schedule allows you to select the update-ready option to receive an update warning for the installation or exchange if everything else is equal.

- In-app Camera Feature: When it comes to analyzing the QR code, an in-app camera is a fantastic feature. It’s also useful for collecting screenshots in case you require proof of payment.

- Integration of QR Codes: The inclusion of a QR code allows the client to make payments in order to be successful profoundly and quickly. Compared to simple dark/white codes created with specialized libraries, creating changed QR codes has become a lot easier.

- Integration of a Chatbot: Integrating chatbots is necessary these days because your users may require assistance at any time. Chatbots come in handy when there isn’t a live person present or if a user needs support outside of normal office hours.

- Push Notification: The use of message pop-ups will keep clients constantly aware. The app informs users about various events such as awards, payment confirmation, and other important warnings so that any important notification does not go unnoticed.

- Cloud Operations: All transactions can be stored securely and dependably using cloud operations. The cloud operation enhances the quality standards of your software and allows users to complete transactions much more quickly. It allows for more powerful data access and attracts the user’s attention.

Mobile eWallet Application Types

Choosing e-wallet mobile application features is mostly dictated by the type of mobile e-wallet application you plan to develop. Each has its own set of drawbacks and benefits. If you’re unsure about the different types of eWallet application types, you can read further to understand the various types better:

- Closed Wallets: Some applications, however, have built-in payment functionality, and transactions completed through these applications are not generic. You’ve probably come across Walmart Pay and noticed that you could only use the digital wallet to make purchases if you buy things through the application. Despite the fact that the business has been in operation for a long time, the eWallet payment option was only added afterward. This enables payment for a specific application and not for the others. These businesses have been around for a long time, and they frequently exchange loyalty points, rewards, and special discounts in the application wallet. For example, you may have a Zomato, Amazon, Myntra wallet in which you save the majority of your refunds and reward points, which can be used later.

- Semi-Closed eWallets: Semi-Closed eWallets provide more leverage in comparison to closed eWallets. The cost of development of Semi-Closed eWallets is quite similar to that of the developmental costs of PayTM or Google Pay. Such applications are frequently used to pay for things in businesses. It’s conceivable that their functionality is restricted and that they can’t be utilized at all stages, leading to the term “half-closed” or “semi-closed” e-wallets.

- Open eWallets: Open e-wallets are by far the most prevalent e software because they are straightforward and convenient for use by users. Open eWallets are functional with all types of network connections and may be installed on any system. Furthermore, these have a wide range of payment options and can handle various transactions.

Tech Stack Requirement for eWallet App Development

The e-wallet app developers work on projects that aim to provide you with excellent outcomes while maintaining your desired feature set. The cost of developing a payment app is greatly dependent on the technological stack employed.

- GWT: For Robust Programming

- Nexmo: For, Voice, Phone, and SMS Verification

- PayPal & Braintree: For acquiring payments

- Twilio: To obtain Push Notifications

- ZBar bar code reader: For scanning the QR code

- Mandrill: For anything related to emails

- Datastax: For Data Management

- Cloud Environment: Amazon AWS

- Debian: The universal Operating System Database

- Real-time Analytics: Spark, BigData, Hadoop, Cisco, IBM, Apache Flink

- MongoDB, Cassandra, Hbase, MailChimp, Postgres Integration

How Much Does It Cost to Make an eWallet App for iOS and Android

The Cost of Developing eWallet Mobile App is not fixed because it relies on several elements, each of which has a different cost. How to make e wallet is influenced by a number of factors, including the following:

- Platform for Development: The platform on which the mobile application shall be developed also plays a vital role in deciding the cost factor. If the software is designed for the iOS operating system. In that case, it will be developed either in Swift or Objective C. Similarly, for the Android platform, it will be developed on either kotlin or Java. Furthermore, if in the case where the application has to be produced for both platforms, cross-platform development is the way to go, as it is less expensive than native apps.

- App Design: The emphasis here is on User Interface/UX aspects, which suggest that the application design needs to be simple for easy navigation. However, it must be interactive to keep the users engaged. You can hire UX/UX designer to inspect the graphics and navigations and design the app accordingly.

- App Size: One of the most crucial variables in determining the cost of an e-wallet app is the size of the application. If the application’s size is reduced, the number of pages is reduced, and the set of features will also be significantly reduced as well, resulting in a lower overall cost. On the other hand, if one wants more features in their apps, they’ll need to have more space to display them, indicating the need for more pages, which will ultimately cost more.

