NextGen FinTech Where Crypto Meets AI for Smarter Digital Payments

Table of Content:

- Introduction

- The Evolution of Digital Payments

- Introduction of Cryptocurrencies

- AI in Digital Payments

- Cryptocurrency and Blockchain Technology

- Integration of AI and Cryptocurrency

- Smart Contracts and Automation

- Financial Inclusion and Accessibility

- Future Trends and Innovations

- Case Studies

- How MultiQoS Enhances AI in FinTech Payments

- The Botton Line

- FAQ

Introduction

Next-gen FinTech is the type of financial technology that was derived from previous financial technologies and integrated with new-generation technologies like AI and cryptocurrency. The advancement in payment systems has influenced the consumer–business interface in financial transactions in many ways.

Where AI is already improving decision-making processes and cryptocurrencies are providing decentralized financial services, NextGen FinTech is building a future of digital finance through innovative FinTech app development.

At the beginning of January 2024, there were nearly 13,100 FinTech companies, of which the Americas led this change compared to last year. The worldwide FinTech market was estimated to earn $79.38 billion in 2023, and after an estimate, it will be $140.88 billion in 2028.

Integrating artificial intelligence and cryptocurrency is essential to solving some of the most significant problems with digital payments, like security, decentralization, and the ability to include a large number of participants.

Combined, these technologies are on course to create a more efficient and inclusive financial process, where transactions cost less time and money and are more secure.

The Evolution of Digital Payments

Online payments have since been transformed into augmented intelligence to advance the uptake of secure, efficient, and personalized payment systems.

AI-powered digital payment improves the ability to prevent fraudsters, digitizes payment intermediaries, and decision-making based on customer needs.

In the modern world, solutions based on using digital payments remain one of the most effective and convenient for both buyers and sellers.

Traditional Payment Systems

Traditional payment methods were basically through traditional means such as credit card payments, debit card payments checks, and of course cash. These systems were generally characterized by low speed, high costs, and high inaccuracies.

Transaction costs were relatively expensive and customers had little or no access to intraday stock quotes.

Rise of Digital Wallets and Contactless Payments

Due to advances in communication technology such as Smartphones and the internet, Mobile payment Systems (Apple Pay, Google Wallet), and contactless payment systems.

These took the following general functions, which was the general use of making payments from the phone without necessarily involving a card.

They also contributed to enabling efficiency in e-commerce and enhancing the experiences of the consumer to some extent.

Introduction of Cryptocurrencies

Cryptocurrency, which started with Bitcoin, introduced decentralized finance (DeFi) or financial systems. It allowed many people to transact directly with each other, mostly without the services of traditional financial institutions like banks, making the process faster and borderless.

Cryptocurrency payment gateway brought about a new revolution in how people viewed digital payments, as blockchain technology made the transactions transparent, secure, and irreversible.

AI in Digital Payments

AI is at the center of change in the payments industry, especially in constantly evolving processes such as transactions and security. Payment data can be potentially large and complex for an ordinary algorithm to process, but machine learning allows AI to take on the task of filtering through the data to look for patterns and predict behaviors to improve payments for users and businesses alike.

This real-time processing enhances efficiency, accuracy, and time taken to conduct a transaction. Also, regarding payment security AI works constantly analyzing transaction data in search of abnormality and possibly fraudulent activities.

AI systems are therefore capable of providing a constantly changing and more adaptive approach to fraud.

Some of these are; fraud detection through analysis of transactions for any irregularities and Biometrics, such as facial and fingerprint for user identification.

These above AI innovations aid in minimizing the risks of performing digital payment while at the same time making the payment process more easy and secure.

Cryptocurrency and Blockchain Technology

Cryptocurrency also known as digital currency uses blockchain as the underlying technology, presenting an opportunity to conventional fiat currencies from central authorities. Traditional banks differ from cryptocurrencies as these last ones use nodes to validate and gather transaction information.

Cryptocurrencies are built on blockchain, which is an unchangeable, secure record of transactions that eliminates the function of middlemen and greatly decreases the cost of the transaction.

They include; faster cross-border payments, enhanced privacy, and enhanced security because control is decentralized and the transaction is not controlled by a single entity.

