How to Create a Buy Now Pay Later App Like Affirm & Sezzle?

Table of Contents

Introduction

As we all know, the recent epidemic has affected us all on an emotional, mental, and financial level. People were straining to make timely loan payments, and many of them utterly failed. Since then, people have been looking for more suitable solutions to buy things online due to their financial difficulties. So, here the concept of Buy Now, Pay Later (BNPL) is introduced.

What is the BNPL Model, and How Does It Work?

Buy Now, Pay Later (BNPL) allows clients to buy things online or in stores right away and pay for them over time. It is a sort of short-term financing that will enable you to pay for products in installments over time.

E-commerce sites have seen significant growth since this financial solution was introduced. This solution aids in attracting more customers to your website who are willing to make a purchase.

In fact, most individuals who use credit cards are aware of this notion; therefore, it will be simple for them to understand. However, for those who don’t know what a credit card is, let us tell you that it’s a reality of our childhood dream where we can buy things without paying for them.

Yes, you heard it right!

Buy Now, Pay Later is similar to credit cards, and individuals are prepared to invest in this financial solution because of the pay later option. Customers can use a buy now, pay later technology to purchase things online and avoid paying full price at the checkout. The best feature about this Buy Now, Pay Later application is that it is interest-free and allows customers to pay in installments.

Before Buy Now Pay Later App Development: Best Examples

Let’s look at some of the most popular applications in this market.

Affirm

One of the most popular BNPL applications is Affirm. You may purchase stress-free at your favorite retailer and pay over time with flexible payment plans with the Affirm app. In short, there are no late fees or hidden charges.

You can see precisely how much you’ll owe from day one to day done in this app, and you can also take advantage of savings, offers, and rates as low as 0% APR.

Sezzle

Sezzle is a highest-shopper-rated digital payment network that allows anyone to manage their finances, spend ethically, and purchase effortlessly. When you shop with Sezzle, your purchases are divided into four 0% interest installments spread out over six weeks. There’s also no effect on your credit!

Afterpay

Afterpay Limited is a financial technology firm based in Australia that is best known for its Buy now, pay later service. There is no interest, but if a payment is not made within ten days, Afterpay levies an $ 8 to $ 25 late fee. Clients must pay only one upfront payment and the remaining balance within six weeks.

Fascinating Trends in Mobile Payment

In the current scenario, anyone can pay anywhere with a single click. So let’s take a look at some noteworthy mobile payment trends.

Contactless Payments

These are considered a convenient and rapid payment method, as customers are not required to provide a PIN. Contactless payments are more secure as they reduce the risk for both the consumers and the retailers.

Apple, Google, and Samsung have all hopped on board with their versions of contactless payments by the names as Apple Pay, Google Pay, and Samsung Pay, respectively. However, different companies have different technology.

In Apple Pay, your fingerprint is scanned (and validated) at the first instance, and after that, you can use the app to make a payment. You have to place your device in front of the scanner, which accepts the payment. On the other hand, you must first download the app to use Google Pay. Instead of a credit card number, Google sends an encrypted number associated with the user’s payment card to the store. Users can also send and receive money using an email address or phone number, just like Apple Pay. In comparison, the users can simply take a photo of their card or a barcode and tap on their Samsung app to check out.

Mobile POS

A mobile point of sale works as a register on a smartphone or tablet. Large and small enterprises and their customers benefit from a simpler payment ecosystem. You may download the POS app, link your reader to your mobile device, and start accepting payments right away if you choose mPOS software for your business.

Mobile Wallets

According to Statista, Paytm, PhonePe, and Google Pay are expected to have hundreds of millions of users in India by 2025. Paytm and PhonePe were both ranked as India’s main digital payment methods in 2020 and were more widely used for online shopping than credit or debit cards.

A mobile wallet, also known as a virtual wallet, allows users to pay digitally without using their credit or debit card in real life. You can pay and receive money to and from other users, respectively, and store money in a mobile wallet. It is a very convenient solution for users to save their payments safely.