- App Development Team: The e-wallet android app development cost also includes the size of the mobile application development team that you will hire for your payment apps development. The developmental team shall include expert designers, business analysts, project managers, team leads, app tests, developers, and others. Every such person should be a skilled professional to provide the best app development.

- Geographical Location: This also forms one of the major determinants of the ultimate App development cost. The cost of services varies by location, which impacts the cost of establishing an e-wallet. India is one of the affordable places for app development, considering that the rates are lower compared to other countries.

The total number of people required and the time limit for app development are the most important factors determining the e wallet app development cost. As a result of the aforementioned considerations, the cost of building an e-wallet varies. The cost to android and iOS hire dedicated developer will vary with the company you decide to hire and the geographical location. Companies in the United States charge around $190 per hour, whereas companies in North America charge around $150 per hour, and companies in Europe charge around $130 per hour.

The estimated cost of establishing a basic e-Wallet on the Android platform will be between $20,000 and $45,000, with any additional advanced features in the app costing between $80,000 and $150,000.

The cost of developing an e-wallet app for the iOS platform ranges from $25,000 to $55,000. However, developing a sophisticated app like Paypal or Alipay might cost anywhere from $100,000 to $150,000.

How Much Does It Cost to Make an eWallet Website Development

In comparison to a full-fledged mobile wallet program, an e-wallet web application or website has fewer capabilities. Because a website’s capabilities aren’t as extensive as a mobile app, developing an eWallet web takes less time and involves fewer people. In comparison to the smartphone app, the pricing is likewise relatively low. As a result, the total cost of developing an e-wallet website will be between $25,000 and $50,000.

MultiQoS Expertise in App Development

MultiQoS is one the leading Mobile App Development Company in India, with a team of competent and talented developers and designers who can handle any type of web development. We have a team of talented specialists at MultiQoS who can offer a highly sought-after e-wallets app in a matter of months. One of the leading Mobile App Development Services Company in India, MultiQoS specialises in the development of high-performing native Android and iOS mobile applications that are digitally transformative and feature-rich. Companies and organizations that choose us for their bespoke mobile application development needs can rest certain that their final deliverable will be secure, scalable, and sustainable in any environment it is hosted, regardless of the technology used.

Conclusion

The method of making payments have become more convenient with digitalization. Earlier, people used to make payments via the traditional methods of paying cash, and there has been a substantial shift in the method of payment where payments have largely become online. The concept of the e-wallet has revolutionized the payment industry and has made it more secure, safe, and efficient with online payments. However, it is quintessential to understand that since the development process of an e-Wallet necessitates competence, it is critical to choose the best and most expert Mobile App Developer. They can visualize the concept and ideation and create precisely how the owner desires using their vast abilities and resources. E-wallet is expected to boom in the coming years since it forms a vital part of the life of people. Developing an eWallet app is a difficult undertaking because not all application development businesses are capable of doing so. It requires a while, a lot of talents, a lot of resources, and a lot of knowledge to develop a good digital wallet app. Thus, the mobile application development services in India that you hire must pay special attention to the required features in the application. And hiring experienced eWallet application developers to create it is the only way to get it right the first time.

Let’s Create Big Stories Together

Mobile is in our nerves. We don’t just build apps, we create brand. Choosing us will be your best decision.

FAQs About eWallet Mobile App Development

An eWallet is essentially a digitized alternative for securely storing banking information such as debit/credit cards and banking information. It also allows users to store online cash similar assets such as cash coupons, reward points, loyalty cards, virtual currencies (such as bitcoin, bitcoin), and more. This, in turn, can be used to make payments as and when required.

You should work with an expert IT consulting agency like A3logics to know how to create eWallet app. To find the ideal web developer, look at the company’s portfolio track record history to understand the success ratio, industry knowledge, technological stack, client testimonials, and so on.

The cost of establishing an eWallet mobile app is determined by various criteria, including the developer’s location, size of the app, app design, team size and expertise, and feature integration. The cost of an eWallet app is estimated to be between $70k and $80k.

Alipay, Samsung Pay, Apple Pay, Paytm, Google Pay, and others are among the leading global eWallet solution providers.

There are numerous elements to consider when determining how long it takes to construct an eWallet mobile phone app, including the app platform, app design, feature incorporation, development, MVP, testing, and so on.

Get In Touch