Some of the values include; lower transaction costs with no need for banks or payment processors, improved transparency due to recorded transaction history, and decentralization whereby full ownership of the assets is vested in the users thus no fraudulent activities or disputes.

Integration of AI and Cryptocurrency

AI is becoming more involved in cryptocurrencies, helping it functionality faster and more effectively. Trading strategies are enriched by analytical work that is created by using machine learning algorithms to study previous market trends and to make future trend forecasts.

It can also help increase transaction speed since it will be able to identify which pathway to take to achieve the easiest transactions and improve the validation of transactions, thus minimizing complications and improving the experience of users.

Also, with its forecasting function, AI is helping traders and investors in the field of cryptocurrency, providing an opportunity to foresee the tendencies ahead.

The real-time data analysis can help AI predict the change in prices and market conditions suggesting the best possible actions to take during the decision-making process regarding the investments.

Two ideal examples of the incorporation of AI into cryptocurrency trading are the Shrimpy and 3Commas platforms. Such AI implementations save operational control over the trading platforms, with minimal utilization of human inputs to review or initiate trades from these technical platforms.

This makes cryptocurrency trading less discriminative, convenient and in some cases, lucrative for the traditional trader and even the new trader.

Smart Contracts and Automation

These are programs enacted in the blockchain to perform contractual obligations when certain conditions have been met, greatly improving the speed of digital payments.

Using AI code, such self-executing smart contracts can verify data and even stick to contractual terms without the involvement of a third party Thus, a smart digital payment system cannot exist without it. This results in what can be referred to as time and cost-effective transactions.

Thus, using mediums such as smart contracts reduces inefficiencies such as banks and lawyers in areas such as cross-border payments; the funds flow as set and stipulated with no outside interference, faster, and cheaper.

Financial Inclusion and Accessibility

AI and cryptocurrency are strong instruments that are pushing the expansion of the existing and new opportunities for a large population that is not effectively served by the traditional financial sector.

Thus, through the use of blockchain and artificial intelligence in NextGen FinTech solutions, Citizens who cannot afford conventional bank services would conduct digital operations.

Credit scores for consumers with no traditional credit records are determined by AI, and cryptocurrencies help make digital payments since banking systems are not well developed.

Microtransactions and P2P payments are dispensing with the ways people in non-standard markets exchange value, low-barrier AI-powered platforms, and cryptocurrencies freeing people from reliance on formal banking systems to conduct value exchange.