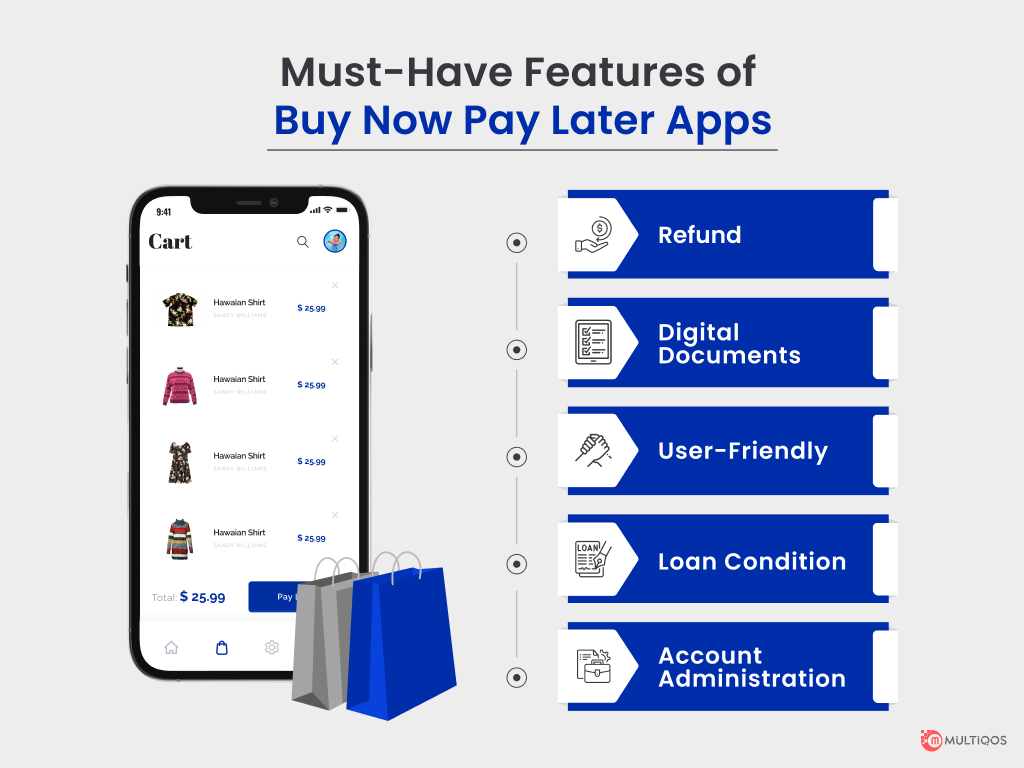

Must-Have Features of Buy Now Pay Later Apps

If you’re building a special buy now, pay later business model right from scratch, make sure to include the following key characteristics:

Refund

When we go shopping, the first thing we look for is a return option. Similarly, seeing refund choices will draw your customer’s attention to your app. Ensure that your buyer has the opportunity to change their mind about their purchase.

Digital Documents

One of the main features of the Buy now, pay later software is that the entire loan application and approval process is made online.

User-Friendly

Every user wishes to register for an app without encountering technical difficulties. Make sure your user doesn’t have to wait long. The quick borrowing process will appeal to users and assist you in growing.

Loan Condition

When it comes to reading terms and conditions, people usually get bored. So make sure that your apps are simple to understand and trustworthy for your users.

Account Administration

Account management should lead client success activities, which should create or manage a defined customer roadmap. A client journey map can help you maintain consistency in communication and message, preserve precise scheduling, and keep team members on the same page throughout the client experience.

Steps to Develop Buy Now, Pay Later App (BNPL App)

Here are some steps to make your payment later payment app development process easier.

Scope Statement

There are several questions to address before a pay later wallet app development.

- Why do you want to build this app?

- What is the app’s central concept?

- Who is your targeted audience?

- What features do the users like the most about the Buy now, pay later app?

Apart from these questions, you should thoroughly understand your market and your competition.

Performing Research

Learn everything you can about your potential customers. Find out how old your users are, where they live, what gadgets they use, and so on. Creating a user persona can help you better understand your users’ needs. It will also assist you in understanding your clients’ pain points while paying later credit ios or android app development.

Developing a Plan

You’ve undoubtedly learned how to make your buy now, pay later app. So, it’s high time to build a perfect strategy for the Buy now, pay later software development. To strategize, you must first determine the features and unique technologies you will include in your Buy now pay later app and how you will expand it from scratch.

It is critical to forming a solid team where you can hire an app developer or hire mobile app developer and select the individuals who will be a part of it, as it will aid in the formation of a strong programming team and a well-defined procedure.

Prepare Interface Design

Having a well-known buy now, pay later system design will help you attract visitors to your website and keep them there. A small change in UI Design can significantly impact your website.

Invest in an Identity Verification System

As there are so many fake identities on the internet that make it difficult for users to believe in the real ones, it’s critical to have an identity verification system that allows businesses to identify their customers. Regulatory agencies require such a mechanism for online payment services. Furthermore, it has become the industry standard.

Develop Buy Now, Pay Later Application

You should consider outsourcing the software development activity rather than purchasing the necessary technology for the project. This will save you time and money in terms of acquiring the essential technology and skill set to complete your project. You can also contact a mobile app development company to learn more about mobile app development because they are already familiar with the app development services.

Implementing and Testing

Perform numerous tests before releasing your application to ensure that all areas of your application that require improvement have been addressed. Make sure everything is in working order. You’ll get fewer negative ratings and uninstalls this way.

How Much Does It Cost to Develop a Buy Now, Pay Later Platform?

The cost of creating a buy now, pay later app is determined by the following factors:Backend Tools and Technologies

- Technical Stack.

- Product Features and Ui/ux Design.

- App Development Team.

- Several Team Members on the Project and Your Development Team’s Hourly Rate.

The change in this parameter can affect the cost and duration of mobile app development. The hourly rate of app developers is the most critical component that determines a project’s worth, and it often varies depending on their location.

Final Thoughts!

You must have deduced from this blog’s extensive information that Buy Now, Pay Later apps are combined with complex capabilities that appear simple to navigate on different devices. As the globe is becoming more digitally connected, the need for these buy now, pay later apps will grow in the future. This will result in significant growth in e-commerce sales as digital solutions appear to be a future industry.

Let’s Create Big Stories Together

Mobile is in our nerves. We don’t just build apps, we create brand. Choosing us will be your best decision.

FAQs on Create a Buy Now Pay Later App

Probably yes! Because of high-interest rates, Buy Now, Pay Later (BNPL) agreements are only better than credit cards. If paid promptly, BNPL usually offers little or no interest. According to Czarnecki’s research, 38% of BNPL customers expect it to replace their credit cards someday.

Affirm is the best BNPL as you may shop stress-free at your favorite store and pay over time with the Affirm app’s flexible payment plans; there are no late penalties or hidden charges.

‘Buy now, pay later is derived from hire-purchase finance, developed in the nineteenth century. It began as a mechanism for people to buy high-value things (such as white goods) that they couldn’t afford altogether.

Get In Touch