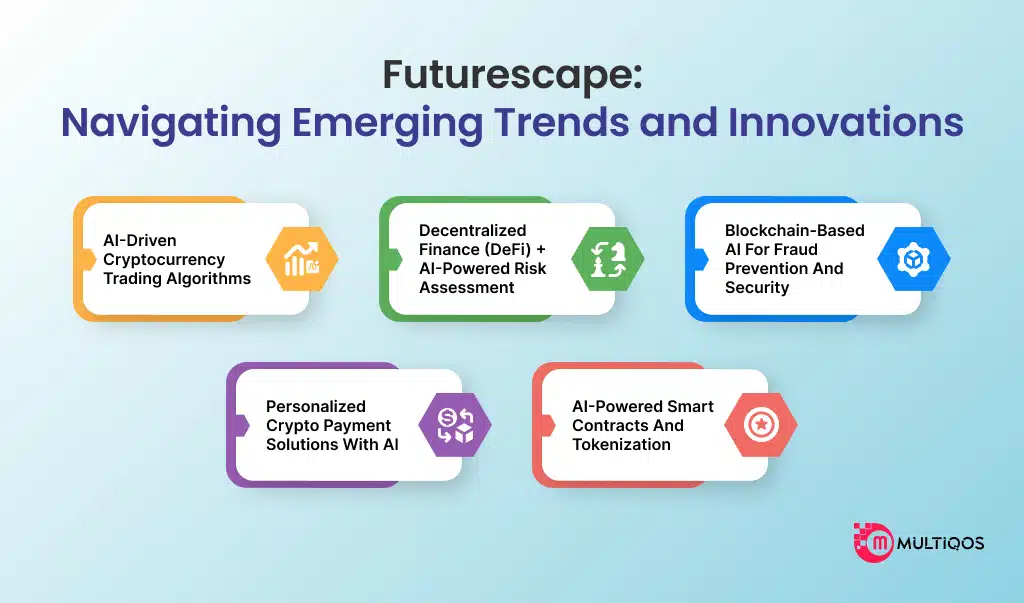

Future Trends and Innovations

1. AI-Driven Cryptocurrency Trading Algorithms

Cryptocurrencies will be improved with the help of AI to collect and analyze big amounts of data as well as to apply predictive learning algorithms and accurate completion of transactions. These AI algorithms as well as be able to generate superior predictions and then also execute trading models in real-time for efficient investment in highly fluctuating cryptocurrencies.

AI will improve the decisions and risks in investing in cryptocurrencies because of the application of sentiment, historical, and market data analyses.

2. Decentralized Finance (DeFi) + AI-Powered Risk Assessment

With an increasing number of DeFi platforms, the application of AI will speed up credit decisions, improve liquidity flow, and make loan risk decisions in the future.

This is because conventional approaches cannot capture risk characteristics from publicly available elements but AI tools can capture from more granular data like transaction history, wallet behavior, and market volatility characteristics.

Their integration will result in improved lending, borrowing, and trading procedures that will still act on decentralized models and avoid depending on intermediary financial institutions.

3. Blockchain-based AI for Fraud Prevention and Security

Blockchain’s characteristics of immutability and transparency can create complex approaches to large-scale fraud detection as part of digital payments that incorporate artificial intelligence. Such architecture can also learn in real-time transactions and detect frauds such as double-spending, unauthorized access, or any other peculiarities.

Thus, using both great features of blockchain – security, and AI prediction, the FinTech platforms can minimize fraud cases and increase the reliability of the Internet and crypto deals.

4. Personalized Crypto Payment Solutions with AI

AI and crypto shall combine to provide custom payment options. AI can use User behavior, spending, and consumption patterns to provide solutions of introducing a crypto pay gateway, smart wallet options, and optimal exchange rates to accept.

Such personalization will be carried out in designing individual digital wallets and payment applications that integrate the ability to choose the optimal or cheapest form of cryptography for use depending on the applicable fee charges, exchange rates, trends, and security measures.

5. AI-Powered Smart Contracts and Tokenization

Smart contracts on blockchains will be boosted by AI in the upcoming future. Contracting shall be made efficient and automatic by using artificial intelligence in the enforcement of contractual provisions.

Since AI learns from previous transactions and in the light of new conditions, the smart contract may also be self-optimizing and may undergo changes according to the market conditions or adjust the terms of a contract based on new data.

Also, the tokenization of real-world assets (such as real estate, equities, or commodities) will be optimized by using AI algorithms that evaluate, transfer, and facilitate the tokenized asset’s liquidity in real-time.

Case Studies

Case Study 1: Square

(Integration of AI and Blockchain for Payment Processing)

Square, a leading financial technology company, has successfully integrated AI and blockchain technology to revolutionize payment processing for small businesses. By leveraging AI, Square provides deeper insights into customer behavior and offers personalized recommendations, enhancing the overall customer experience. The blockchain component ensures secure and transparent transactions, reducing fraud and increasing trust among users.

Impact on Small Businesses and Market Penetration Square’s innovative approach has significantly benefited small businesses by simplifying the payment process and reducing costs. The company’s affordable solutions, such as the Square Reader and Square Terminal, have enabled countless small businesses to accept electronic payments easily. This has led to increased market penetration, with Square becoming a major player in the financial technology industry.

Case Study 2: Finastra

(Use of AI and Blockchain for Improving Payment Systems)

Finastra, a leading financial technology company, has leveraged AI and blockchain technology to enhance its payment systems significantly. By integrating AI, Finastra has been able to automate various payment processes, reducing manual intervention and increasing efficiency. The AI algorithms analyze transaction patterns and detect anomalies, which helps in preventing fraud and ensuring compliance with regulatory requirements.

The integration of AI and blockchain has significantly improved the security and transaction speed of Finastra’s payment systems. AI-driven security measures detect and mitigate potential threats in real-time, providing a robust defense against cyber-attacks. Blockchain technology ensures that transactions are processed quickly and securely, reducing the time required for payment settlements.

Case Study 3: JPMorgan Chase Onyx

(Blockchain-Based Solutions for Domestic and Cross-Border Payments)

JPMorgan Chase Onyx, now known as Kinexys, has been at the forefront of blockchain innovation in the financial sector. The platform offers blockchain-based solutions that facilitate both domestic and cross-border payments, transforming the way money and information move globally.

By leveraging blockchain technology, Kinexys enables real-time, multicurrency payments 24/7. This innovative approach allows for seamless and secure transactions across borders, even after traditional markets have closed1. The platform supports programmable payments, which can be customized based on pre-determined conditions, ensuring efficient and automated payment flows.

How Can MultiQoS Boost AI-Powered FinTech Apps for Digital Payments?

MultiQoS can greatly enrich AI-based FinTech applications in digital payments by offering efficient NextGen FinTech solutions for the enhancement of service capabilities and quality of the client’s experiences.

Incorporating artificial intelligence, these apps need sound backend support to manage challenging informational transactions, analytic calculations, and instant payments.

Our team is aware of cloud infrastructure, enhanced data protection, and machine learning ensuring that FinTech applications are tenacious and perform well despite large loads of transactions. This leads to quicker and safer business activities which are key requirements for users in the dynamic environment of Global Digital Payments.

Through Fintech software solutions, MultiQoS guarantees that the applications in the digital payment system will be developed using AI technologies to suit the business markets and customers.

As for fraud detection systems and paid-up Individualised Payment Recommendations, when you choose to hire Multi QoS’s Fintech app development skills means that all such advanced technologies can be efficiently incorporated into effective Fintech applications.

The Botton Line

In conclusion, the integration of cryptocurrency in AI-powered digital payments has knocked down the door towards revolutionizing the way of financial transactions. As the consumer expectation evolves towards speed, security, and personalization of payments these technologies provide perfect solutions that enhance throughput and consumer experience.

AI currently plays a critical role in enabling real-time anti-fraud systems, predictive analytics, and active transactions, as well as adapting payment solutions as prevalent cryptocurrencies to provide low-cost approaches to banking services across the globe.

As we move forward, cryptocurrency payment solutions are becoming an integral part of the digital finance landscape, driving new opportunities for cross-border transactions and decentralized finance.

The application of blockchain and AI will enable smart digital payment systems that are efficient, secure, transparent, and efficient. It is defining the future of FinTech by making the digital payment processes faster, smarter, and more efficient going forward than it has ever been before.

Frequently Asked Questions

Digital payments enabled by AI are used to improve transaction operations in real-time. Thanks to machine learning algorithms AI can identify the intentions and behavior of a user through transactional data and help with fraud detection to secure payments.

These systems enhance transaction velocities, increase customers’ satisfaction, and facilitate customer-specific payment services, which are part of the NextGen FinTech solutions. The most important aspect of AI-powered digital payments is that it improves the relationship between consumers and businesses: smarter financial interactions.

AI in cryptocurrency payment solutions is applied through the algorithms that analyze and facilitate transactions in cryptocurrencies. AI plays the role of providing confident security and performance during transactions specifically in decentralised networks.

It helps to improve the effectiveness of the given method, predict market demands and consumer behavior, as well as offer the user information on the most favorable conditions for carrying out transactions, security measures, and possible threats.

Indeed, both AI and cryptocurrency are set to define the future of digital payments to a very large extent. AI-powered digital payment systems and the use of cryptocurrencies in payment will create improved, secure, and scalable payment systems.

With the development of more efficient transaction spotting and forecasting AI applications, and the further embrace of cryptocurrency, smart digital payment systems will adapt to the higher requirements for speed, security, and charge reduction.

Of course, we do provide excellent AI-powered digital solutions with modern approaches that involve AI solutions, Blockchain, and Cryptocurrencies for secure and efficient financial transactions. If you wish to get in touch with us, simply click here or our team will gladly help you discover how NextGen FinTech solutions can add value to your business.

Get In Touch